Answered step by step

Verified Expert Solution

Question

1 Approved Answer

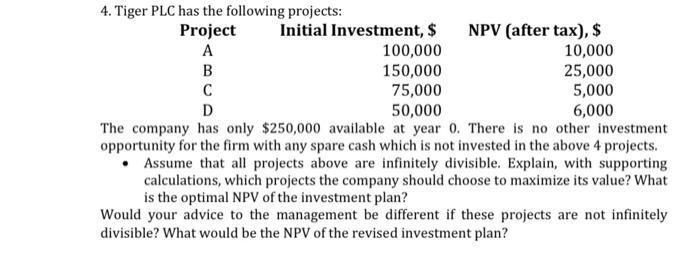

4. Tiger PLC has the following projects: Project A B C D The company has only $250,000 available at year 0. There is no

4. Tiger PLC has the following projects: Project A B C D The company has only $250,000 available at year 0. There is no other investment opportunity for the firm with any spare cash which is not invested in the above 4 projects. Assume that all projects above are infinitely divisible. Explain, with supporting calculations, which projects the company should choose to maximize its value? What is the optimal NPV of the investment plan? Would your advice to the management be different if these projects are not infinitely divisible? What would be the NPV of the revised investment plan? Initial Investment, $ 100,000 150,000 75,000 50,000 NPV (after tax), $ 10,000 25,000 5,000 6,000

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To determine which projects Tiger PLC should choose to maximize its value we need to calculate the i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started