Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Using the bond approach, determine the value of a plain vanilla interest rate swap to Company A. Assume that the swap has 3.5 years

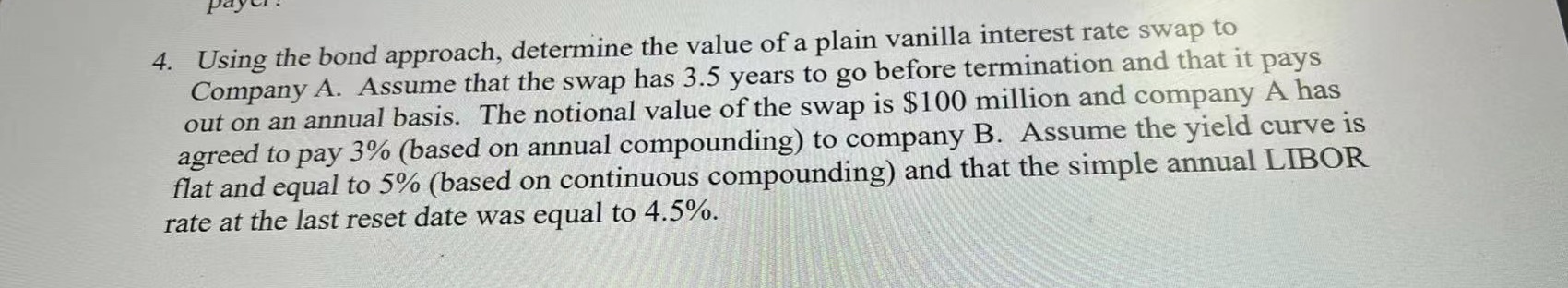

4. Using the bond approach, determine the value of a plain vanilla interest rate swap to Company A. Assume that the swap has 3.5 years to go before termination and that it pays out on an annual basis. The notional value of the swap is $100 million and company A has agreed to pay 3% (based on annual compounding) to company B. Assume the yield curve is flat and equal to 5% (based on continuous compounding) and that the simple annual LIBOR rate at the last reset date was equal to 4.5%

4. Using the bond approach, determine the value of a plain vanilla interest rate swap to Company A. Assume that the swap has 3.5 years to go before termination and that it pays out on an annual basis. The notional value of the swap is $100 million and company A has agreed to pay 3% (based on annual compounding) to company B. Assume the yield curve is flat and equal to 5% (based on continuous compounding) and that the simple annual LIBOR rate at the last reset date was equal to 4.5% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started