Answered step by step

Verified Expert Solution

Question

1 Approved Answer

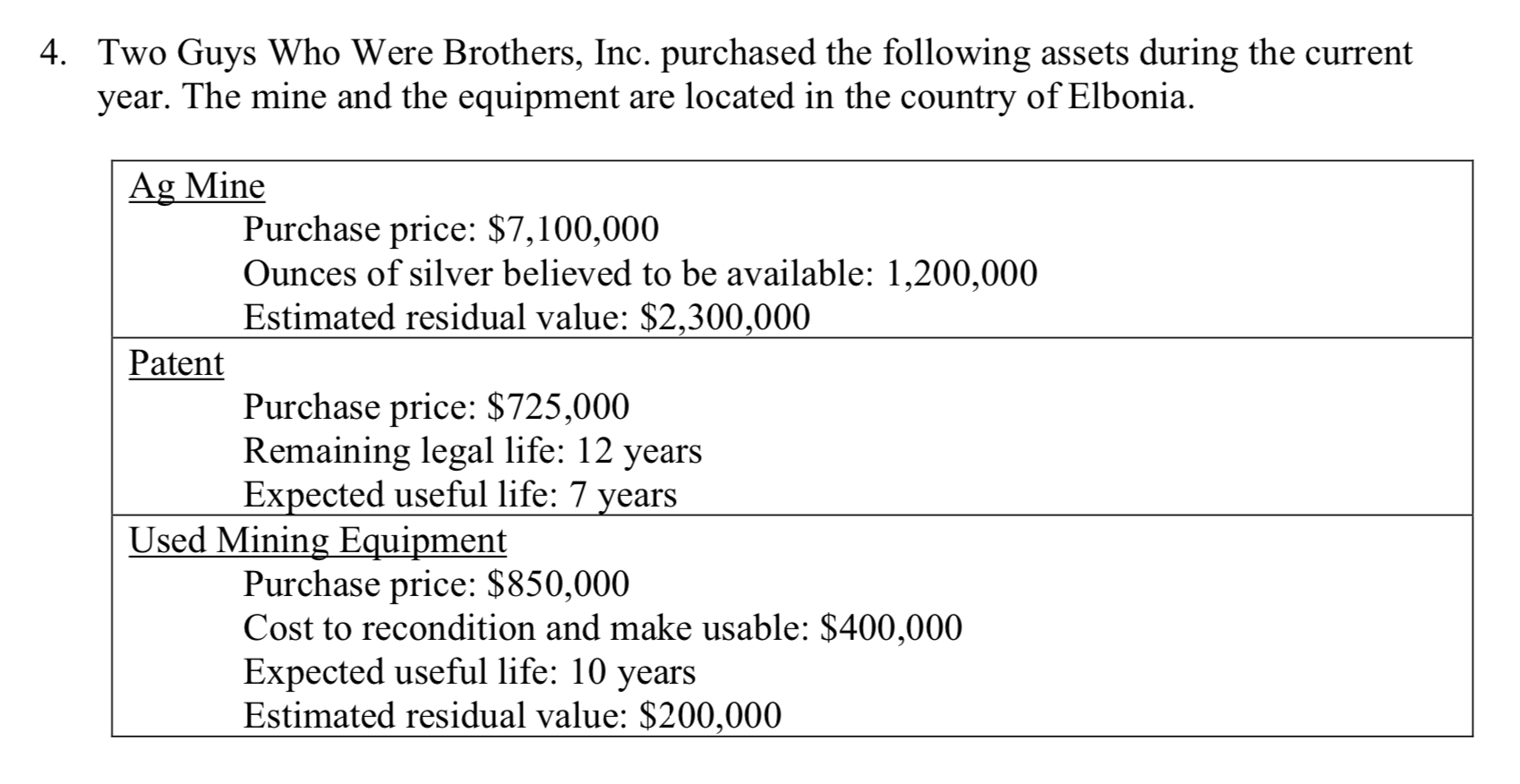

4. Two Guys Who Were Brothers, Inc. purchased the following assets during the current year. The mine and the equipment are located in the country

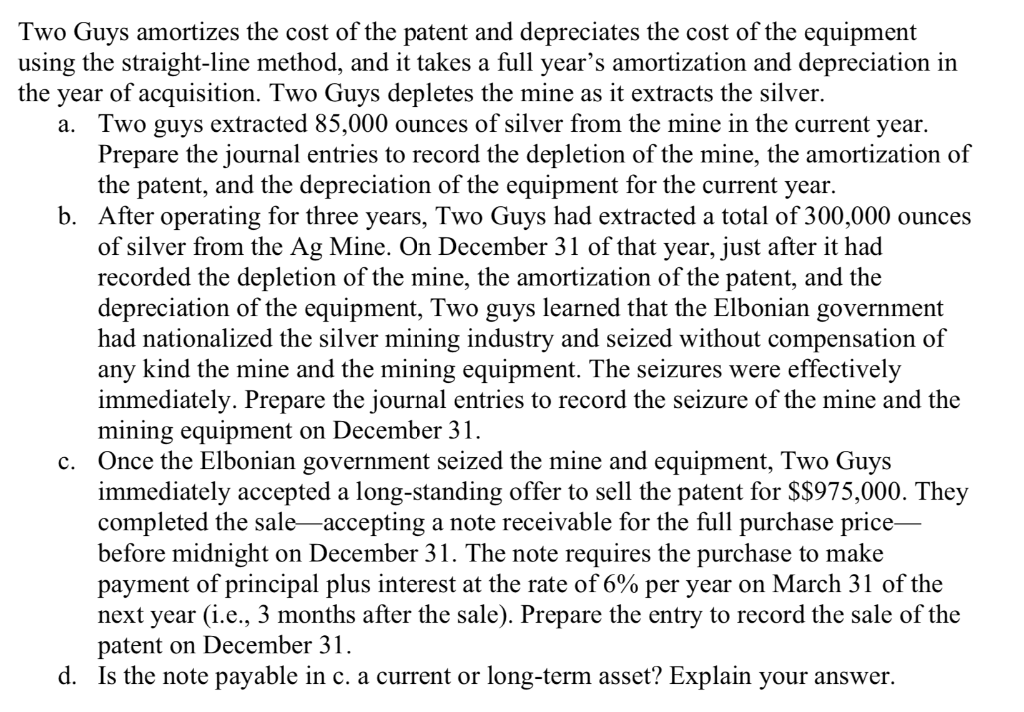

4. Two Guys Who Were Brothers, Inc. purchased the following assets during the current year. The mine and the equipment are located in the country of Elbonia. | Ag Mine Purchase price: $7,100,000 Ounces of silver believed to be available: 1,200,000 Estimated residual value: $2,300,000 Patent Purchase price: $725,000 Remaining legal life: 12 years Expected useful life: 7 years Used Mining Equipment Purchase price: $850,000 Cost to recondition and make usable: $400,000 Expected useful life: 10 years Estimated residual value: $200,000 Two Guys amortizes the cost of the patent and depreciates the cost of the equip using the straight-line method, and it takes a full year's amortization and depreciation in the year of acquisition. Two Guys depletes the mine as it extracts the silver. a. Two guys extracted 85,000 ounces of silver from the mine in the current year. Prepare the journal entries to record the depletion of the mine, the amortization of the patent, and the depreciation of the equipment for the current year. b. After operating for three years, Two Guys had extracted a total of 300,000 ounces of silver from the Ag Mine. On December 31 of that year, just after it had recorded the depletion of the mine, the amortization of the patent, and the depreciation of the equipment, Two guys learned that the Elbonian government had nationalized the silver mining industry and seized without compensation of any kind the mine and the mining equipment. The seizures were effectively immediately. Prepare the journal entries to record the seizure of the mine and the mining equipment on December 31. c. Once the Elbonian government seized the mine and equipment, Two Guys immediately accepted a long-standing offer to sell the patent for $$975,000. They completed the saleaccepting a note receivable for the full purchase price- before midnight on December 31. The note requires the purchase to make payment of principal plus interest at the rate of 6% per year on March 31 of the next year (i.e., 3 months after the sale). Prepare the entry to record the sale of the patent on December 31. d. Is the note payable in c. a current or long-term asset? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started