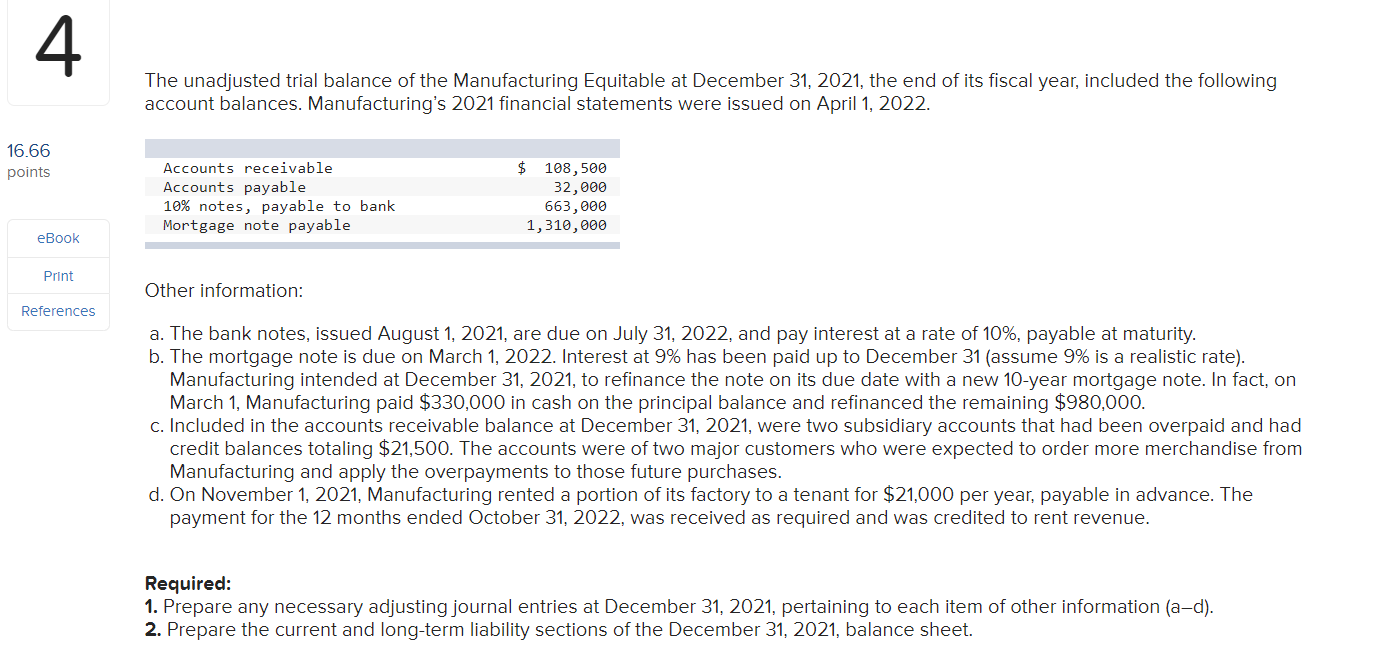

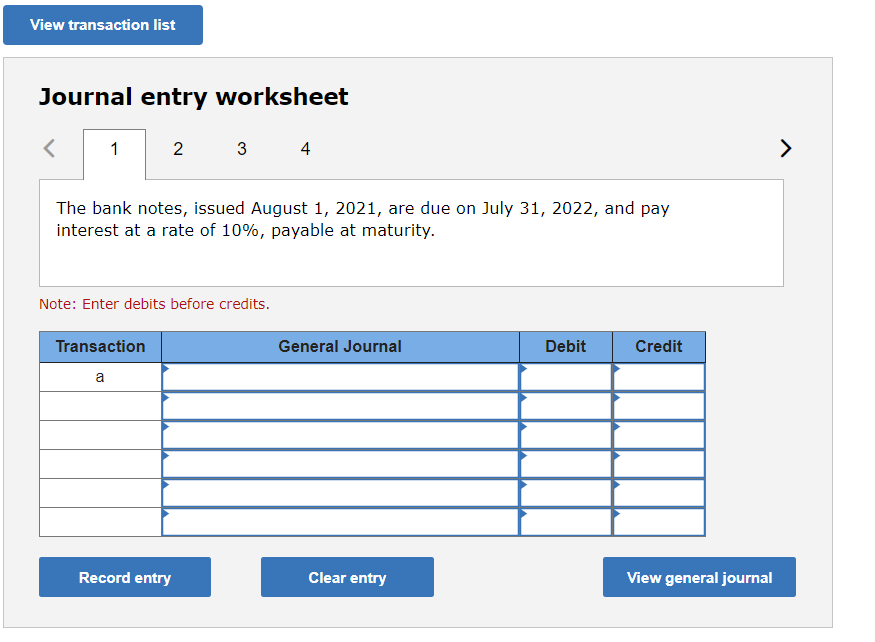

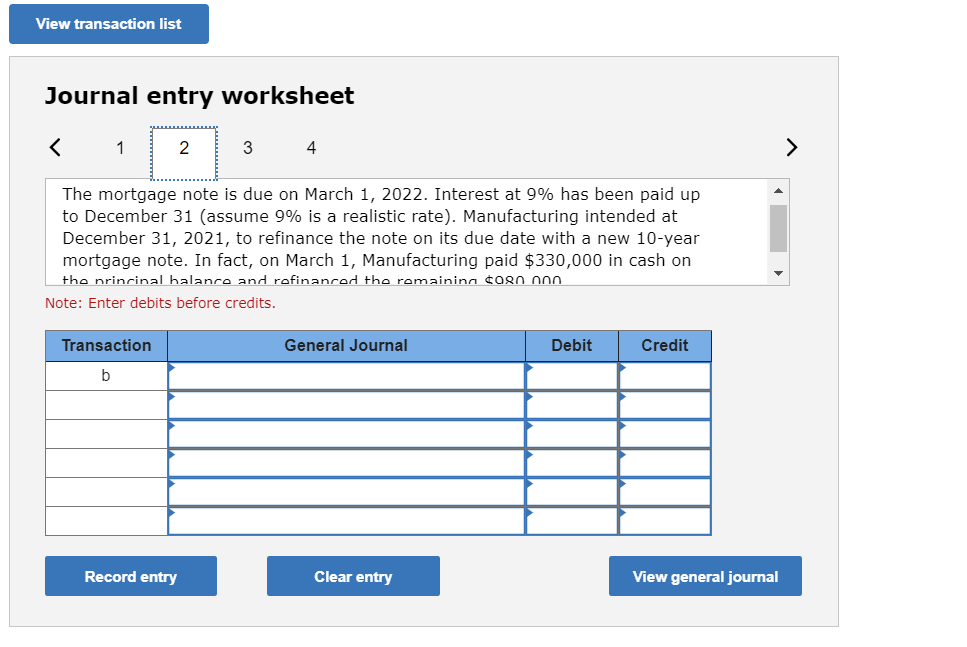

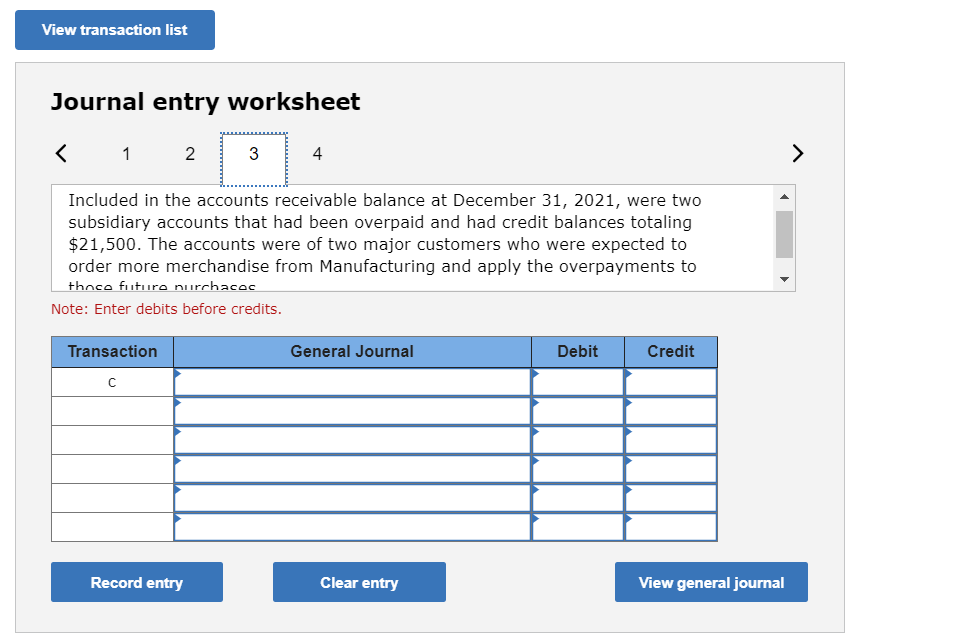

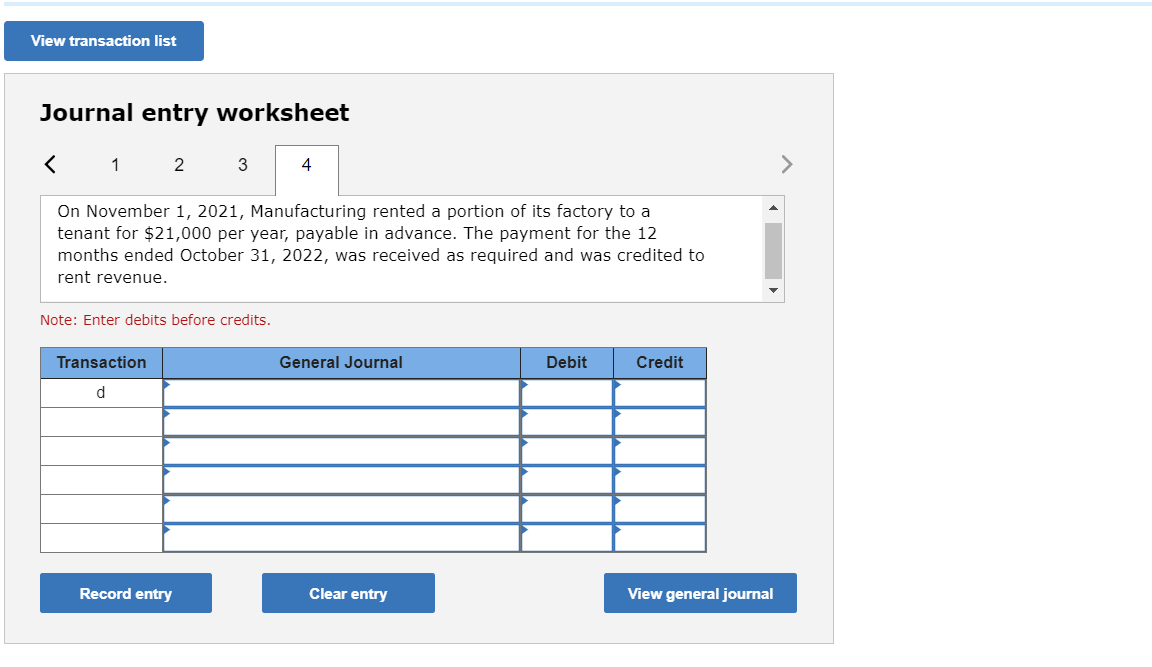

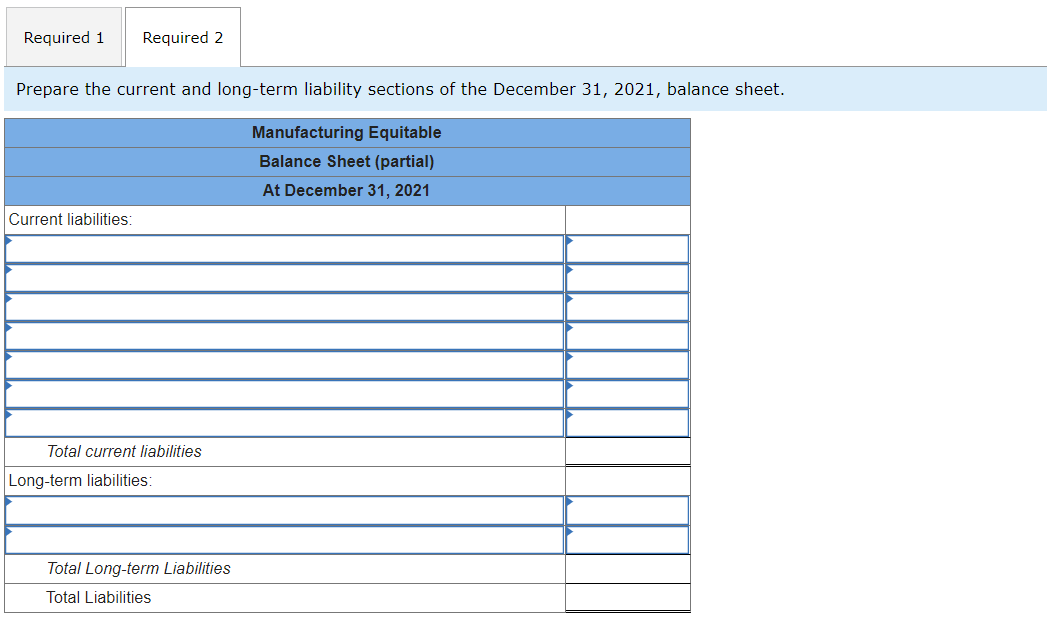

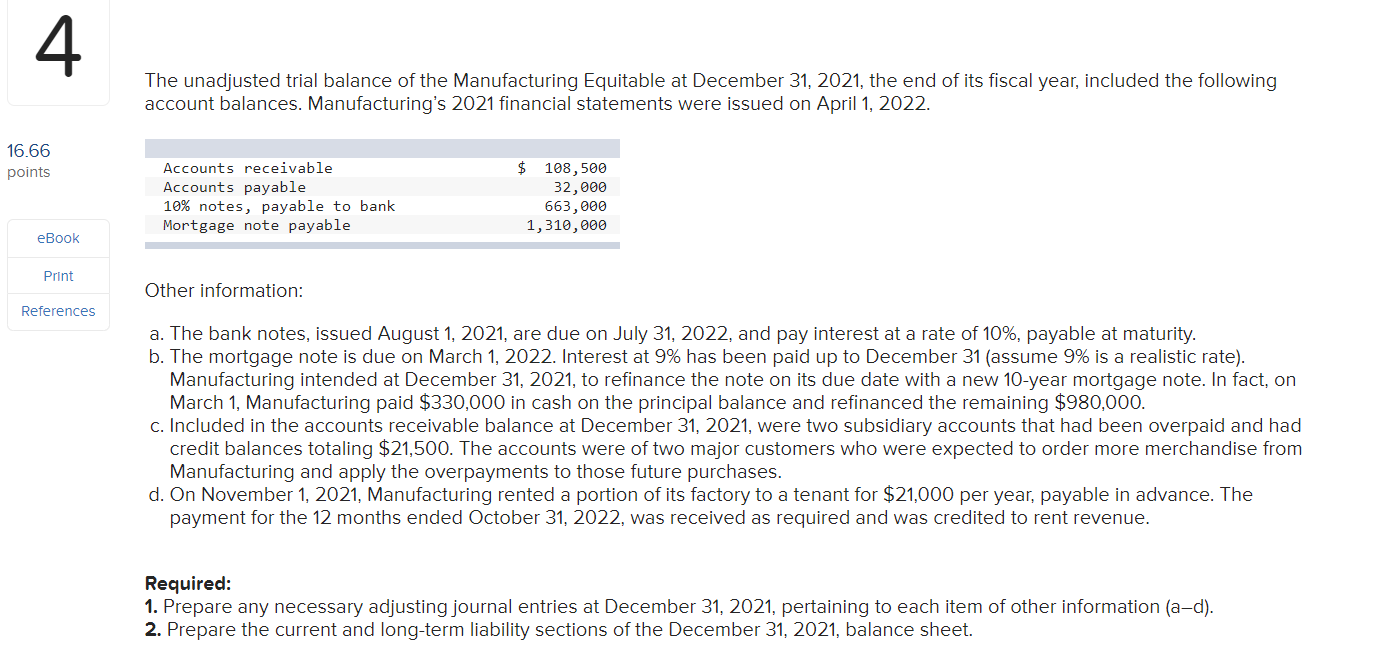

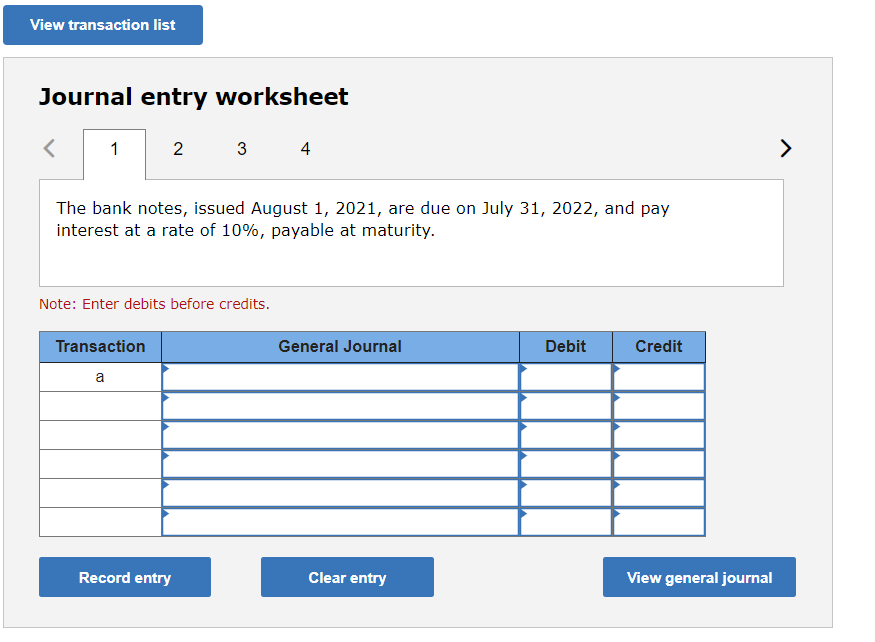

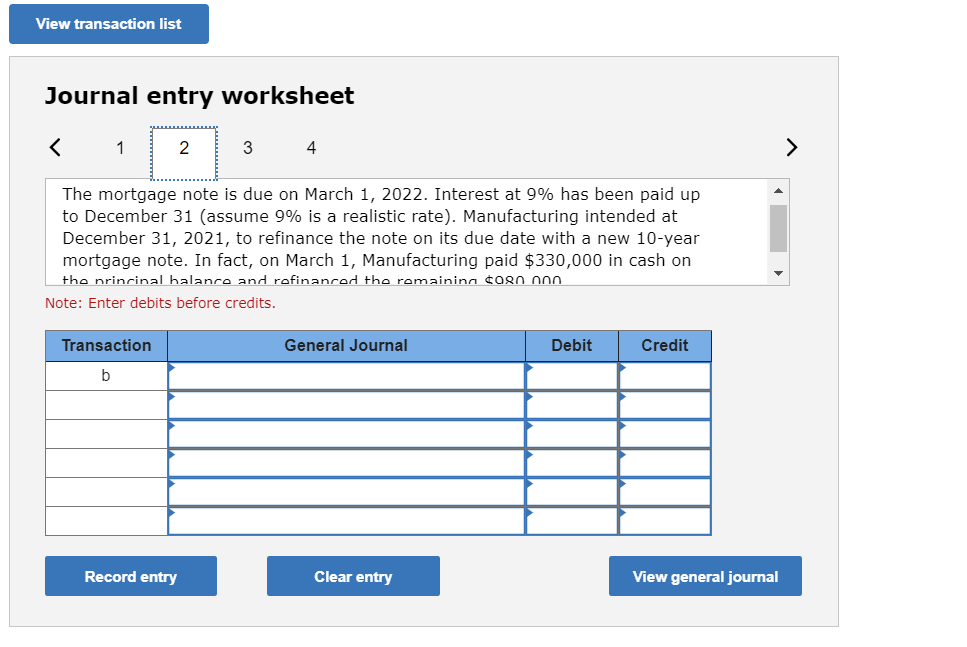

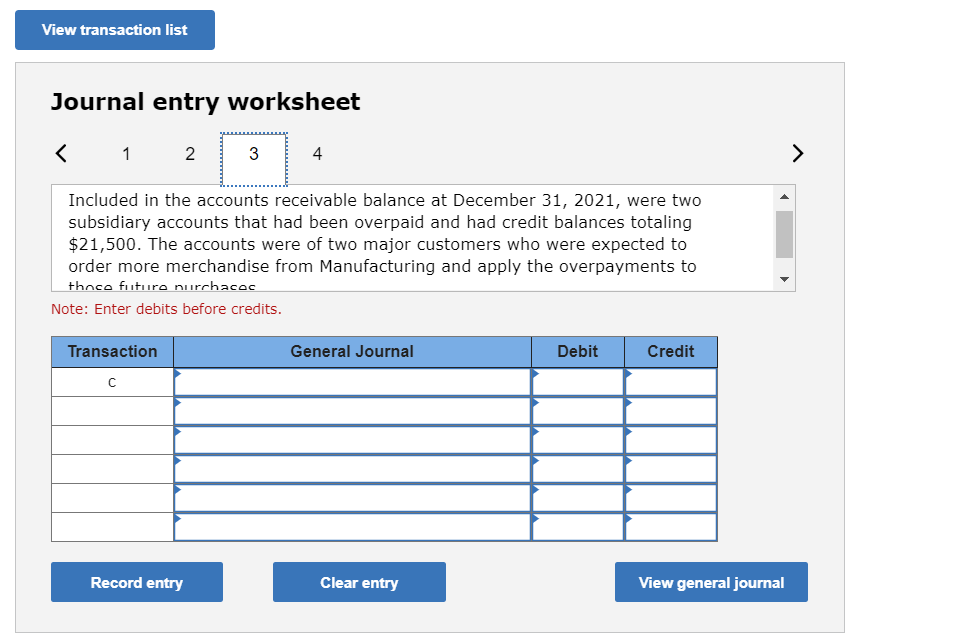

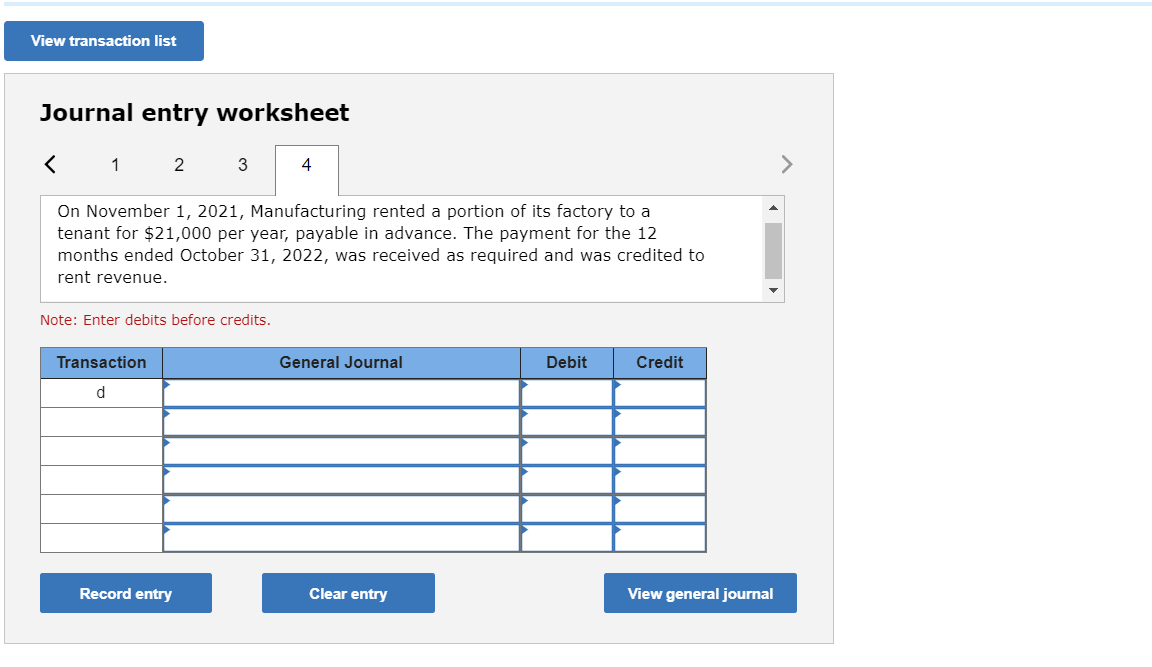

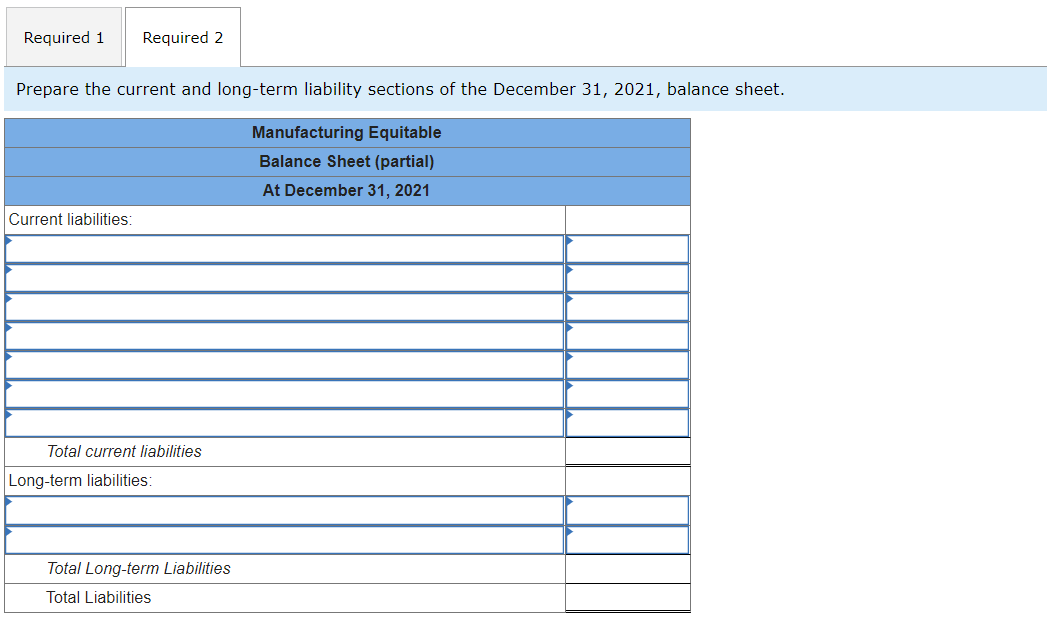

4. The unadjusted trial balance of the Manufacturing Equitable at December 31, 2021, the end of its fiscal year, included the following account balances. Manufacturing's 2021 financial statements were issued on April 1, 2022. 16.66 points Accounts receivable Accounts payable 10% notes, payable to bank Mortgage note payable $ 108,500 32,000 663,000 1,310,000 eBook Print Other information: References a. The bank notes, issued August 1, 2021, are due on July 31, 2022, and pay interest at a rate of 10%, payable at maturity. b. The mortgage note is due on March 1, 2022. Interest at 9% has been paid up to December 31 (assume 9% is a realistic rate). Manufacturing intended at December 31, 2021, to refinance the note on its due date with a new 10-year mortgage note. In fact, on March 1, Manufacturing paid $330,000 in cash on the principal balance and refinanced the remaining $980,000. c. Included in the accounts receivable balance at December 31, 2021, were two subsidiary accounts that had been overpaid and had credit balances totaling $21,500. The accounts were of two major customers who were expected to order more merchandise from Manufacturing and apply the overpayments to those future purchases. d. On November 1, 2021, Manufacturing rented a portion of its factory to a tenant for $21,000 per year, payable in advance. The payment for the 12 months ended October 31, 2022, was received as required and was credited to rent revenue. Required: 1. Prepare any necessary adjusting journal entries at December 31, 2021, pertaining to each item of other information (a-d). 2. Prepare the current and long-term liability sections of the December 31, 2021, balance sheet. View transaction list Journal entry worksheet The bank notes, issued August 1, 2021, are due on July 31, 2022, and pay interest at a rate of 10%, pay ole at ty. Note: Enter debits before credits. General Journal Debit Credit Transaction a Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 3 4 The mortgage note is due on March 1, 2022. Interest at 9% has been paid up to December 31 (assume 9% is a realistic rate). Manufacturing intended at December 31, 2021, to refinance the note on its due date with a new 10-year mortgage note. In fact, on March 1, Manufacturing paid $330,000 in cash on the nrincinal halance and refinanced the remaining co80 000 Note: Enter debits before credits. Transaction General Journal Debit Credit b Record entry Clear entry View general journal View transaction list Journal entry worksheet