Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(4) The notional amount of a derivative instrument is a. related to the number of units specified in the derivative and the price that relates

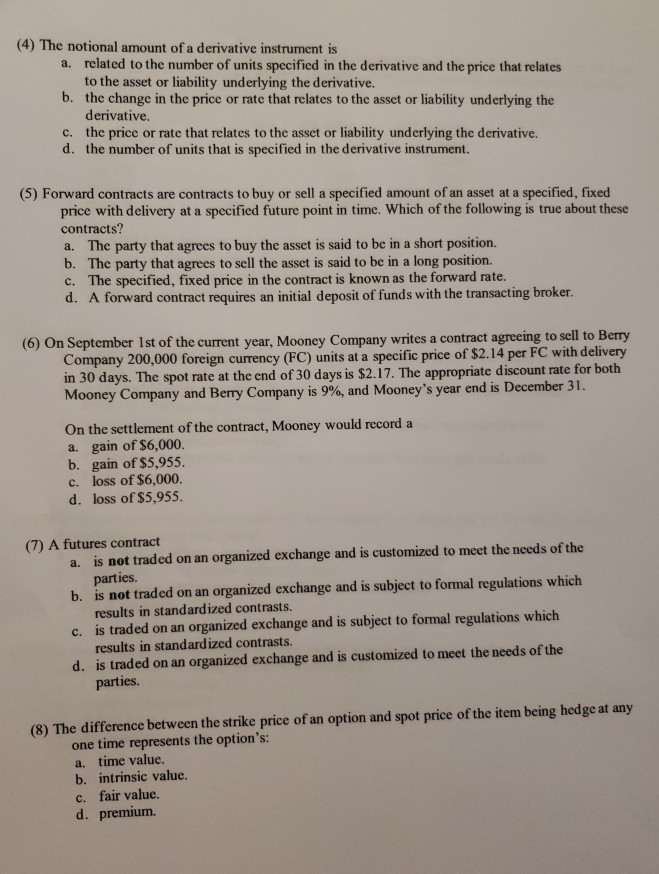

(4) The notional amount of a derivative instrument is a. related to the number of units specified in the derivative and the price that relates to the asset or liability underlying the derivative. b. the change in the price or rate that relates to the asset or liability underlying the derivative. c. the price or rate that relates to the asset or liability underlying the derivative. d. the number of units that is specified in the derivative instrument. (5) Forward contracts are contracts to buy or sell a specified amount of an asset at a specified, fixed price with delivery at a specified future point in time. Which of the following is true about these contracts? a. The party that agrees to buy the asset is said to be in a short position. b. The party that agrees to sell the asset is said to be in a long position. c. The specified, fixed price in the contract is known as the forward rate. d. A forward contract requires an initial deposit of funds with the transacting broker. (6) On September 1st of the current year, Mooney Company writes a contract agreeing to sell to Berry Company 200,000 foreign currency (FC) units at a specific price of $2.14 per FC with delivery in 30 days. The spot rate at the end of 30 days is $2.17. The appropriate discount rate for both Mooney Company and Berry Company is 9%, and Mooney's year end is December 31. On the settlement of the contract, Mooney would record a a. gain of $6,000. b. gain of $5,955. c. loss of $6,000. d. loss of $5,955. (7) A futures contract a. is not traded on an organized exchange and is customized to meet the needs of the parties. b. is not traded on an organized exchange and is subject to formal regulations which results in standardized contrasts. c. is traded on an organized exchange and is subject to formal regulations which results in standardized contrasts. d. is traded on an organized exchange and is customized to meet the needs of the parties. (8) The difference between the strike price of an option and spot price of the item being hedge at any one time represents the option's: a. time value. b. intrinsic value. c. fair value. d. premium

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started