Answered step by step

Verified Expert Solution

Question

1 Approved Answer

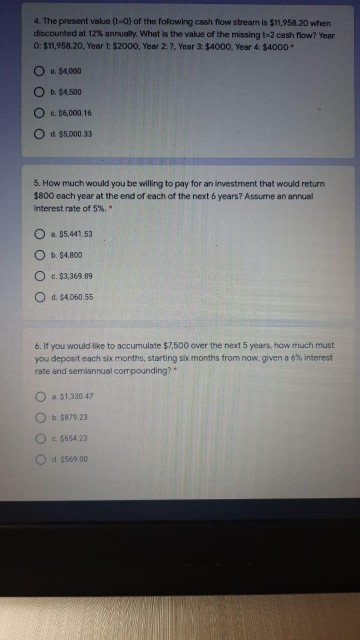

4. The present value (t-0) of the folowing cash flow stream is $11.958.20 when discounted at 12% annually. What is the value of the missing

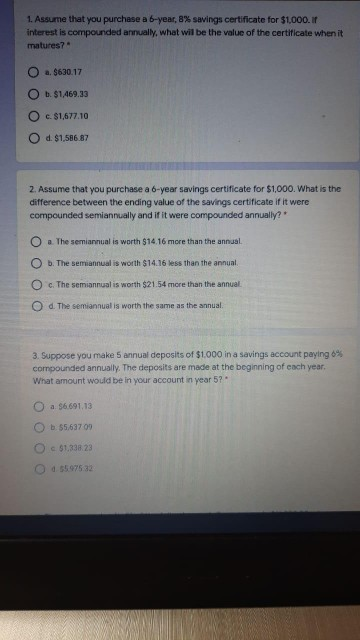

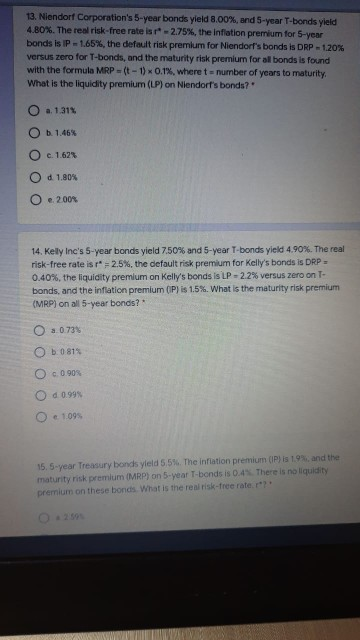

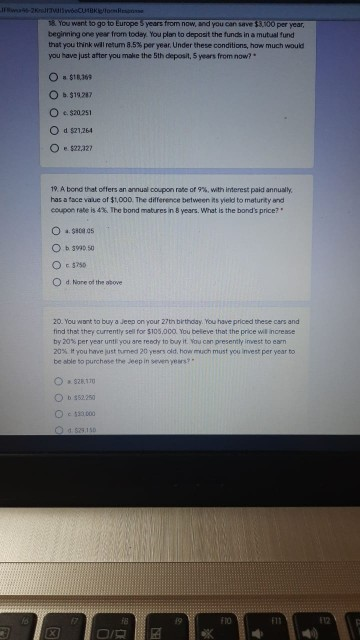

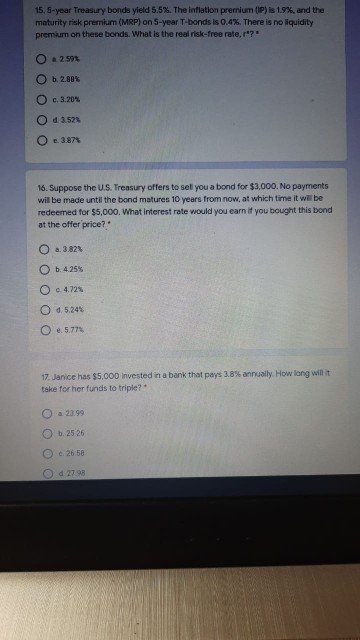

4. The present value (t-0) of the folowing cash flow stream is $11.958.20 when discounted at 12% annually. What is the value of the missing t-2 cash flow? Year 0: $11,958.20 Year 1: S2000, Year 2: 7. Year 3: $4000, Year 4: $4000 O . $4,000 O . $4.500 O c. 56,000.16 O $5,000.00 5. How much would you be willing to pay for an investment that would return $800 each year at the end of each of the next 6 years? Assume an annual interest rate of 5%. O a $5,441.53 O O O b. $4,800 c.$3,369.89 d. $4.060.55 6. If you would like to accumulate $7.500 over the next 5 years, how much must you deposit cach six months, starting se months from now, given a 6% interest rate and semiannual compounding? O a $1,330.47 O $279 23 O $65423 Od $569.00 1. Assume that you purchase a 6-year, 8% savings certificate for $1.000.IT interest is compounded annually, what will be the value of the certificate when it matures? 0 a $630.17 O b. $1.469.33 O c. $1,677.10 O d. $1,586.87 2. Assume that you purchase a 6-year savings certificate for $1,000. What is the difference between the ending value of the savings certificate if it were compounded semiannually and if it were compounded annually? O a The semiannual is worth $14.16 more than the annual b. The semiannual is worth $14.16 less than the annual O c. The semiannual is worth $21.54 more than the annual O d. The semiannual is worth the same as the annual 3. Suppose you make 5 annual deposits of $1.000 in a savings account paying % compounded annually. The deposits are made at the beginning of each year, What amount would be in your account in year 5? O a $6.691.13 Ob $5,63709 O 61338:23 13. Niendorf Corporation's 5-year bonds yield 8.00% and 5-year T-bonds yield 4.80%. The real risk-free rate isr - 2.75%, the inflation premium for 5-year bonds is P-1.65%, the default risk premium for Niendorfs bonds is RP 120% versus zero for T-bonds, and the maturity risk premium for all bonds is found with the formula MRP (t-1) 0.1%, where t number of years to maturity. What is the liquidity premium (LP) on Niendorf's bonds? 0 .131 O b. 1.46% O c. 1.62% Od 1.80% O 2008 14. Kely Inc's 5-year bonds yield 7.50% and 5-year T-bonds yield 4.90%. The real risk-free rate is 192.5%, the default risk premium for Kellys bonds is DRP = 0.40%, the liquidity premium on Kelly's bonds is LP-22% versus zero on T- bonds, and the inflation premium (IP) is 1.5%. What is the maturity risk premium (MRP) on all 5-year bonds? O a 0731 O O 6.000 O 009 O 109 15.5-year Treasury bonds yield 5,5%. The inflation premium (IP) is 19%and the maturity risk premium (MRP) on 5-year T-bonds is 0.4% There is no liquidity premium on these bonds. What is the real risk-free rate 2Utena & You want to go to Europe years from now, and you can save $300 per year, beginning one year from today You plan to deposit the funds in a mutual fund that you think will return 8.5% per year. Under these conditions, how much would you have just after you make the 5th deposit, 5 years from now? $16.369 O . $19.217 O $20.251 Od $21,264 O $22,327 19. A bond that offers an annual coupon rate of 9%, with interest paid annually has a face value of $1,000. The difference between its yield to maturity and coupon rate is 4%. The bond matures in 8 years. What is the bond's price?" 0.00 Ob $990.50 O $750 d. None of the above 20. You want to buy a jeep on your 27th birthday. You have priced these cars and find that they currently sell for $105,000. You believe that the price will increase by 20% per year until you are ready to buy it. You can presently invest to earn 20% If you have just turned 20 years old, how much must you invest per year to be able to purchase the Jeep in seven years?" O $28170 $52.250 13.000 15. 5-year Treasury bonds yield 5.5%. The inflation premium (IP) is 1.9%, and the maturity risk premium (MRP) on 5-year T-bonds is 0.4%. There is no liquidity premium on these bonds. What is the real risk-free rate.r? 0.2592 O 6.2.89% Oc.3.202 43528 23871 16. Suppose the U.S. Treasury offers to sel you a bond for $3,000. No payments will be made until the bond matures 10 years from now, at which time it will be redeemed for $5,000. What interest rate would you earn if you bought this bond at the offer price? 3.821 b. 4.258 O e 4728 O 0.5245 O 5.773 17. Janice has $5,000 invested in a bank that pays 3.8% annually. How long willit take for her funds to triple? O a 23.99 5.2526 2652 . 27.98 O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started