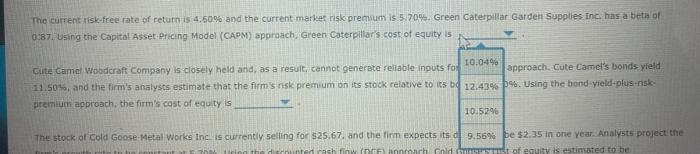

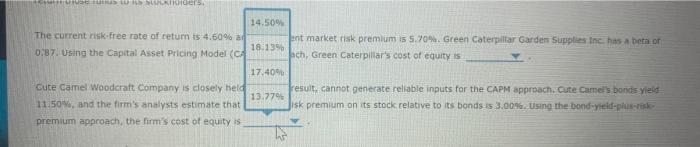

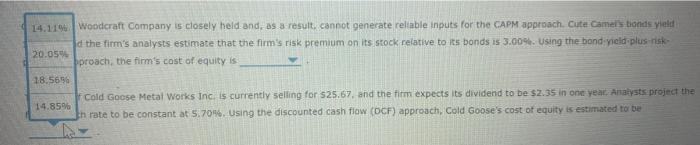

4. The cost of retained earnings If a tiem cannot invest retained earnings to earn a rate of return greater than or cual to the shareholders' required rate of return, it should return those funds to its stockholders. The current risk-free rate of return is 4,60% and the current market risk premium 5.709. Green Caterpillar Garden Supplies Inc. has a beta of 0:37. Using the Capital Asset Pricing Model (CAPM) approach. Green Caterpillar's cost of equity is Cute Camel Wooderaft Company is closely held and, as a result, cannot generate reliable inputs for the CAPM approach. Cute Camel's bonds yield 11.50%, and the firm's analysts estimate that the firm's risk premium on its stock relative to its bonds is 3.00%. Using the bond-yield-plus-risk primum approach, the im's cost of equity is The stock of Cold Goose Metal Works Inc is currently selling for $25.67, and then expects its dividend to be $2.35 in one year. Analysts project the firms arowth rate to be constant at 5.70 Using the discounted cash flow (DCF) approach, Cold Goose's cost ot equity is estimated to be The current risk-free rate of return is 4.60% and the current market risk premium is 5.70%. Green Caterpillar Garden Supplies Inc. has a beta o 087. Using the Capital Asset Pricing Model (CAPM) approach, Green Caterpillar's cost of equity is Cute Camel Woodcraft Company is closely held and, as a result, cannot generate reliable inputs for 10.0496 approach. Cute Camel's bonds yield 11.50%, and the firm's analysts estimate that the firm's risk premium on its stock relative to its bd 12.43% 5%. Using the bond yield-plus-risk- premium approach, the firm's cost of equity is 10.5294 The stock of Cold Goose Metal Works Inc. is currently selling for $25.67. and the im expects its d 9.56% e $2.35 in one year. Analysts project the cash finnah Cold of equity is estimated to be eder. 14.509 The current free rate of retum is 4.60% ad ent market risk premium 15 5.70% Green Caterpillar Garden Supplies Inc has a beth or 18.13% 0.87. Using the Capital Asset Pricing Model (CA ach, Green Caterpillar's cost of equity is 17.40% Cute Camel Woodcraft Company is closely held result, cannot generate reliable inputs for the CAPM approach. Cute Camel's bonds yield 13.779 11.50%, and the firm's analysts estimate that Jisk premium on its stock relative to its bonds 15 3.00%. Using the bond-yield-plus- premium approach, the firm's cost of equity is 14.11% Woodcraft Company is closely held and, as a result, cannot generate reliable inputs for the CAPM approach. Cute Camels bonds yield d the firm's analysts estimate that the firm's risk premium on its stock relative to its bonds is 3.00%. Using the bond yield.plus-risk 20.05% pproach, the firm's cost of equity is 18.56% Cold Goose Metal Works Inc is currently selling for $25.67, and the firm expects its dividend to be $2.35 in one year. Analysts project the 14.85% In rate to be constant at 5.704. Using the discounted cash flow (OCF) approach, Cold Goose's cost of equity is estimated to be