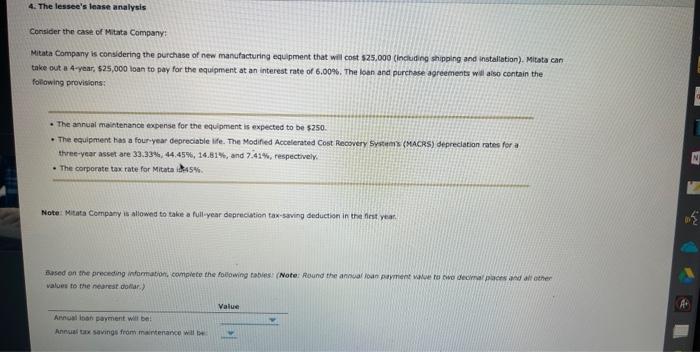

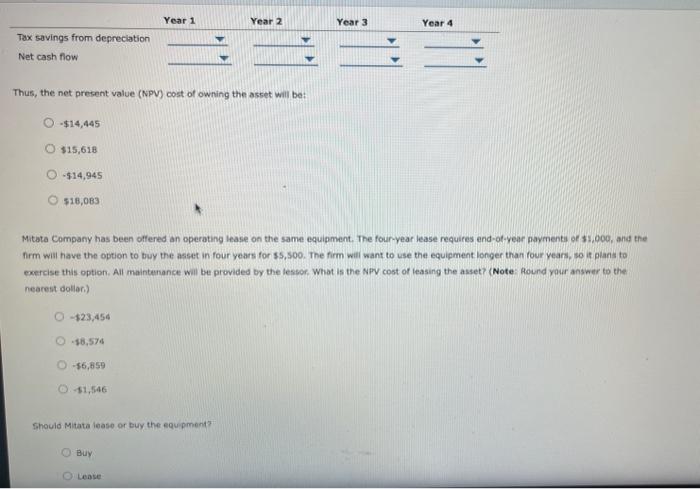

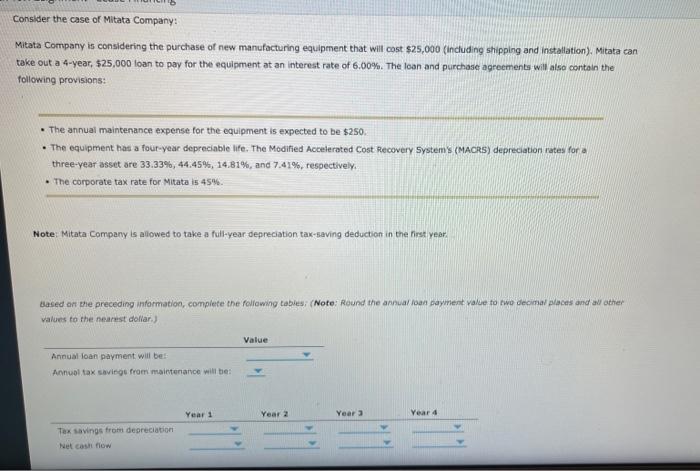

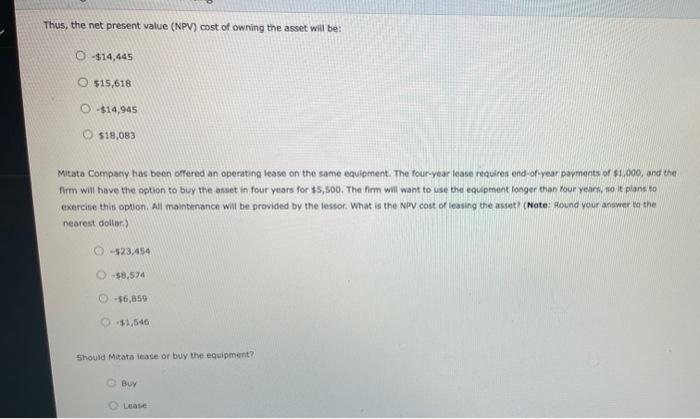

4. The lessee's lease analysis Consider the case of Mitrata Company? Mitata Company is considering the purehase of new manufacturing equipment that wil cost 525,000 (inctuding shipping and instaliation). Mitata can take out a 4-year, 525,000 loan to pay for the equipment at an interest rate of 6,00\%. The loan ard purcharce agreemeots will also contain the folowing provisians: - The ahnual maintenance expense for the equipment is expected to be 5250 . * The equipment has a fouryear deoreciable life. The Modified Accelerated Cost Aocovery Systenas (MhchS) depreclatian rates for a three-year asset are 33.334,44,45%,14.81%, and 7.41%, respectively. * The comporate tax rate for Mitata ias 4 is. Note: Moata Company is allowed to take a full-year deprecuation tax-saving deduction in the ficst year. valoen to the nedrest oblar.? Thus, the net present value (NPV) cost of owning the asset will be: $14,445$15,618$14,945$18,083 Mitata Company has been offered an operating lease on the same equipment. The four-year lease requires end-ot-year payrnenti of st.ooo, and the firm will have the option to buy the asset in four years for 55,500 . The firm will want to use the equipment longer than four vears, so it glan to exercise thas option. All maintenance will be provided by the lessor. What is the NpV cost of leasing the asset? (Note: Round your ansher to the nearest dotior. 423,45418,57456,65941,546 Should Mitata lease or buy the equ pment? Buy Lease Mitata Company is considering the purchase of new manufacturing equipment that will cast 525,000 (including shipping and installation). Mitata can take out a 4-year, $25,000 loan to pay for the equipment at an interest rate of 6.00%. The loan and purchase agreements will also contoin the following provisions: - The annual maintenance expense for the equipment is expected to be $250. - The equipment has a four-year depreciable life. The Modified Accelerated Cost Recovery 5ystem's (MAcrS) depreciation rates for a three-year asset are 33.33%;44.45%,14.81%, and 7.41%, respectively. - The corporate tax rate for Mitata is 45%. Note: Mitata Company is allowed to take a full-year-depreciation tax-saving deduction in the first year. Uased an whe preceding information, compiete the following tabues: (Note: Round the annual ioan payment value to two decimar places and an ather values to the nearest doliar.) Thus, the net present value (NPM) cost of owning the asset will be: Mitata Company has been orfered an operating lease on the same equiement. The four-year lease ruquirea end-of-year payments of 11 ood, and the firm will have the option to buy the asset in four years for $5,500. The firm will want to use the equipment longer than four years, Bo it plans to exercise this opton. All maintenance Will be provided by the lessor. What is the NPN cost of leasing the asset? (Note: Pound your answer to the nearest doltar.) Should Mirats leace or buy the equipment? BuY Lease