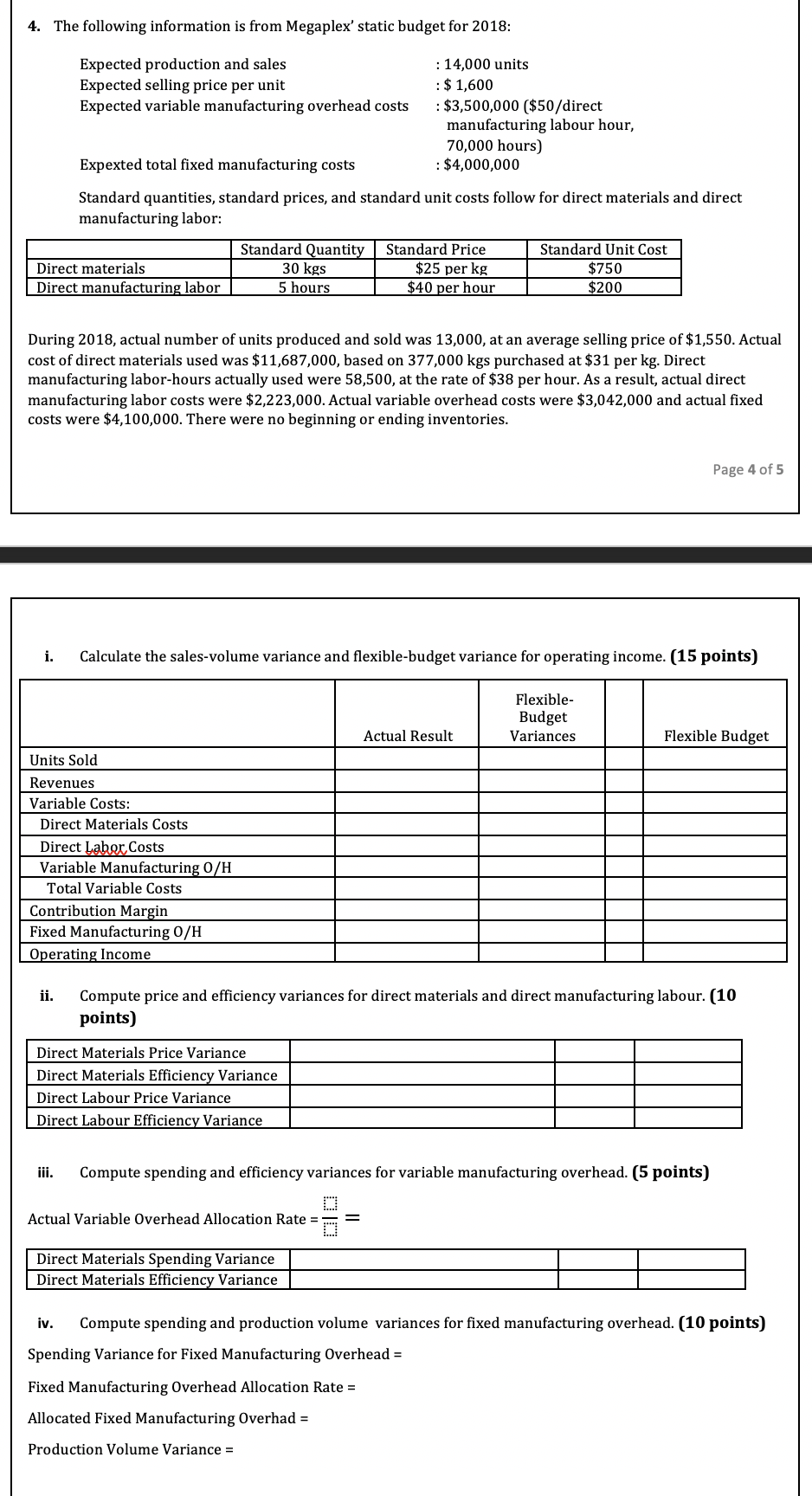

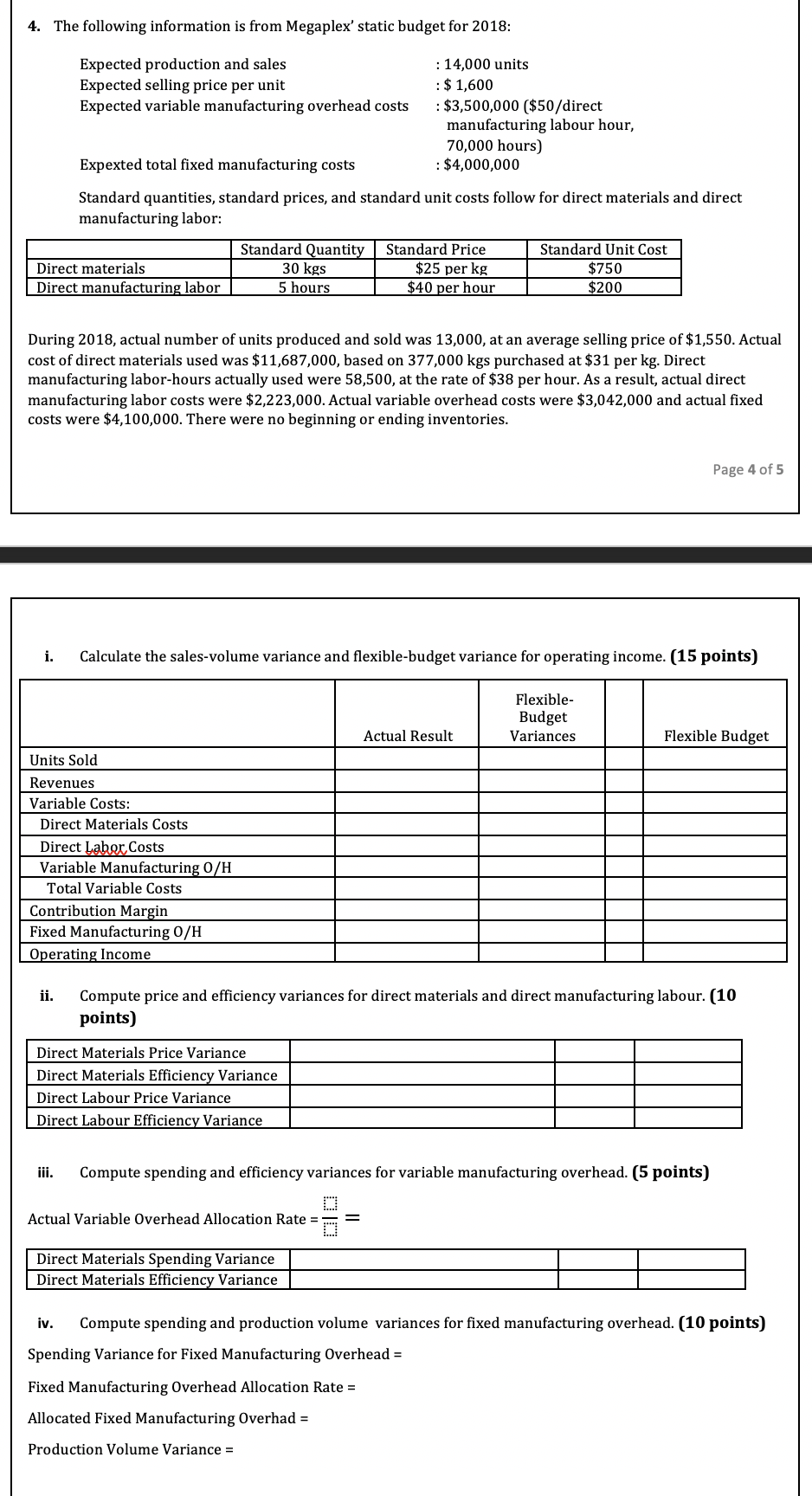

4. The following information is from Megaplex' static budget for 2018: Expected production and sales Expected selling price per unit Expected variable manufacturing overhead costs : 14,000 units : $ 1,600 : $3,500,000 ($50/direct manufacturing labour hour, 70,000 hours) : $4,000,000 Expexted total fixed manufacturing costs Standard quantities, standard prices, and standard unit costs follow for direct materials and direct manufacturing labor: Direct materials Direct manufacturing labor Standard Quantity 30 kgs 5 hours Standard Price $25 per kg $40 per hour Standard Unit Cost $750 $200 During 2018, actual number of units produced and sold was 13,000, at an average selling price of $1,550. Actual cost of direct materials used was $11,687,000, based on 377,000 kgs purchased at $31 per kg. Direct manufacturing labor-hours actually used were 58,500, at the rate of $38 per hour. As a result, actual direct manufacturing labor costs were $2,223,000. Actual variable overhead costs were $3,042,000 and actual fixed costs were $4,100,000. There were no beginning or ending inventories. Page 4 of 5 i. Calculate the sales-volume variance and flexible-budget variance for operating income. (15 points) Flexible- Budget Variances Actual Result Flexible Budget Units Sold Revenues Variable Costs: Direct Materials Costs Direct Labor Costs Variable Manufacturing O/H Total Variable Costs Contribution Margin Fixed Manufacturing O/H Operating Income ii. Compute price and efficiency variances for direct materials and direct manufacturing labour. (10 points) Direct Materials Price Variance Direct Materials Efficiency Variance Direct Labour Price Variance Direct Labour Efficiency Variance iii. Compute spending and efficiency variances for variable manufacturing overhead. (5 points) Actual Variable Overhead Allocation Rate = Direct Materials Spending Variance Direct Materials Efficiency Variance iv. Compute spending and production volume variances for fixed manufacturing overhead. (10 points) Spending Variance for Fixed Manufacturing Overhead = Fixed Manufacturing Overhead Allocation Rate = Allocated Fixed Manufacturing Overhad = Production Volume Variance =