Answered step by step

Verified Expert Solution

Question

1 Approved Answer

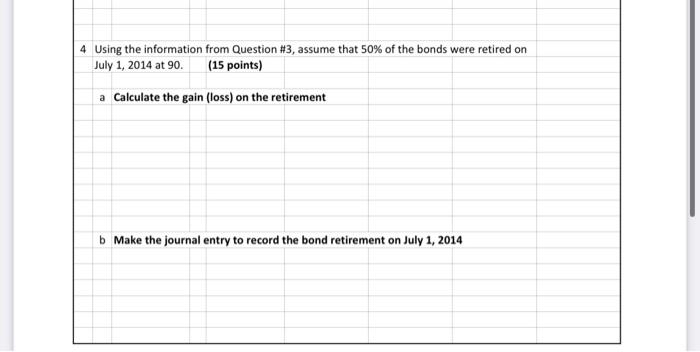

4 Using the information from Question #3, assume that 50% of the bonds were retired on July 1, 2014 at 90. (15 points) a

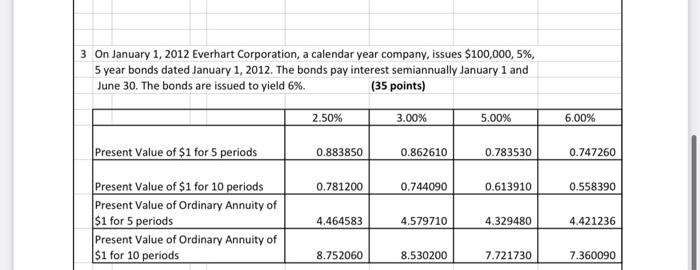

4 Using the information from Question #3, assume that 50% of the bonds were retired on July 1, 2014 at 90. (15 points) a Calculate the gain (loss) on the retirement b Make the journal entry to record the bond retirement on July 1, 2014 3 On January 1, 2012 Everhart Corporation, a calendar year company, issues $100,000, 5%, 5 year bonds dated January 1, 2012. The bonds pay interest semiannually January 1 and June 30. The bonds are issued to yield 6%. (35 points) 2.50% 5.00% 3.00% 6.00% Present Value of $1 for 5 periods 0.883850 0.862610 0.783530 0.747260 Present Value of $1 for 10 periods Present Value of Ordinary Annuity of $1 for 5 periods 0.781200 0.744090 0.613910 0.558390 4.464583 4.579710 4.329480 4.421236 Present Value of Ordinary Annuity of $1 for 10 periods 8.752060 8.530200 7.721730 7.360090

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

3 Working notes Calculation PV factor PV of Amount at 3 Cash flows Face value Cash Interest Issue pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started