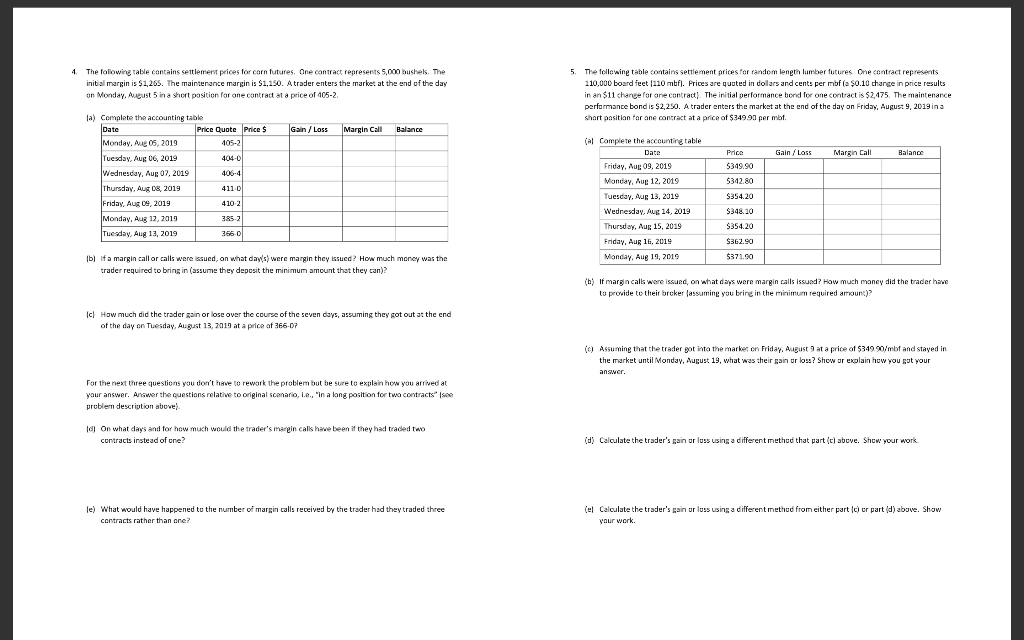

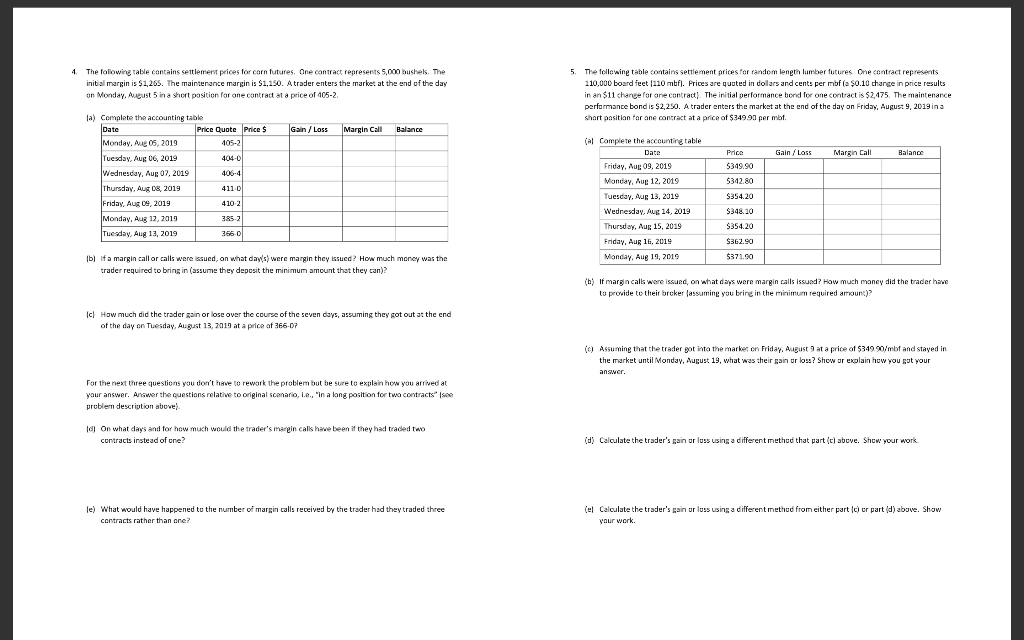

4. The following table contains settlement prices for corn futures. One contract represents 5.000 bushels. The initial margin is $1,265. The maintenance margin is $1,150. Atrader enters the market at the end of the day on Monday, August 5 in a short position for one contract at a price of 405-2 5. The following table contains settlement prices for random length lumber futures One contract represents 110,000 board feet (110 mtf). Prices are quoted in dollars and cents per mbf (a $0.10 change in price results in an $11 chance for one contract The initial performance bend for one contract is $2 175. The maintenance performance bond is $2,250. A trader enters the market at the end of the day on Friday, August 9, 2019 in a shart pasition for and contract at a price of $349.90 per mot Gain / Loss Margin Call Balance (al Complete the accounting table Date Gain/Lass Margin Call Balance la) Complete the accounting table Date Price Quote Price $ Monday, Aug 05, 2019 405-2 Tuesday, Aug 06, 2019 Wednesday, Aug 07, 2019 Thursday, Aug 08, 2019 4110 Friday, Aug 09. 2019 410 21 Price $399.90 Friday, Aug 09, 2019 Monday, Aug 12, 2019 Tuesday, Aug 13, 2019 Wednesday, Aug 14, 2019 Thursday, Aug 15, 2019 $342.80 $354.20 $348 10 5354.20 Monday, Aug 12, 2019 Tuesday, Aug 13, 2019 Friday, Aug 16, 2019 $362.90 Manday, Aug 19, 2019 $371.90 b) Ifa margin call or calls were issued, on what day's) were mangin they sucd? How much money was the trader required to bring in (assume they deposit the minimum amount that they can)? (b) If margin calls were issued on what days were margin calls issued? How much money did the trader have to provide to their broker assuming you bring in the minimum required amount) Ich How much did the trader gain or lose over the course of the seven days, assuming they got out at the end of the day on Tuesday, August 13, 2019 at a price af 366-07 c) Assuming that the trader got into the marker on Friday, August 9 At a price of $349 90/mot and stayed in the market until Monday, August 19, what was their gain or los? Show or explain how you got your For the next three questions you don't have to rework the problem but be sure to explain how you arrived at your answer. Answer the questions relative to original scenario, le, "in a lang position for two contracts see problem description above) Id On what days and for how much would the trader's margin call have been if they had traced to contracts instead of one? (d) Calculate the trader's gain or loss using a different method that part (c) above. Show your work le) What would have happened to the number of margin calls received by the trader had they traded three contracts rather than one? (el Calculate the trader's gain ur luss using a different method from either part (c) or part (d) above. Show your work. 4. The following table contains settlement prices for corn futures. One contract represents 5.000 bushels. The initial margin is $1,265. The maintenance margin is $1,150. Atrader enters the market at the end of the day on Monday, August 5 in a short position for one contract at a price of 405-2 5. The following table contains settlement prices for random length lumber futures One contract represents 110,000 board feet (110 mtf). Prices are quoted in dollars and cents per mbf (a $0.10 change in price results in an $11 chance for one contract The initial performance bend for one contract is $2 175. The maintenance performance bond is $2,250. A trader enters the market at the end of the day on Friday, August 9, 2019 in a shart pasition for and contract at a price of $349.90 per mot Gain / Loss Margin Call Balance (al Complete the accounting table Date Gain/Lass Margin Call Balance la) Complete the accounting table Date Price Quote Price $ Monday, Aug 05, 2019 405-2 Tuesday, Aug 06, 2019 Wednesday, Aug 07, 2019 Thursday, Aug 08, 2019 4110 Friday, Aug 09. 2019 410 21 Price $399.90 Friday, Aug 09, 2019 Monday, Aug 12, 2019 Tuesday, Aug 13, 2019 Wednesday, Aug 14, 2019 Thursday, Aug 15, 2019 $342.80 $354.20 $348 10 5354.20 Monday, Aug 12, 2019 Tuesday, Aug 13, 2019 Friday, Aug 16, 2019 $362.90 Manday, Aug 19, 2019 $371.90 b) Ifa margin call or calls were issued, on what day's) were mangin they sucd? How much money was the trader required to bring in (assume they deposit the minimum amount that they can)? (b) If margin calls were issued on what days were margin calls issued? How much money did the trader have to provide to their broker assuming you bring in the minimum required amount) Ich How much did the trader gain or lose over the course of the seven days, assuming they got out at the end of the day on Tuesday, August 13, 2019 at a price af 366-07 c) Assuming that the trader got into the marker on Friday, August 9 At a price of $349 90/mot and stayed in the market until Monday, August 19, what was their gain or los? Show or explain how you got your For the next three questions you don't have to rework the problem but be sure to explain how you arrived at your answer. Answer the questions relative to original scenario, le, "in a lang position for two contracts see problem description above) Id On what days and for how much would the trader's margin call have been if they had traced to contracts instead of one? (d) Calculate the trader's gain or loss using a different method that part (c) above. Show your work le) What would have happened to the number of margin calls received by the trader had they traded three contracts rather than one? (el Calculate the trader's gain ur luss using a different method from either part (c) or part (d) above. Show your work