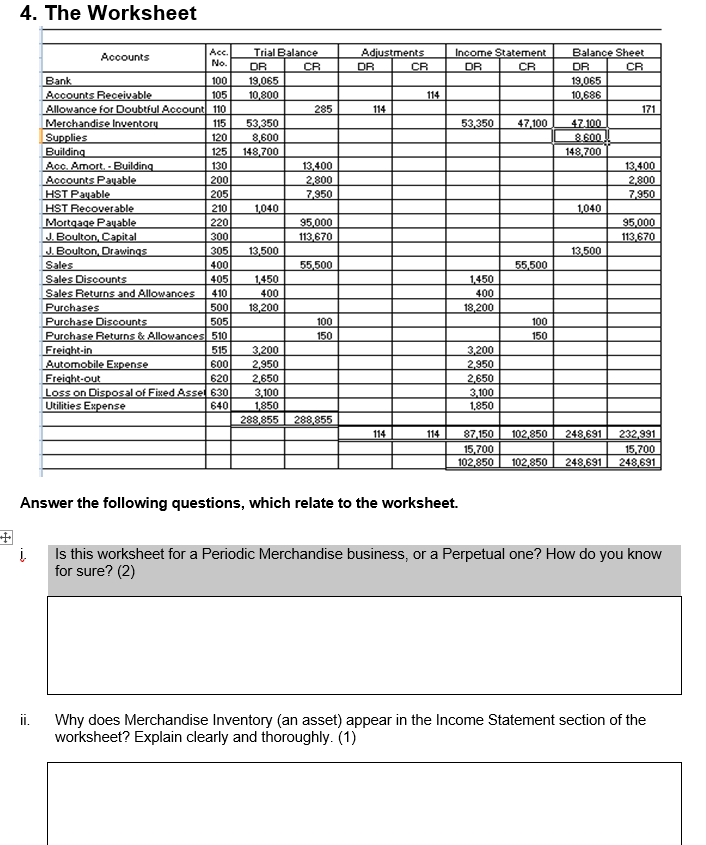

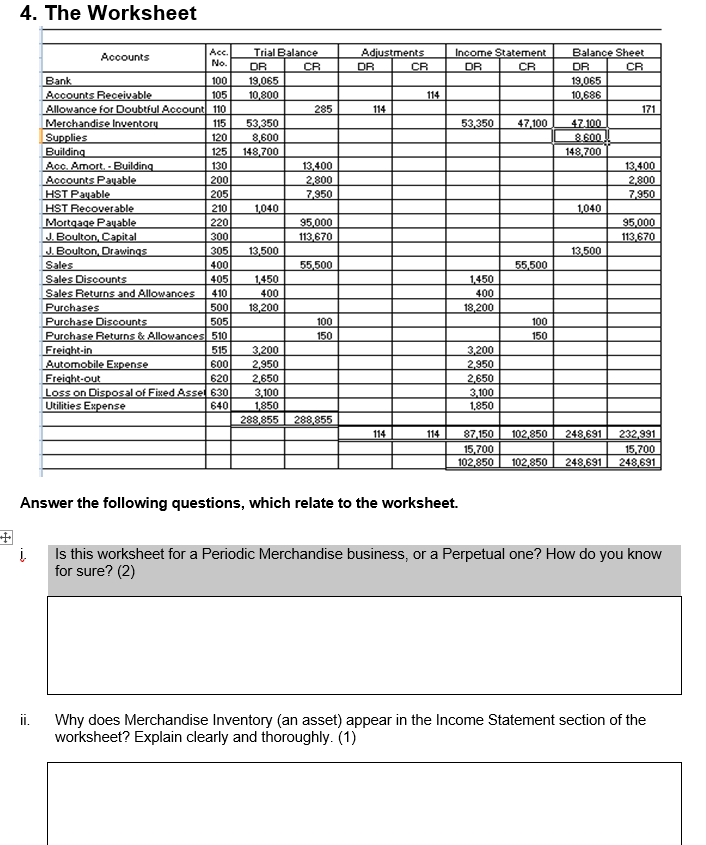

4. The Worksheet Acc. No. Adjustments DR CR Income Statement DR CR 114 114 53,350 47.100 Accounts Trial Balance DR CR Bank 100 19,065 Accounts Receivable 105 10.800 Allowance for Doubtful Account 110 285 Merchandise Inventory 115 53,350 Supplies 120 8,600 Building 125 148,700 Acc. Amort. - Building 130 13,400 Accounts Payable 200 2.800 HST Payable 205 7.950 HST Recoverable 210 1040 Mortgage Payable 220 95.000 J. Boulton Capital 300 113.670 J. Boulton, Drawings 305 13500 Sales 400 55500 Sales Discounts 405 1450 Sales Returns and Allowances 410 400 Purchases 500 18,200 Purchase Discounts 505 100 Purchase Returns & Allowances 510 150 Freight-in 515 3,200 Automobile Expense 600 2.950 Freight-out 620 2650 Loss on Disposal of Fixed Assel 630 3100 Utilities Expense 640 1850 288,855 288,855 Balance Sheet DR CR 19.065 10.686 171 47.100 8.600 148,700 13.400 2.800 7950 1040 95.000 113670 13.500 55,500 1.450 400 18,200 100 150 3.200 2.950 2.650 3.100 1.850 114 114 102,850 248.691 87,150 15,700 102.850 232.991 15,700 248,691 102.850 248.691 Answer the following questions, which relate to the worksheet. i Is this worksheet for a Periodic Merchandise business, or a Perpetual one? How do you know for sure? (2) ii. Why does Merchandise Inventory (an asset) appear in the Income Statement section of the worksheet? Explain clearly and thoroughly. (1) 4. The Worksheet Acc. No. Adjustments DR CR Income Statement DR CR 114 114 53,350 47.100 Accounts Trial Balance DR CR Bank 100 19,065 Accounts Receivable 105 10.800 Allowance for Doubtful Account 110 285 Merchandise Inventory 115 53,350 Supplies 120 8,600 Building 125 148,700 Acc. Amort. - Building 130 13,400 Accounts Payable 200 2.800 HST Payable 205 7.950 HST Recoverable 210 1040 Mortgage Payable 220 95.000 J. Boulton Capital 300 113.670 J. Boulton, Drawings 305 13500 Sales 400 55500 Sales Discounts 405 1450 Sales Returns and Allowances 410 400 Purchases 500 18,200 Purchase Discounts 505 100 Purchase Returns & Allowances 510 150 Freight-in 515 3,200 Automobile Expense 600 2.950 Freight-out 620 2650 Loss on Disposal of Fixed Assel 630 3100 Utilities Expense 640 1850 288,855 288,855 Balance Sheet DR CR 19.065 10.686 171 47.100 8.600 148,700 13.400 2.800 7950 1040 95.000 113670 13.500 55,500 1.450 400 18,200 100 150 3.200 2.950 2.650 3.100 1.850 114 114 102,850 248.691 87,150 15,700 102.850 232.991 15,700 248,691 102.850 248.691 Answer the following questions, which relate to the worksheet. i Is this worksheet for a Periodic Merchandise business, or a Perpetual one? How do you know for sure? (2) ii. Why does Merchandise Inventory (an asset) appear in the Income Statement section of the worksheet? Explain clearly and thoroughly. (1)