Answered step by step

Verified Expert Solution

Question

1 Approved Answer

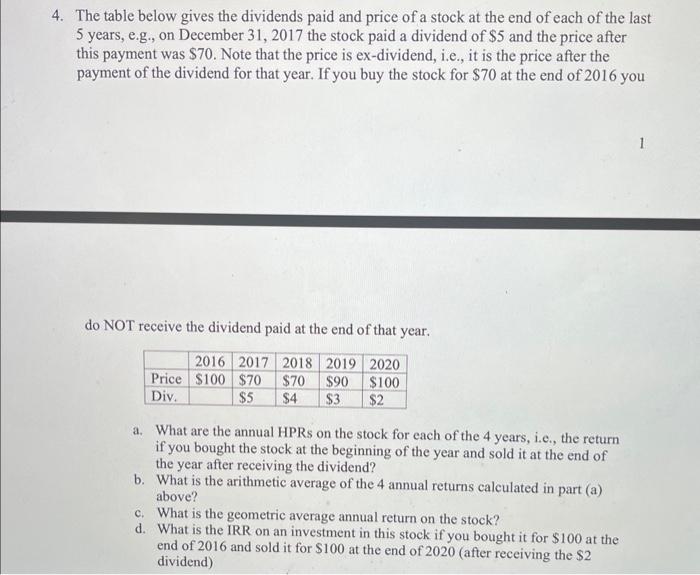

4. The table below gives the dividends paid and price of a stock at the end of each of the last 5 years, e.g.,

4. The table below gives the dividends paid and price of a stock at the end of each of the last 5 years, e.g., on December 31, 2017 the stock paid a dividend of $5 and the price after this payment was $70. Note that the price is ex-dividend, i.e., it is the price after the payment of the dividend for that year. If you buy the stock for $70 at the end of 2016 you do NOT receive the dividend paid at the end of that year. 2016 2017 2018 2019 2020 $100 Price $100 $70 Div. $5 $70 $90 $4 $3 $2 a. What are the annual HPRs on the stock for each of the 4 years, i.e., the return if you bought the stock at the beginning of the year and sold it at the end of the year after receiving the dividend? b. What is the arithmetic average of the 4 annual returns calculated in part (a) above? c. What is the geometric average annual return on the stock? d. What is the IRR on an investment in this stock if you bought it for $100 at the end of 2016 and sold it for $100 at the end of 2020 (after receiving the $2 dividend) 1 4. The table below gives the dividends paid and price of a stock at the end of each of the last 5 years, e.g., on December 31, 2017 the stock paid a dividend of $5 and the price after this payment was $70. Note that the price is ex-dividend, i.e., it is the price after the payment of the dividend for that year. If you buy the stock for $70 at the end of 2016 you do NOT receive the dividend paid at the end of that year. 2016 2017 2018 2019 2020 $100 Price $100 $70 Div. $5 $70 $90 $4 $3 $2 a. What are the annual HPRs on the stock for each of the 4 years, i.e., the return if you bought the stock at the beginning of the year and sold it at the end of the year after receiving the dividend? b. What is the arithmetic average of the 4 annual returns calculated in part (a) above? c. What is the geometric average annual return on the stock? d. What is the IRR on an investment in this stock if you bought it for $100 at the end of 2016 and sold it for $100 at the end of 2020 (after receiving the $2 dividend) 1

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the annual Holding Period Returns HPRs for each of the 4 years you need to consider both the change in stock price and the dividends re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started