Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. The table below shows the daily closing values of the S&P 500 index, along with the daily prices for the S&P 500 futures

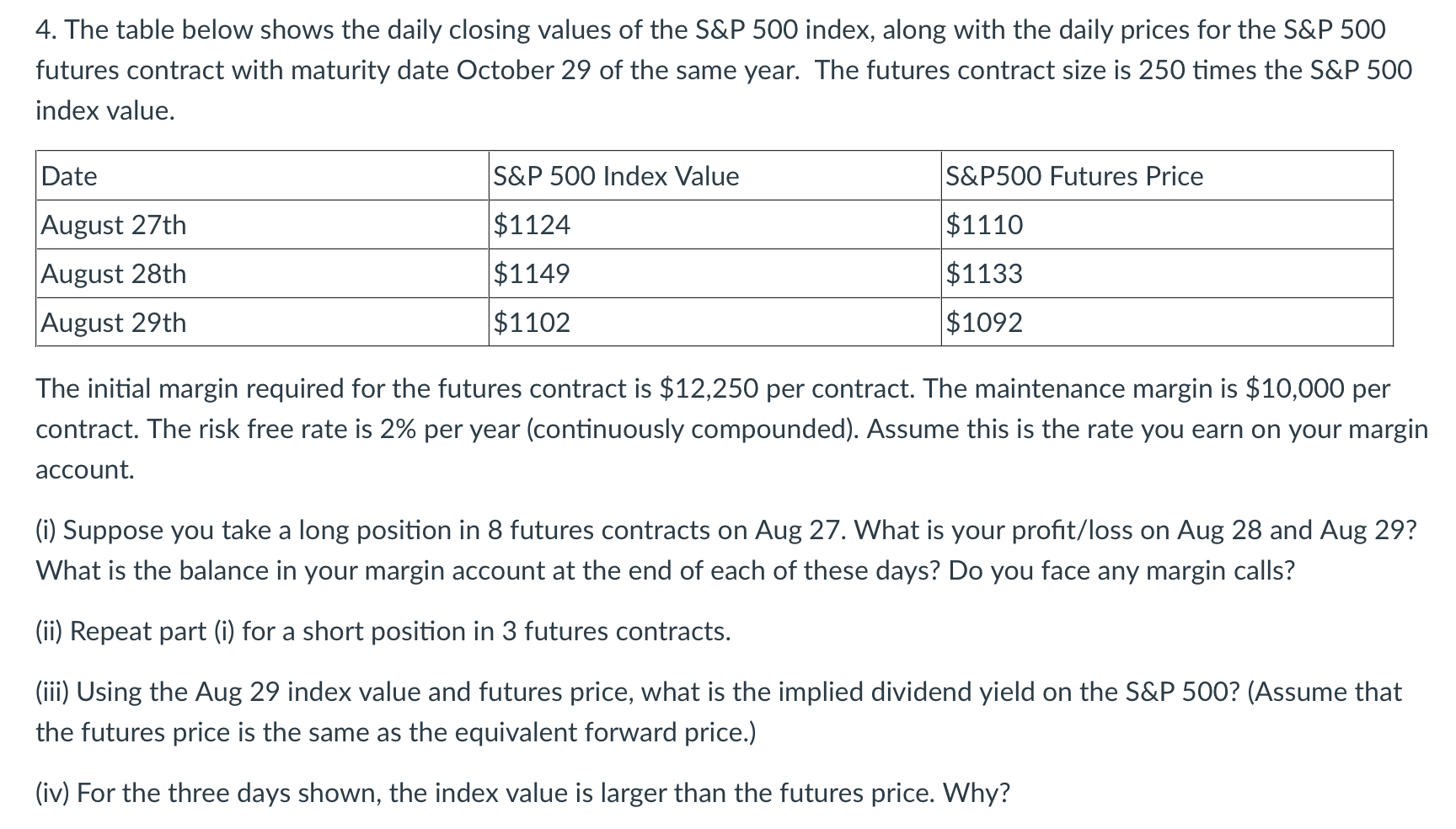

4. The table below shows the daily closing values of the S&P 500 index, along with the daily prices for the S&P 500 futures contract with maturity date October 29 of the same year. The futures contract size is 250 times the S&P 500 index value. Date August 27th August 28th August 29th S&P 500 Index Value $1124 $1149 $1102 S&P500 Futures Price $1110 $1133 $1092 The initial margin required for the futures contract is $12,250 per contract. The maintenance margin is $10,000 per contract. The risk free rate is 2% per year (continuously compounded). Assume this is the rate you earn on your margin account. (i) Suppose you take a long position in 8 futures contracts on Aug 27. What is your profit/loss on Aug 28 and Aug 29? What is the balance in your margin account at the end of each of these days? Do you face any margin calls? (ii) Repeat part (i) for a short position in 3 futures contracts. (iii) Using the Aug 29 index value and futures price, what is the implied dividend yield on the S&P 500? (Assume that the futures price is the same as the equivalent forward price.) (iv) For the three days shown, the index value is larger than the futures price. Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Long Position in 8 Futures Contracts on Aug 27 Initial Margin per Contract 12250 Number of Contracts 8 Total Initial Margin Required 12250 8 98000 O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started