#4 thanks

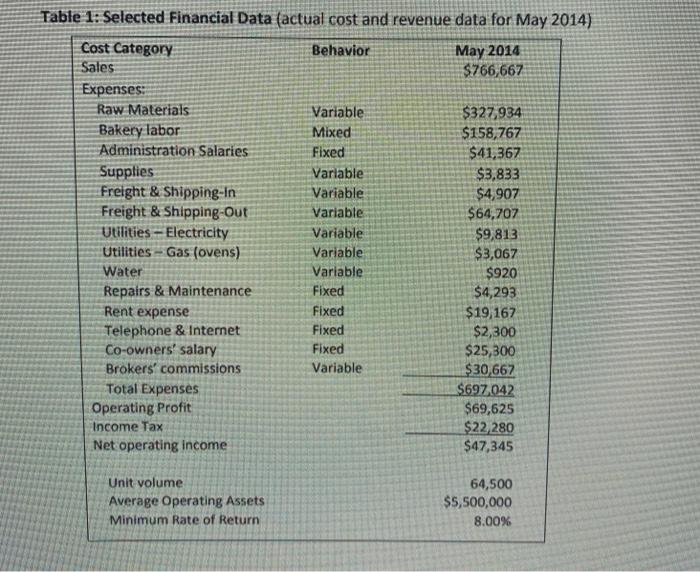

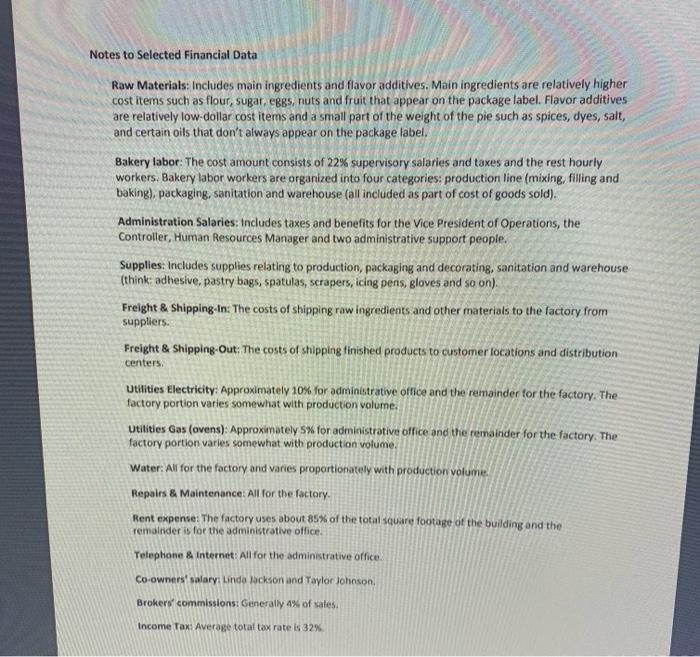

4. Analyze and Compute the Break-Even Point in units and sales Dollars... Which is better for this situation and why? (15 points) Table 1: Selected Financial Data (actual cost and revenue data for May 2014) Cost Category Behavior May 2014 Sales $766,667 Expenses: Raw Materials Variable $327,934 Bakery labor Mixed $158,767 Administration Salaries Fixed $41,367 Supplies Variable $3,833 Freight & Shipping-In Variable $4,907 Freight & Shipping-Out Variable $64,707 Utilities - Electricity Variable $9,813 Utilities - Gas (ovens) Variable $3,067 Water Variable $920 Repairs & Maintenance Fixed $4,293 Rent expense Fixed $19,167 Telephone & Internet Fixed $2,300 Co-owners' salary Fixed $25,300 Brokers' commissions Variable $30,667 Total Expenses $697042 Operating Profit $69,625 Income Tax $22 280 Net operating income $47,345 Unit volume Average Operating Assets Minimum Rate of Return 64,500 $5,500,000 8.00% Notes to Selected Financial Data Raw Materials: Includes main ingredients and flavor additives. Main ingredients are relatively higher cost items such as flour, sugar, eggs, nuts and fruit that appear on the package label. Flavor additives are relatively low-dollar cost items and a small part of the weight of the pie such as spices, dyes, salt, and certain oils that don't always appear on the package label. Bakery labor: The cost amount consists of 22% supervisory salaries and taxes and the rest hourly workers. Bakery labor workers are organized into four categories: production line (mixing, filling and baking), packaging, sanitation and warehouse (all included as part of cost of goods sold). Administration Salaries: Includes taxes and benefits for the Vice President of Operations, the Controller, Human Resources Manager and two administrative support people. Supplies: Includes supplies relating to production, packaging and decorating, sanitation and warehouse (think: adhesive, pastry bags, spatulas, scrapers, icing pens, gloves and so on). Freight & Shipping-In: The costs of shipping raw ingredients and other materials to the factory from suppliers Freight & Shipping-Out: The costs of shipping finished products to customer locations and distribution centers Utilities Electricity: Approximately 10% for administrative office and the remainder for the factory. The factory portion varies somewhat with production volume. Utilities Gas (ovens): Approximately 5% for administrative office and the remainder for the factory. The factory portion varies somewhat with production volume. Water: All for the factory and varies proportionately with production volume Repairs & Maintenance: All for the factory. Rent expense: The factory uses about 85% of the total square footage of the building and the remainder is for the administrative office Telephone & Internet: All for the administrative office Co-owners' salary: Linda Jackson and Taylor Johnson Brokers' commissions: Generally 4% of sales. Income Tax Average total tax rate is 32%