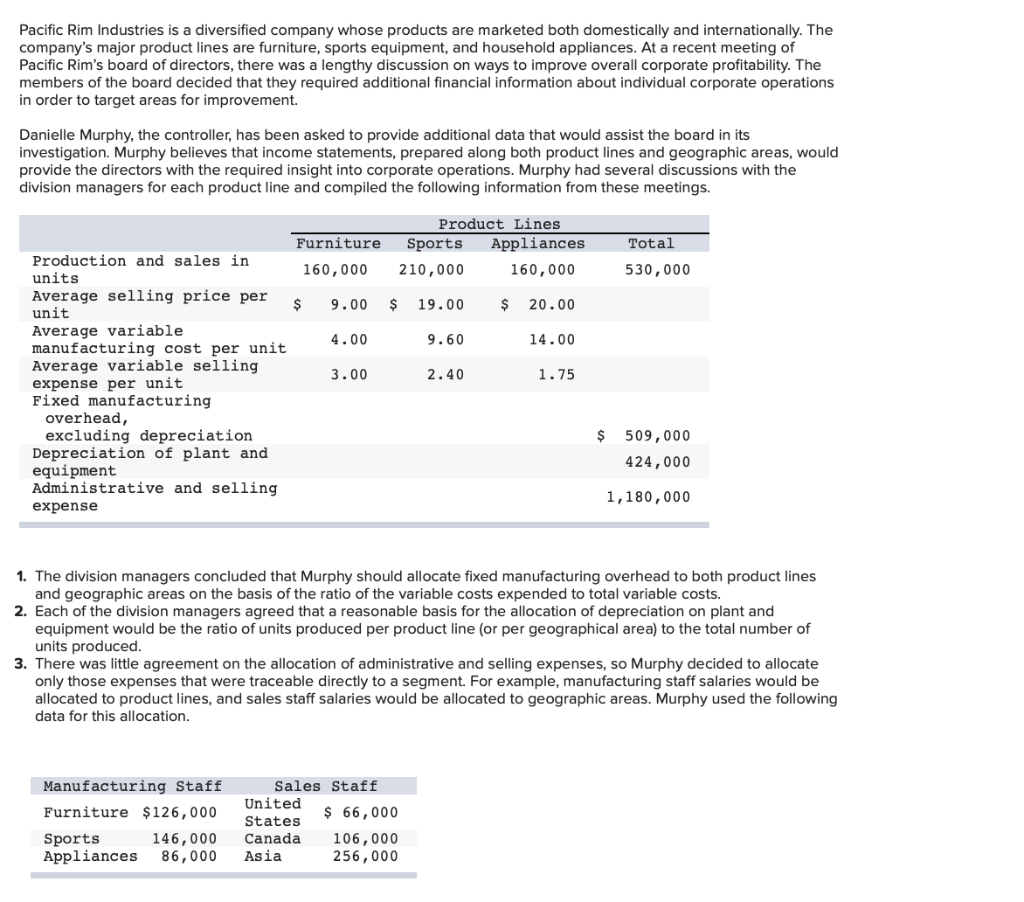

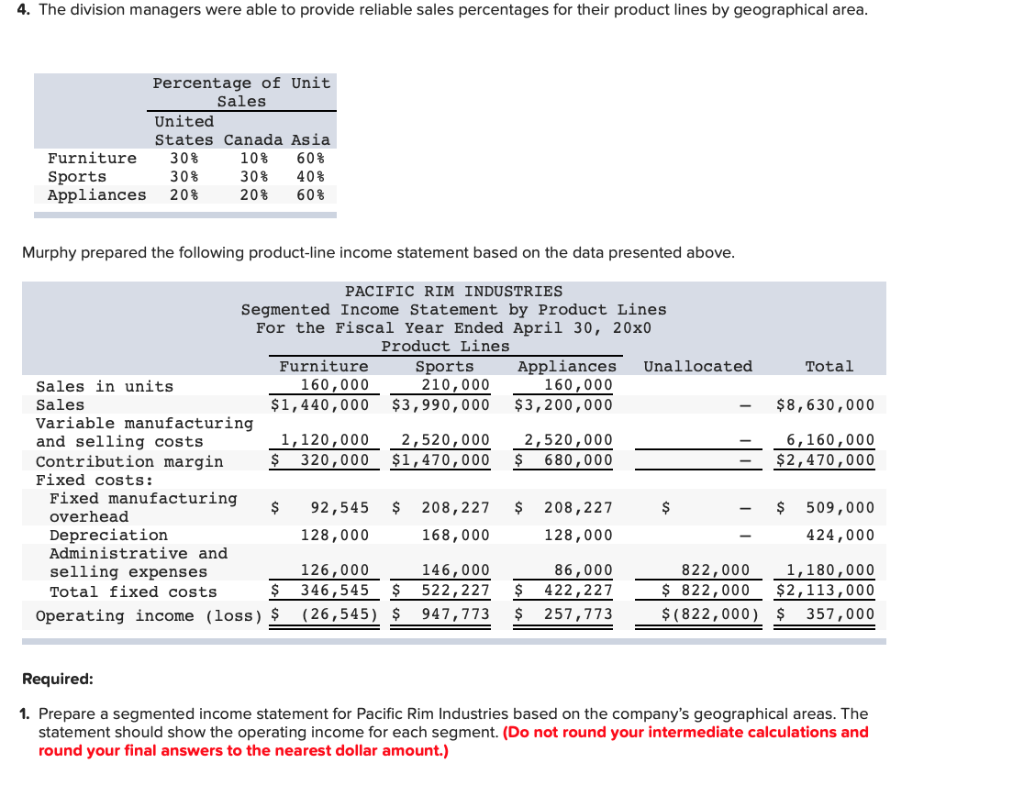

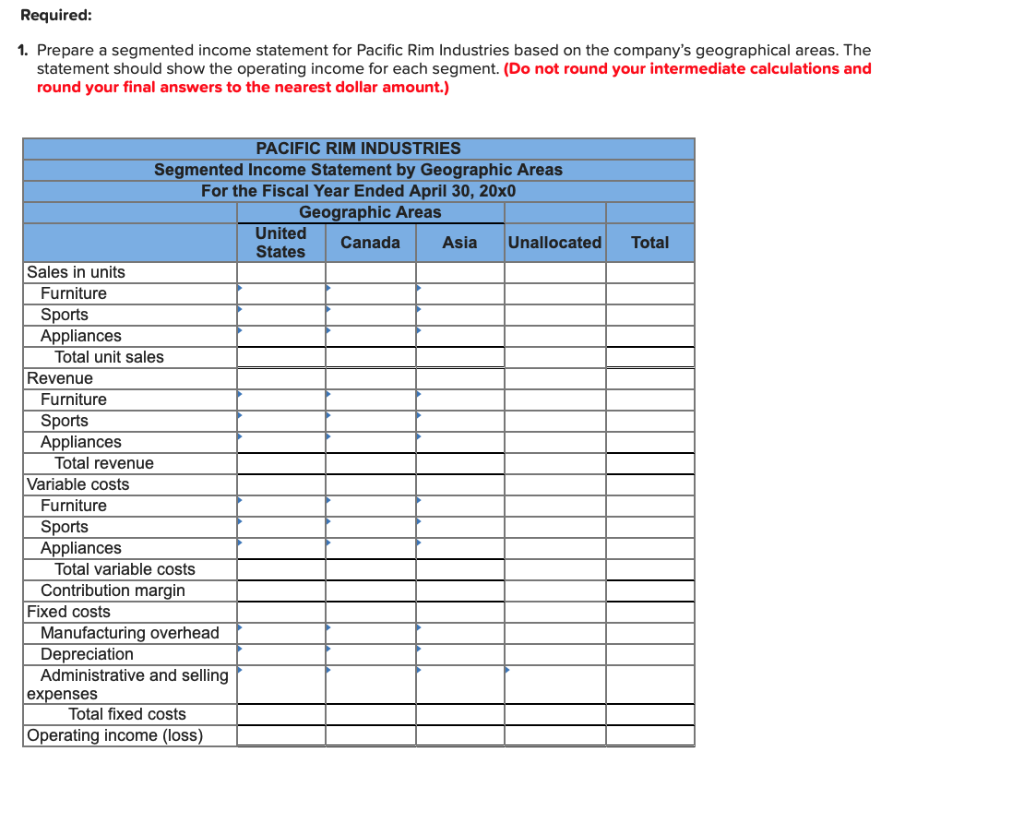

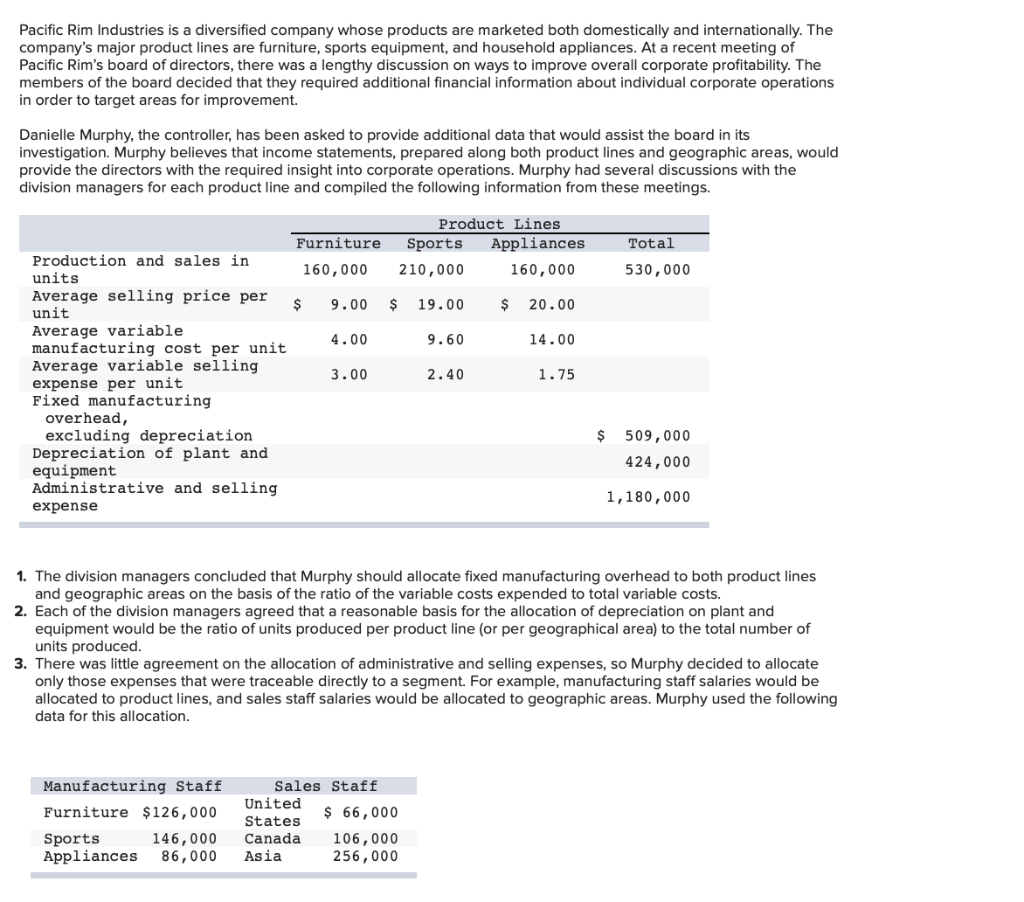

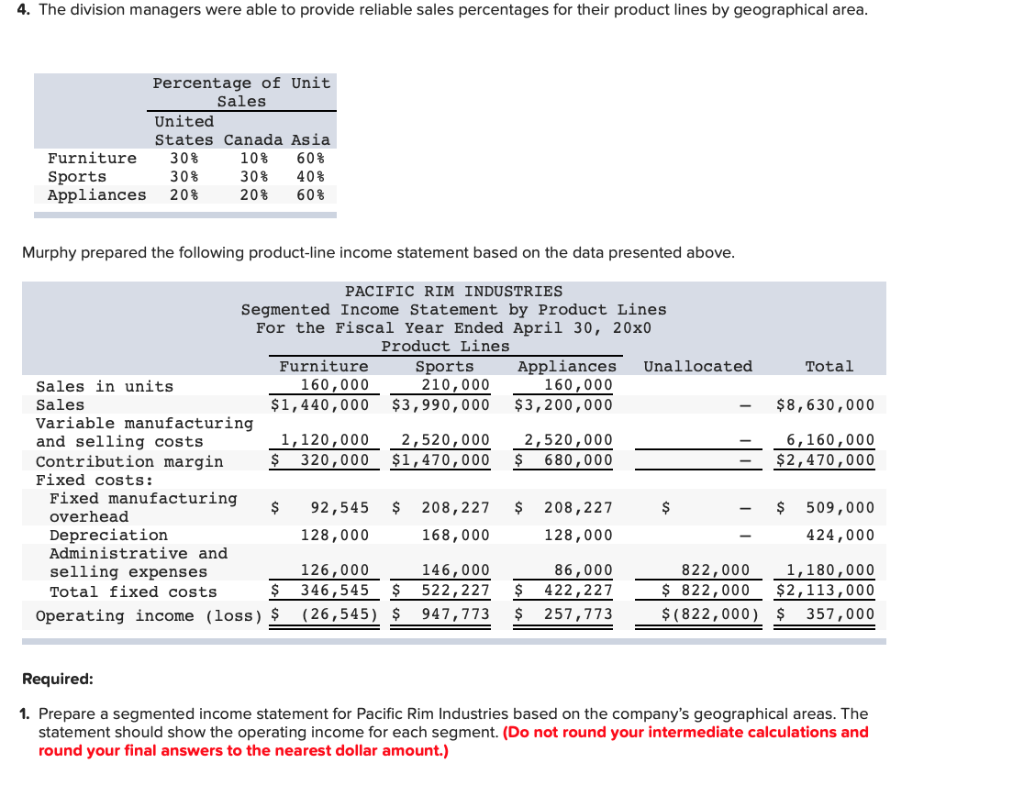

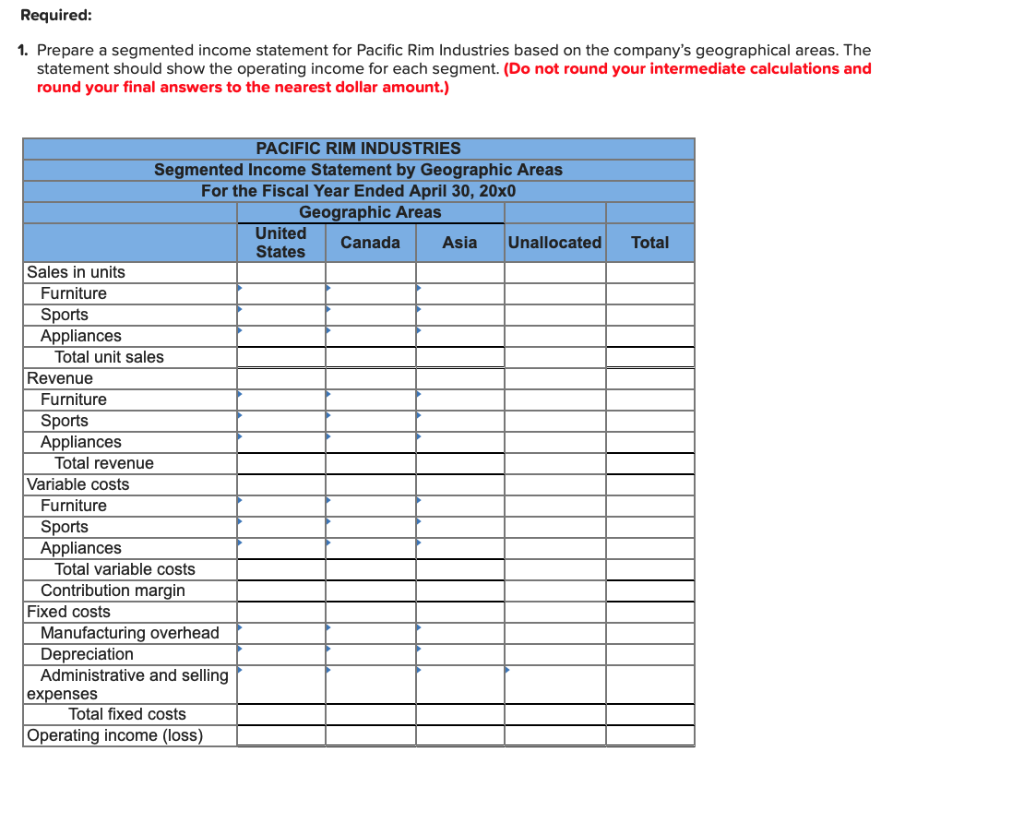

4. The division managers were able to provide reliable sales percentages for their product lines by geographical area Percentage of Unit Sales United States Furniture 30% Sports Appliances 20% Canada Asia 10% 60% 30% 40% 20% 60% 30% Murphy prepared the following product-line income statement based on the data presented above PACIFIC RIM INDUSTRIES Segmented Income Statement by Product Lines For the Fiscal Year Ended April 30, 20x0 Product Lines Sports Furniture Appliances Unallocated Total $8,630,000 6,160,000 160,000210,00O160,000 Sales in units Sales Variable manufacturing and selling costs Contribution margin Fixed costs: $1,440,000 $3,990,000 3,200,000 1,120,000 2,520,000 2,520,000 $ 320,000 $1,470,000 680,000 $ 92,545 $ 208,227$ 208,227 128,000 146,000 86,000 $2,470,000 Fixed manufacturing overhead Depreciation Administrative and selling expenses Total fixed costs $ 509,000 424,000 128,000 168,000 822,000 1,180,000 822,000 2,113,000 126,000146,00 S 346.545 522,227 422.227 Operating income (loss) $(26,545) $ 947,773 257,773 $ (822,000) 357,000 Required 1. Prepare a segmented income statement for Pacific Rim Industries based on the company's geographical areas. The statement should show the operating income for each segment. (Do not round your intermediate calculations and round your final answers to the nearest dollar amount.) Required: 1. Prepare a segmented income statement for Pacific Rim Industries based on the company's geographical areas. The statement should show the operating income for each segment. (Do not round your intermediate calculations and round your final answers to the nearest dollar amount.) PACIFIC RIM INDUSTRIES Segmented Income Statement by Geographic Areas For the Fiscal Year Ended April 30, 20x0 Geographic Areas United States Canada AsiaUnallocatedTotal Sales in units Furniture Sports Appliances Total unit sales Revenue Furniture Sports Appliances Total revenue Variable costs Furniture Sports Appliances Total variable costs Contribution margin Fixed costs Manufacturing overhead Depreciation Administrative and selling expenses Total fixed costs Operating income (loss)