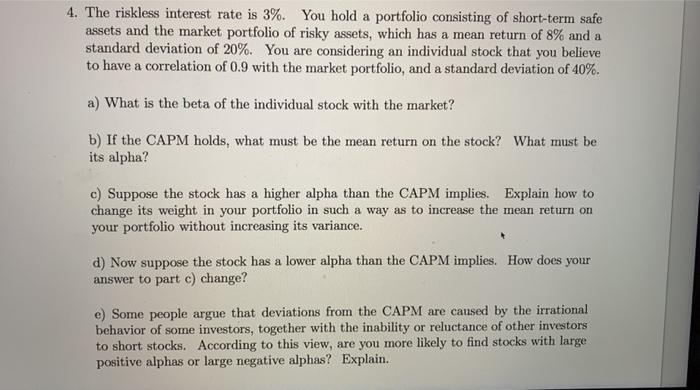

4. The riskless interest rate is 3%. You hold a portfolio consisting of short-term safe assets and the market portfolio of risky assets, which has a mean return of 8% and a standard deviation of 20%. You are considering an individual stock that you believe to have a correlation of 0.9 with the market portfolio, and a standard deviation of 40%. a) What is the beta of the individual stock with the market? b) If the CAPM holds, what must be the mean return on the stock? What must be its alpha? c) Suppose the stock has a higher alpha than the CAPM implies. Explain how to change its weight in your portfolio in such a way as to increase the mean return on your portfolio without increasing its variance. d) Now suppose the stock has a lower alpha than the CAPM implies. How does your answer to part c) change? e) Some people argue that deviations from the CAPM are caused by the irrational behavior of some investors, together with the inability or reluctance of other investors to short stocks. According to this view, are you more likely to find stocks with large positive alphas or large negative alphas? Explain. 4. The riskless interest rate is 3%. You hold a portfolio consisting of short-term safe assets and the market portfolio of risky assets, which has a mean return of 8% and a standard deviation of 20%. You are considering an individual stock that you believe to have a correlation of 0.9 with the market portfolio, and a standard deviation of 40%. a) What is the beta of the individual stock with the market? b) If the CAPM holds, what must be the mean return on the stock? What must be its alpha? c) Suppose the stock has a higher alpha than the CAPM implies. Explain how to change its weight in your portfolio in such a way as to increase the mean return on your portfolio without increasing its variance. d) Now suppose the stock has a lower alpha than the CAPM implies. How does your answer to part c) change? e) Some people argue that deviations from the CAPM are caused by the irrational behavior of some investors, together with the inability or reluctance of other investors to short stocks. According to this view, are you more likely to find stocks with large positive alphas or large negative alphas? Explain