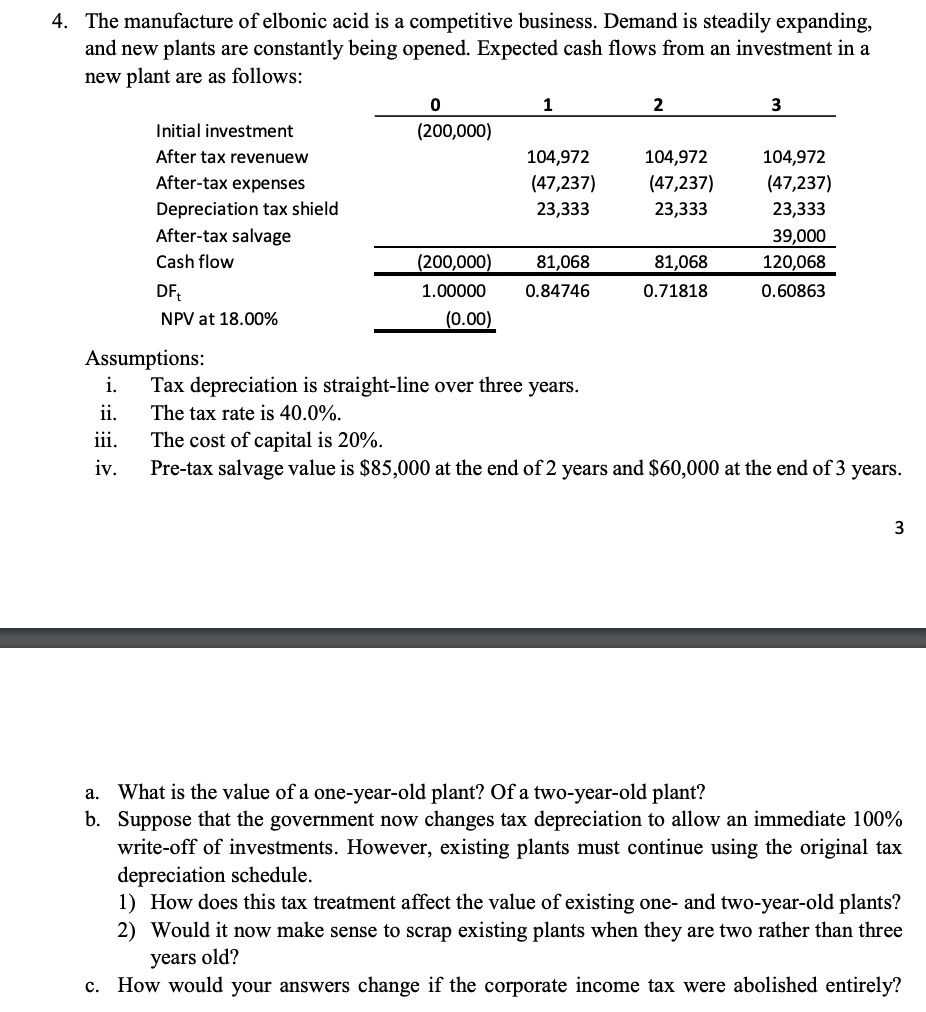

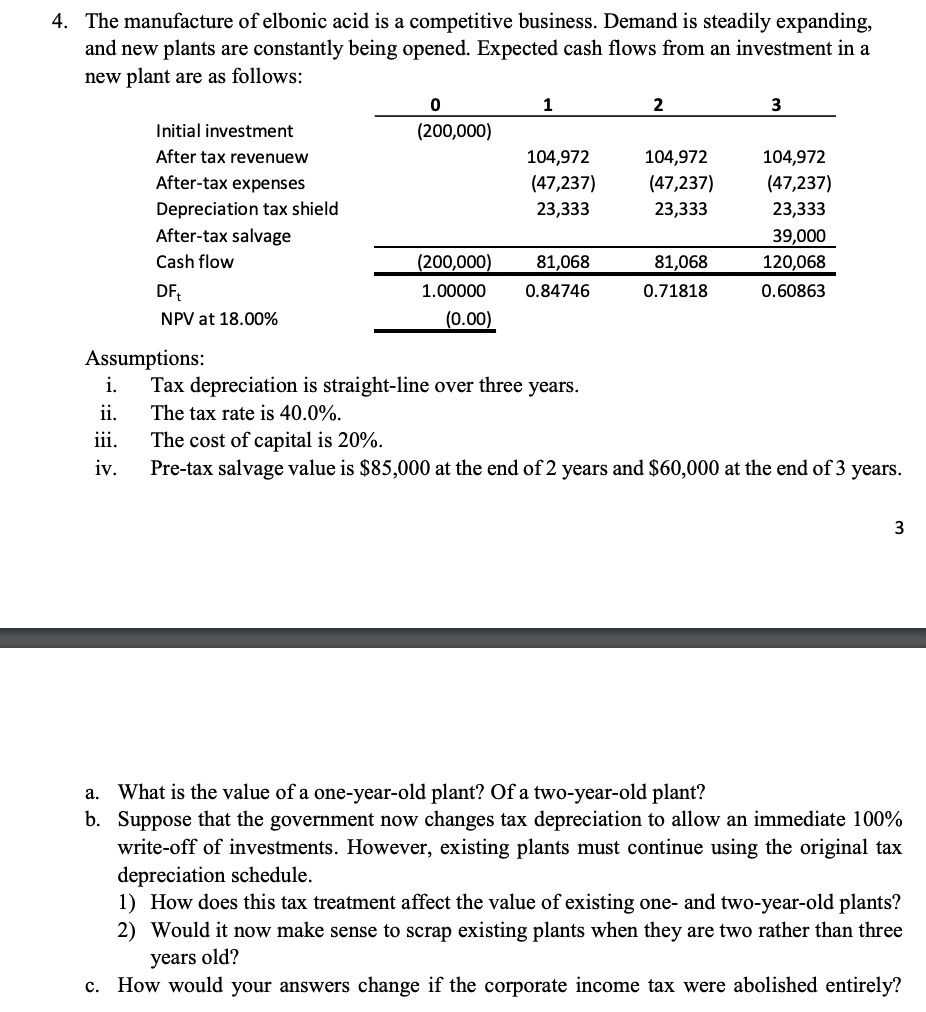

4. The manufacture of elbonic acid is a competitive business. Demand is steadily expanding, and new plants are constantly being opened. Expected cash flows from an investment in a new plant are as follows: 0 1 2 3 Initial investment (200,000) After tax revenuew 104,972 104,972 104,972 After-tax expenses (47,237) (47,237) (47,237) Depreciation tax shield 23,333 23,333 23,333 After-tax salvage 39,000 Cash flow (200,000) 81,068 81,068 120,068 DF 1.00000 0.84746 0.71818 0.60863 NPV at 18.00% (0.00) Assumptions: i. Tax depreciation is straight-line over three years. ii. The tax rate is 40.0%. iii. The cost of capital is 20%. iv. Pre-tax salvage value is $85,000 at the end of 2 years and $60,000 at the end of 3 years. 3 a. What is the value of a one-year-old plant? Of a two-year-old plant? b. Suppose that the government now changes tax depreciation to allow an immediate 100% write-off of investments. However, existing plants must continue using the original tax depreciation schedule. 1) How does this tax treatment affect the value of existing one- and two-year-old plants? 2) Would it now make sense to scrap existing plants when they are two rather than three years old? c. How would your answers change if the corporate income tax were abolished entirely? 4. The manufacture of elbonic acid is a competitive business. Demand is steadily expanding, and new plants are constantly being opened. Expected cash flows from an investment in a new plant are as follows: 0 1 2 3 Initial investment (200,000) After tax revenuew 104,972 104,972 104,972 After-tax expenses (47,237) (47,237) (47,237) Depreciation tax shield 23,333 23,333 23,333 After-tax salvage 39,000 Cash flow (200,000) 81,068 81,068 120,068 DF 1.00000 0.84746 0.71818 0.60863 NPV at 18.00% (0.00) Assumptions: i. Tax depreciation is straight-line over three years. ii. The tax rate is 40.0%. iii. The cost of capital is 20%. iv. Pre-tax salvage value is $85,000 at the end of 2 years and $60,000 at the end of 3 years. 3 a. What is the value of a one-year-old plant? Of a two-year-old plant? b. Suppose that the government now changes tax depreciation to allow an immediate 100% write-off of investments. However, existing plants must continue using the original tax depreciation schedule. 1) How does this tax treatment affect the value of existing one- and two-year-old plants? 2) Would it now make sense to scrap existing plants when they are two rather than three years old? c. How would your answers change if the corporate income tax were abolished entirely