Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. This question is on stochastic interest rates and bond pricing a. - - Suppose the spot interest rater, which is a function of time

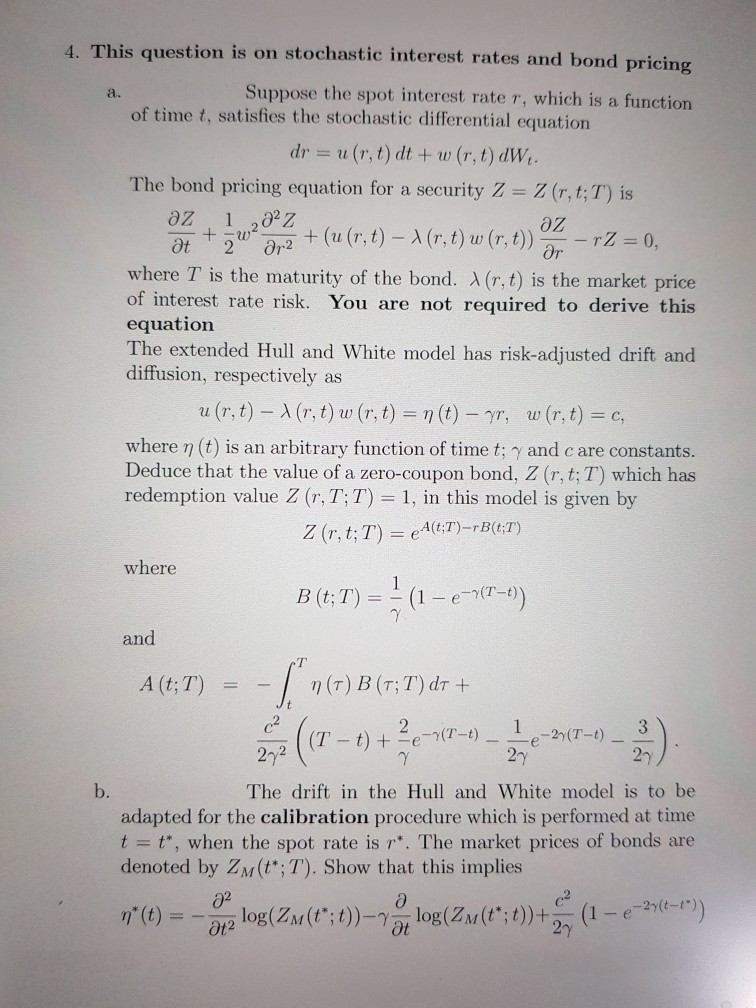

4. This question is on stochastic interest rates and bond pricing a. - - Suppose the spot interest rater, which is a function of time t, satisfies the stochastic differential equation dr = u(r, t) dt + w (r, t) dW. The bond pricing equation for a security Z = Z (r,t;T) is az 1 ,a2z - rZ at =0, 3+ (u (r,t) - 1 (r, t) w (r, t)) 2 ar2 where T is the maturity of the bond. (r,t) is the market price of interest rate risk. You are not required to derive this equation The extended Hull and White model has risk-adjusted drift and diffusion, respectively as u(r, t) - \(r, t) w (r, t) = n(t) yr, war, t) = C, where n (t) is an arbitrary function of time t; y and c are constants. Deduce that the value of a zero-coupon bond, Z (r, t;T) which has redemption value Z (r,T;T) = 1, in this model is given by Z (r,t;T) = Aft:T)-rB(0:1) where B (t;7) = + (1 -2-10-1) and A (t;T) = -1 (7) B (7;T)dt + ((T t) + 2e-17-4) 2-27(7-) - 3). 2. 27 The drift in the Hull and White model is to be adapted for the calibration procedure which is performed at time t = t", when the spot rate is r*. The market prices of bonds are denoted by Zm(t":T). Show that this implies c2 n* (t) = - log(Zm(t"; t))-7 log(Zm(t";t))+1 - (1 - e-29(-)) 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started