Answered step by step

Verified Expert Solution

Question

1 Approved Answer

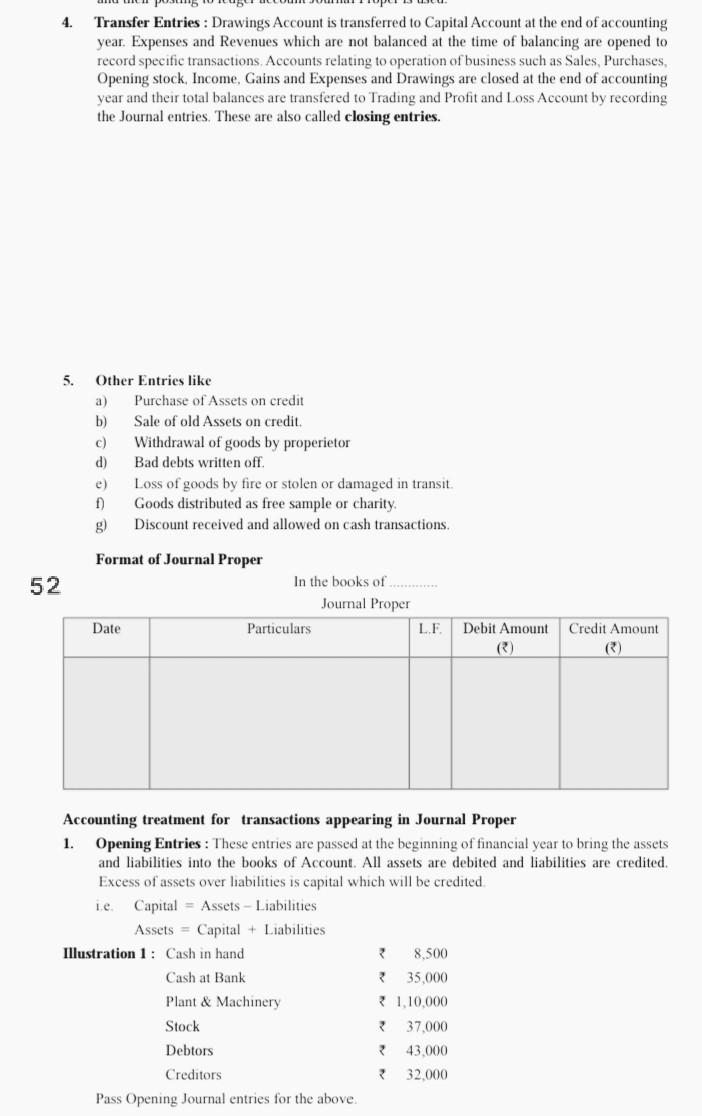

4. Transfer Entries : Drawings Account is transferred to Capital Account at the end of accounting year. Expenses and Revenues which are not balanced at

4. Transfer Entries : Drawings Account is transferred to Capital Account at the end of accounting year. Expenses and Revenues which are not balanced at the time of balancing are opened to record specific transactions Accounts relating to operation of business such as Sales, Purchases, Opening stock. Income, Gains and Expenses and Drawings are closed at the end of accounting year and their total balances are transfered to Trading and Profit and Loss Account by recording the Journal entries. These are also called closing entries. 5. Other Entries like a Purchase of Assets on credit b) Sale of old Assets on credit. c) Withdrawal of goods by properietor d) Bad debts written off e) Loss of goods by fire or stolen or damaged in transit. f) Goods distributed as free sample or charity Discount received and allowed on cash transactions 52 Format of Journal Proper In the books of ........... Journal Proper Date Particulars LE Debit Amount Credit Amount Accounting treatment for transactions appearing in Journal Proper 1. Opening Entries: These entries are passed at the beginning of financial year to bring the assets and liabilities into the books of Account. All assets are debited and liabilities are credited, Excess of assets over liabilities is capital which will be credited le Capital = Assets - Liabilities Assets = Capital + Liabilities Illustration 1 : Cash in hand 8,500 Cash at Bank 35,000 Plant & Machinery 1.10,000 Stock ; 37,000 Debtors 43.000 Creditors 32.000 Pass Opening Journal entries for the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started