Answered step by step

Verified Expert Solution

Question

1 Approved Answer

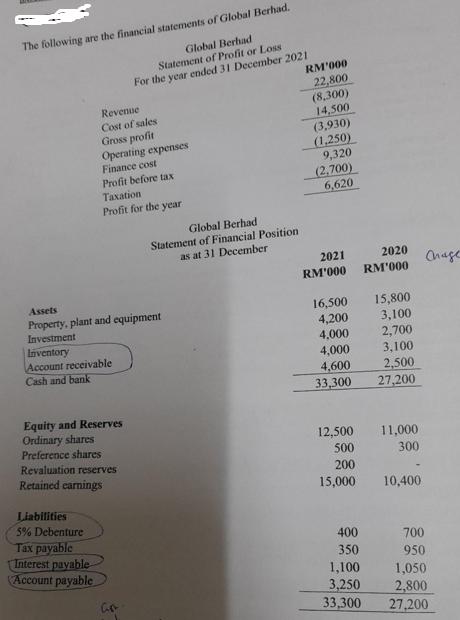

The following are the financial statements of Global Berhad. Global Berhad Statement of Profit or Loss For the year ended 31 December 2021 Revenue

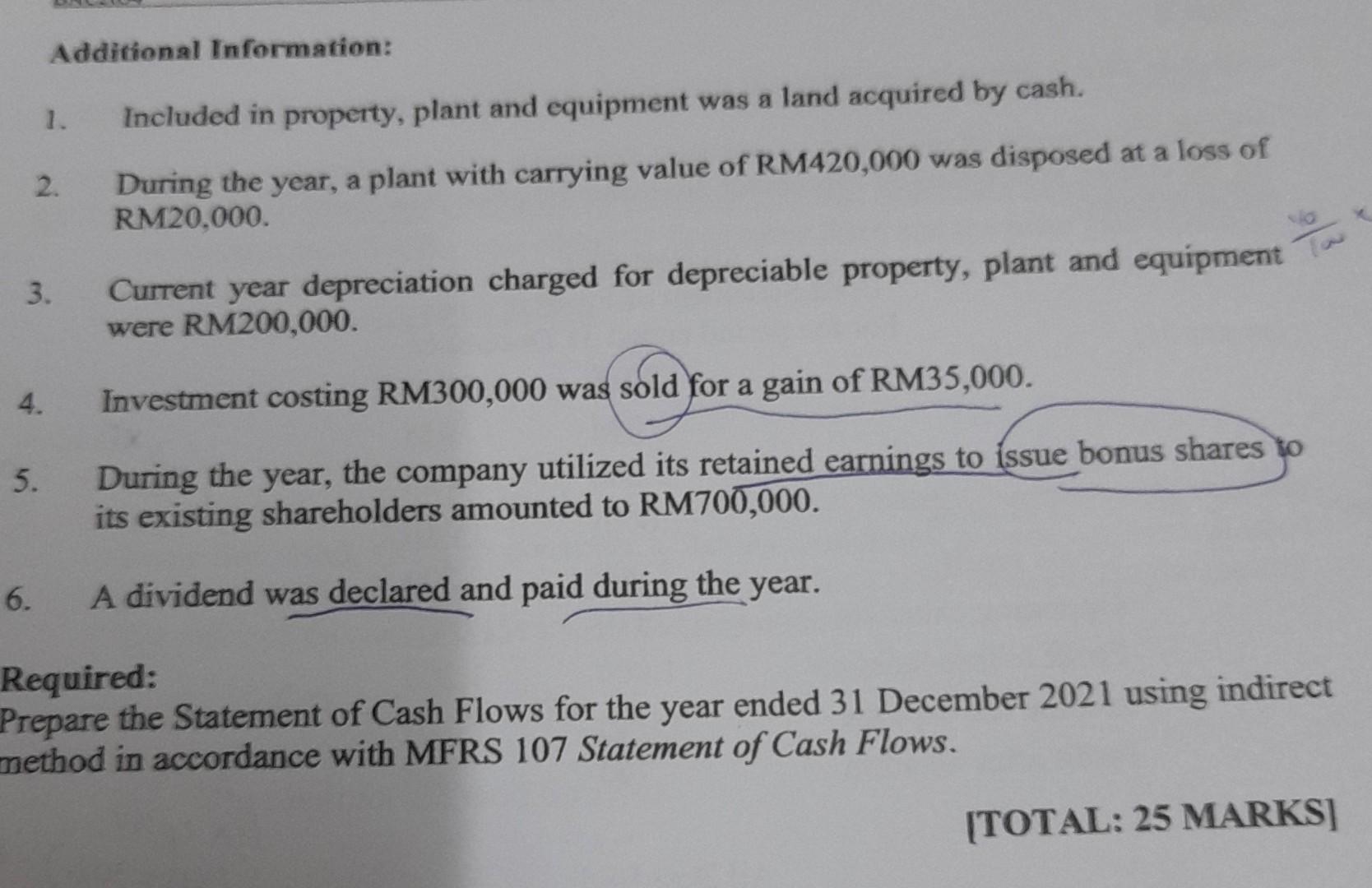

The following are the financial statements of Global Berhad. Global Berhad Statement of Profit or Loss For the year ended 31 December 2021 Revenue Cost of sales Gross profit Operating expenses Finance cost Profit before tax Taxation Profit for the year Liabilities 5% Debenture Tax payable Interest payable Account payable Assets Property, plant and equipment Investment Inventory Account receivable Cash and bank Equity and Reserves Ordinary shares Preference shares Revaluation reserves Retained earnings Global Berhad Statement of Financial Position as at 31 December Gp RM'000 22,800 (8,300) 14,500 (3,930) (1,250) 9,320 (2.700) 6,620 2021 RM'000 16,500 4,200 4,000 4,000 4,600 33,300 12,500 500 200 15,000 2020 RM'000 400 350 1,100 3,250 33,300 15,800 3,100 2,700 3,100 2,500 27,200 11,000 300 10,400 700 950 1,050 2,800 27,200 Additional Information: 5. 6. 1. 2. 3. Included in property, plant and equipment was a land acquired by cash. During the year, a plant with carrying value of RM420,000 was disposed at a loss of RM20,000. Current year depreciation charged for depreciable property, plant and equipment were RM200,000. Investment costing RM300,000 was sold for a gain of RM35,000. During the year, the company utilized its retained earnings to issue bonus shares to its existing shareholders amounted to RM700,000. A dividend was declared and paid during the year. Required: Prepare the Statement of Cash Flows for the year ended 31 December 2021 using indirect method in accordance with MFRS 107 Statement of Cash Flows. [TOTAL: 25 MARKS]

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Statement of Cash Flows For the year ended 31 December 2021 Operating Acti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started