Question

4. The stock market is trading at $3,000 and paying a dividend of $60. You expect the growth rates of dividends to be 4%

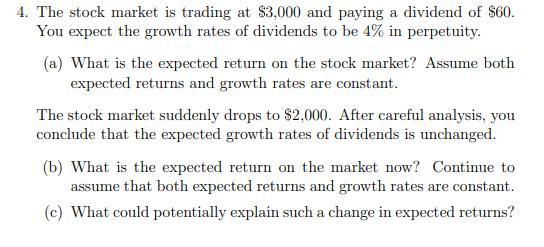

4. The stock market is trading at $3,000 and paying a dividend of $60. You expect the growth rates of dividends to be 4% in perpetuity. (a) What is the expected return on the stock market? Assume both expected returns and growth rates are constant. The stock market suddenly drops to $2,000. After careful analysis, you conclude that the expected growth rates of dividends is unchanged. (b) What is the expected return on the market now? Continue to assume that both expected returns and growth rates are constant. (c) What could potentially explain such a change in expected returns?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting in an Economic Context

Authors: Jamie Pratt

8th Edition

9781118139424, 9781118139431, 470635290, 1118139429, 1118139437, 978-0470635292

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App