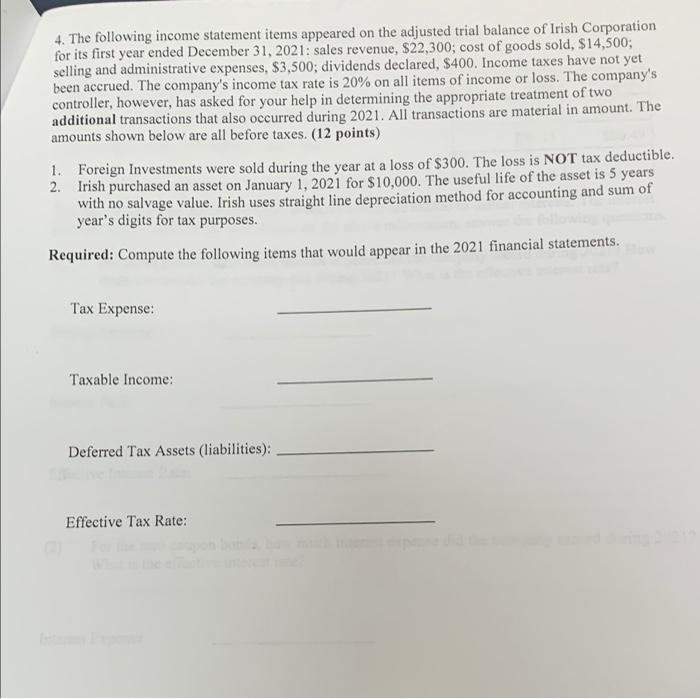

4. The following income statement items appeared on the adjusted trial balance of Irish Corporation for its first year ended December 31, 2021: sales revenue, $22,300; cost of goods sold, $14,500; selling and administrative expenses, $3,500; dividends declared, $400. Income taxes have not yet been accrued. The company's income tax rate is 20% on all items of income or loss. The company's controller, however, has asked for your help in determining the appropriate treatment of two additional transactions that also occurred during 2021. All transactions are material in amount. The amounts shown below are all before taxes. (12 points) 1. Foreign Investments were sold during the year at a loss of $300. The loss is NOT tax deductible. 2. Irish purchased an asset on January 1, 2021 for $10,000. The useful life of the asset is 5 years with no salvage value. Irish uses straight line depreciation method for accounting and sum of year's digits for tax purposes. Required: Compute the following items that would appear in the 2021 financial statements. Tax Expense: Taxable Income: Deferred Tax Assets (liabilities): Effective Tax Rate: 4. The following income statement items appeared on the adjusted trial balance of Irish Corporation for its first year ended December 31, 2021: sales revenue, $22,300; cost of goods sold, $14,500; selling and administrative expenses, $3,500; dividends declared, $400. Income taxes have not yet been accrued. The company's income tax rate is 20% on all items of income or loss. The company's controller, however, has asked for your help in determining the appropriate treatment of two additional transactions that also occurred during 2021. All transactions are material in amount. The amounts shown below are all before taxes. (12 points) 1. Foreign Investments were sold during the year at a loss of $300. The loss is NOT tax deductible. 2. Irish purchased an asset on January 1, 2021 for $10,000. The useful life of the asset is 5 years with no salvage value. Irish uses straight line depreciation method for accounting and sum of year's digits for tax purposes. Required: Compute the following items that would appear in the 2021 financial statements. Tax Expense: Taxable Income: Deferred Tax Assets (liabilities): Effective Tax Rate