Answered step by step

Verified Expert Solution

Question

1 Approved Answer

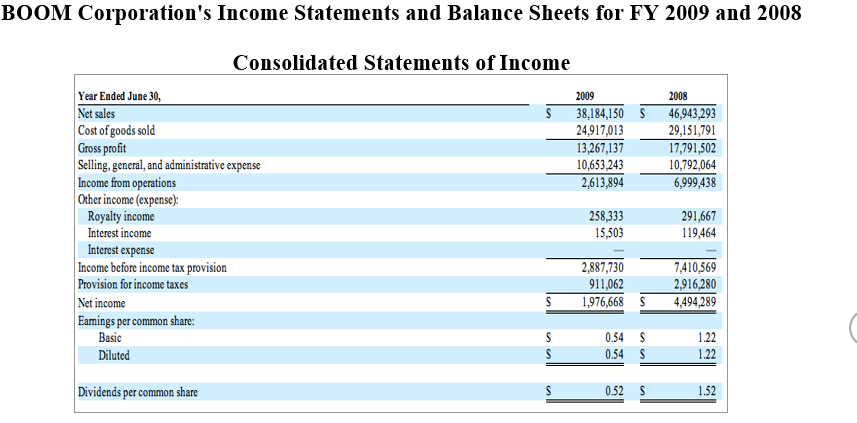

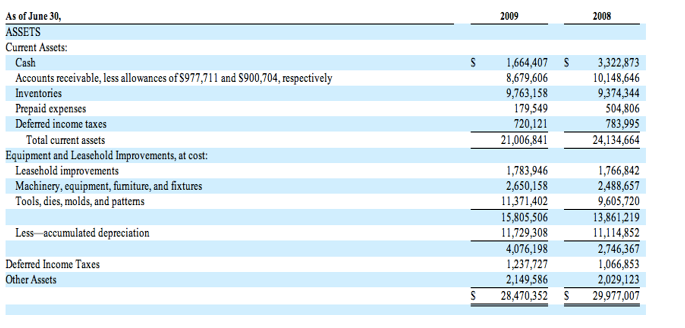

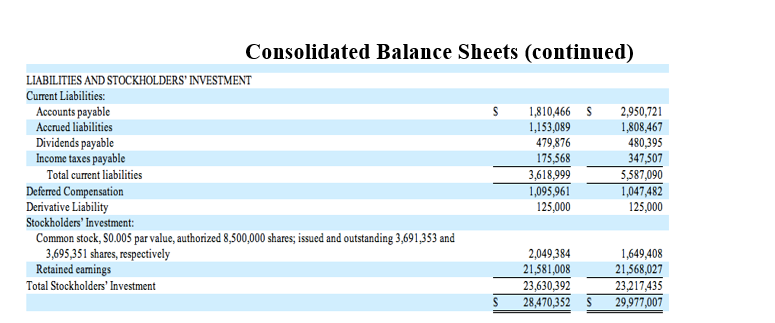

4. Using the financial information in Exhibit 1: a. Calculate the dollar and % change in each line item on both Statements. b. Prepare a

4. Using the financial information in Exhibit 1:

a. Calculate the dollar and % change in each line item on both Statements.

b. Prepare a Common Size Income Statement (all line items as a % of sales) and Balance Sheet (all line items as a % of total assets).

Consolidated Balance Sheets

BooM Corporation's Income Statements and Balance Sheets for FY 2009 and 2008 Consolidated Statements of Income Year Ended June 30, 2009 2008 Net sales 38,184,150 S 46,943,293 24,917,013 Cost of goods sold 29,151,791 Gross profit 3267,137 17,791,502 10,792,064 10,653,243 Selling, general, and administrative expense 2,613,894 6,999438 Income from operations Other income (expense) 258333 291,667 Royalty income Interest income 15.S03 119,464 Interest expense 7410,569 Income before income tax provision 2,887,730 911,062 2,916,280 Provision for income taxes 1,976,668 S 4494,289 Net income Eamings per common share: 0.54 S Basic 1.22 0.54 S Diluted 1.22 0.52 1.52 Dividends per common share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started