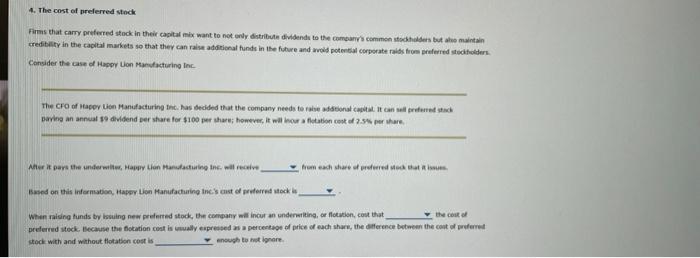

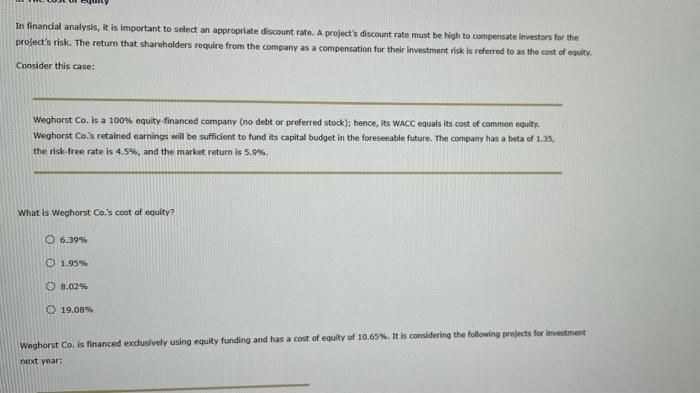

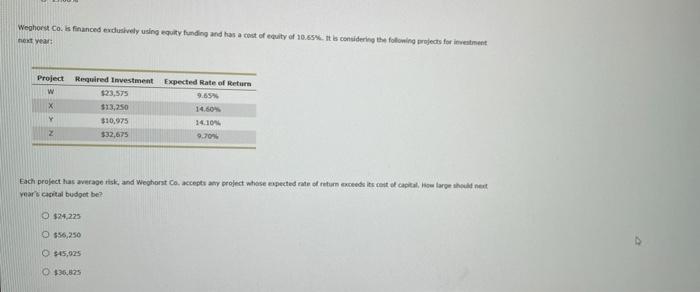

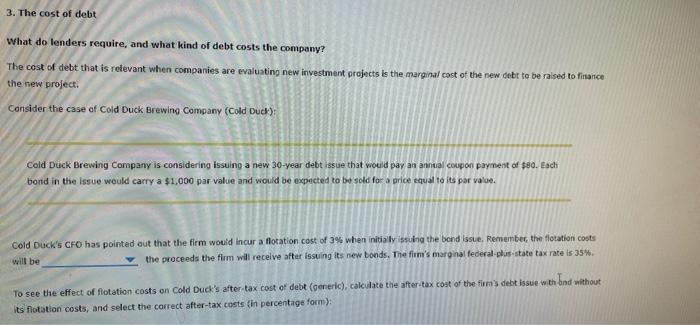

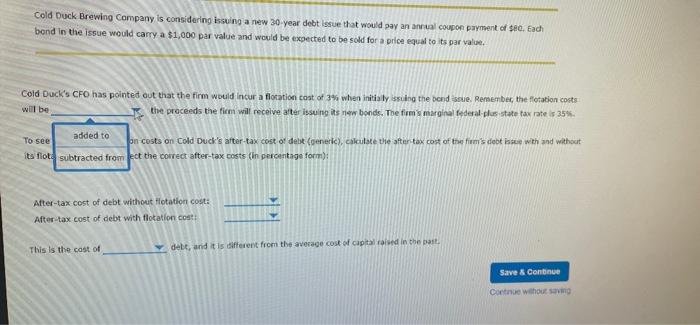

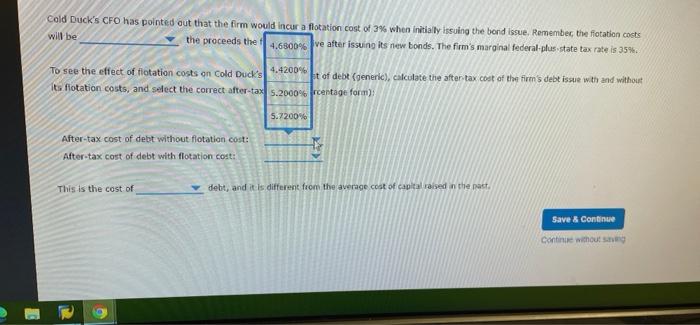

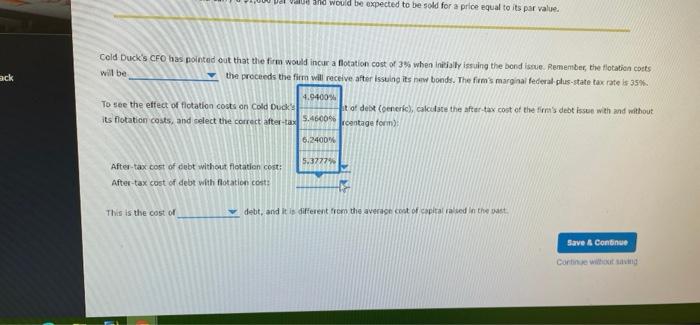

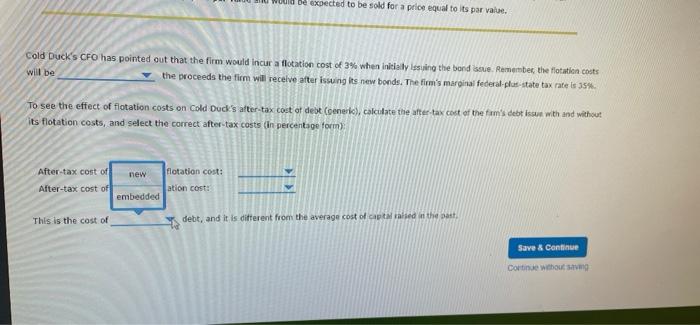

4. The cost of preferred stock Firms that carry preferred stack in their capital i want to not only distributie dividends to the company's common holders but the maintain credibility in the capital markets so that they can raise additional funds in the future and wold potential corporate raidstrom referred stockfolders Corsider the case of use Lion Manufacturing Inc The CFO of Hace Lion Manufacturing the has decided that the company needs to be donat capital i com el derred stock Baving annual dividend per share for $100 per here, however, it wil hour futation cost of 2.5 per here Aftur pars the underweavey Lion Puntacturing the will receive from the red ca Based on this information, Huy Lion Manufacturing Inc.'s cost of preferred Mock When riding funds by issuing new preferred stock, the company wil incur an underwriting, or flotion.cout that the cool preferred stock. Because the flotation cost is usually expressed as a percentage of price of each share the difference between the cost of preferred stock with and without fotation cost is enough to tigrare In financial analysis, it is important to select an appropriate discount rate. A project's discount rate must be Nigh to compensate Investors for the project's risk. The return that shareholders require from the company as a compensation for their investment risk is referred to as the cost of equity. Consider this case: Weghorst Co. is a 100% equity-financed company (no debt or preferred stock); hence, its WACC equals its cost of common equity Weghorst Co's retained earnings will be sufficient to fund its capital budget in the foreseeable future. The company has a beta of 1.35, the risk-free rate is 4.5%, and the market return is 5.9% What is Weghorst Co.s cost of equity? 6.39% O 1.95% 8.02% 19.08% Weghorst Co. is financed exclusively using equity funding and has a cost of equity of 10.65%. It is considering the following projects for investment next year: Weghorst Co. is financed exclusively using ty Lunding and has a cost of city of 10.55. It is considering the following projects for it he Year Project Required Investment Expected Rate of Return w 123,575 9.65 X $13,250 14.60% Y $10,975 14.104 2 $32,675 9.70 Each project has werage risk and Weghort Co, accept any project whose expected rate of ritum exceed its cuit et capital, How farge shouldert years capital budget be? $24.225 $56,250 O $45,025 O $3,825 3. The cost of debt What do lenders require, and what kind of debt costs the company? The cost of debt that is retevant when companies are evaluating new investment projects is the marginal cost of the new debt to be raised to finance the new project. Consider the case of Cold Duck Brewing Company (Cold Duck) Cold Duck Brewing Company is considering issuing a new 30-year debt issue that would pay an annual coupon payment of $80. Esch band in the issue would carry a $1,000 par value and would be expected to be sold for a price equal to its par value. Cold Duck's CFO has pointed out that the firm would incur a flotation cost of 3% when initially issuing the bond issue. Remember the flotation costs will be the proceeds the firm will receive after issuing its new bonds. The firm's marginal federal-plus-state tax rate is 35% To see the effect of flotation costs on Cold Duck's after-tax cost of debt (generic), calculate the after tax cost of the firm's debt issue with and without its flotation costs, and select the correct after-tax costs (in percentage form): Cold Duck Brewing Company is considering issuing a new 30-year debt issue that would pay an annual coupon payment of sec. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a price equal to its par value Cold Duck's CFO has pointed out that the firm would incur a flotation cost of 3% when initial issuing the bond save. Remember, the flotation costs the proceeds the firm will receive after issuing its new bonds. The firm's marginal federal dus state tax rate is 35%. will be To see added to bn costs on Cold Duck's after-tax cost or del Coeneric), calculate the after tax cost of the firm's debt inse with and without its flotd subtracted from ect the correct after-tax costs (In percentage form): After-tax cost of debt without rotation cost: After-tax cost of debt with flotation cost This is the cast of delt, and it is offerent from the average cost of capital role in the past Save & Continue Continue without a Cold Duck's CFO has pointed out that the firm would incur a flotation cost of 3% when initially issuing the bond issue. Remember the flotation cacts will be the proceeds the 4.6800% ve after issuing its new bonds. The firm's marginal federal-plus-state tax rate is 35%. 4.4200% To see the effect of flotation costs on Cold Duck's it of debt (generic), calculate the after tax cost of the firm's debt issue with and without its flotation costs, and select the correct after-tax 5.2000% frentage form) 5.7200% After-tax cost of debt without flotation cost: After-tax cost of debt with flotation cost: This is the cost of debt, and it is different from the average cost of capital alived in the past Save & Continue Continue without Date and would be expected to be sold for a price equal to its par value. ack Cold Duck's CFO bas pointed out that the firm would incur a flotation cost of 3% when initially issuing the bond issue. Remember, the flotation costs will be the proceeds the firm will receive after Issuing its new bonds. The firm's marginal federal plus-state tax rate le 35% 4.9400% To see the effect of flotation costs on cold Ducks bit of debt (eneric), calculate the after tax cost of the firm's debt issue with and without 5.46009 its flotation costs, and select the correct after-tax rcentage form): 6.2400% 5.3727 After-tax cost of debt without flotation cost: After-tax cost of debt with flotation costs This is the cost of debt, and it is different from the average cost of capitala sed in the past Save & Continue Cortine without Juld be expected to be sold for a price equal to its par va Cold Duck's CFO has pointed out that the firm would incur a flotation cost of 3% when initially Issuing the bond save. Remember, the flotation costs will be the proceeds the firm will receive after issuing its new bonds. The firm's marginai federal clut-state tax rate le 35%. To see the effect of flotation costs on Cold Duck's after-tax cost of dest Comerk), calculate the after tax cost of the fam's debt leave with and without its flotation costs, and select the correct after-tax costs in percentage torn) After-tax cost of new After-tax cost of embedded flotation cost: ation cost: > >> This is the cost of debt, and it is different from the average cost of carota bated in the art Save & Continue Continue without