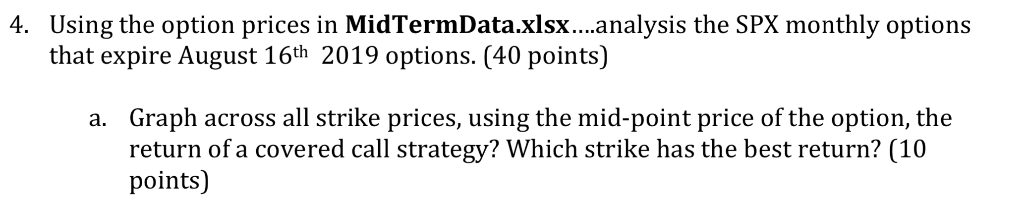

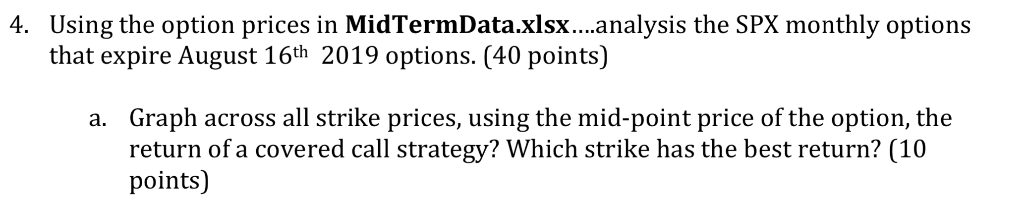

4. Using the option prices in MidTermData.xlsx....analysis the SPX monthly options that expire August 16th 2019 options. (40 points) Graph return of a covered call strategy? Which strike has the best return? (10 points) across all strike prices, using the mid-point price of the option, the . AutoSave OFF 5 MidTerm data Q- Search Sheet Home Share Insert Draw Page Layout Formulas Data Review View AutoSum X Cut CalitriBody 11 A^ A AY. ta wrac Taxt General Fill Capy A , Merge & Center I U Sort & Filrer Paste B = E Carditianal Fermat Cel Stv as De ete Earma Insert Format Clear Formatting Table tx 1827 FS C D E C K L N Calls Last Sale Bid Ask Vo Delta Strike mid-point price 1 Net Gamma Open Int 10.15 20545 SPX190816C01000000 1924 1921.3 1924.4 2155 0.9939 0 1000 1922.85 3 SPXW190816C01000000 C 1918.4 1926.7 0 C 0 0 1000 1922.55 4 SPX190816C01100000 5 SPXW190816C01100000 0 1821.7 1824.8 0 0.9937 C 1100 1823.25 1818.7 0 C 1827 1 0 1100 1822.85 6 SPX190816C01200000 0 1722.1 1725.1 0 0.9929 0 1200 1723.6 SPXW190816C01200000 1727.7 7 0 1719.4 0 C 0 1200 1723.55 8 SPX190816C01300000 C 0 1622.4 1625.5 0 0.9937 0 1300 1623.95 9 SPXW190816C01300000 0 1619.5 1627,8 0.9961 0 1300 1623.65 10 SPX190816C01375000 0 1547,7 1550,8 0 0.9927 0 1375 1549.25 11 SPXW190816C01375000 0 1544.7 1553.1 0 C C 0 1375 1548.9 12 SPX190816C01400000 1522.8 1525,8 0.9932 1400 1524.3 13 SPXW190816C01400000 C 0 1519,8 1528.1 C 0.9964 1400 1523.95 14 SPX190816C01425000 0 1497.9 1500.9 0.9969 1425 1499.4 15 SPXW190816C01425000 1494.9 1503.2 0.997 C C 1425 1499.05 16 SPX190816C01450000 1476 1473 0.9963 1450 1474.5 17 SPXW190816C01450000 C 1470 1478.3 0 C 1450 1474.15 1448.1 18 SPX190816C01475000 C 1451.1 0.996 1475 1449.6 1445.1 19 SPXW190816C01475000 C 1453.4 0.9965 1475 1449.25 0.9962 20 SPX190816C01500000 1423.2 1426.2 201 1500 1424.7 21 SPXW190816C01500000 1420.4 1428.5 C C 0.9969 1500 1424.45 22 SPX190816C01525000 0 1398.3 1401.3 C 0.9955 C 1525 1399.8 23 SPXW190816C01525000 0 1395.6 1403.8 C 0.9907 C C 1525 1399.7 24 SPX190816C01550000 C 1373.4 1376.4 C 0.9923 1550 1374.9 25 SPXW190816C01550000 0 1370.7 1378,7 0.9968 1550 1374.7 26 SPX190816C01575000 1348.5 1351.5 0.9952 1575 1350 27 SPXW190816001575000 1345.7 1353,8 0.9941 1575 1349.75 28 SPXI0 1326.6 anon .... Futures Options Sheet Sheet2 + Ready 150% 4. Using the option prices in MidTermData.xlsx....analysis the SPX monthly options that expire August 16th 2019 options. (40 points) Graph return of a covered call strategy? Which strike has the best return? (10 points) across all strike prices, using the mid-point price of the option, the . AutoSave OFF 5 MidTerm data Q- Search Sheet Home Share Insert Draw Page Layout Formulas Data Review View AutoSum X Cut CalitriBody 11 A^ A AY. ta wrac Taxt General Fill Capy A , Merge & Center I U Sort & Filrer Paste B = E Carditianal Fermat Cel Stv as De ete Earma Insert Format Clear Formatting Table tx 1827 FS C D E C K L N Calls Last Sale Bid Ask Vo Delta Strike mid-point price 1 Net Gamma Open Int 10.15 20545 SPX190816C01000000 1924 1921.3 1924.4 2155 0.9939 0 1000 1922.85 3 SPXW190816C01000000 C 1918.4 1926.7 0 C 0 0 1000 1922.55 4 SPX190816C01100000 5 SPXW190816C01100000 0 1821.7 1824.8 0 0.9937 C 1100 1823.25 1818.7 0 C 1827 1 0 1100 1822.85 6 SPX190816C01200000 0 1722.1 1725.1 0 0.9929 0 1200 1723.6 SPXW190816C01200000 1727.7 7 0 1719.4 0 C 0 1200 1723.55 8 SPX190816C01300000 C 0 1622.4 1625.5 0 0.9937 0 1300 1623.95 9 SPXW190816C01300000 0 1619.5 1627,8 0.9961 0 1300 1623.65 10 SPX190816C01375000 0 1547,7 1550,8 0 0.9927 0 1375 1549.25 11 SPXW190816C01375000 0 1544.7 1553.1 0 C C 0 1375 1548.9 12 SPX190816C01400000 1522.8 1525,8 0.9932 1400 1524.3 13 SPXW190816C01400000 C 0 1519,8 1528.1 C 0.9964 1400 1523.95 14 SPX190816C01425000 0 1497.9 1500.9 0.9969 1425 1499.4 15 SPXW190816C01425000 1494.9 1503.2 0.997 C C 1425 1499.05 16 SPX190816C01450000 1476 1473 0.9963 1450 1474.5 17 SPXW190816C01450000 C 1470 1478.3 0 C 1450 1474.15 1448.1 18 SPX190816C01475000 C 1451.1 0.996 1475 1449.6 1445.1 19 SPXW190816C01475000 C 1453.4 0.9965 1475 1449.25 0.9962 20 SPX190816C01500000 1423.2 1426.2 201 1500 1424.7 21 SPXW190816C01500000 1420.4 1428.5 C C 0.9969 1500 1424.45 22 SPX190816C01525000 0 1398.3 1401.3 C 0.9955 C 1525 1399.8 23 SPXW190816C01525000 0 1395.6 1403.8 C 0.9907 C C 1525 1399.7 24 SPX190816C01550000 C 1373.4 1376.4 C 0.9923 1550 1374.9 25 SPXW190816C01550000 0 1370.7 1378,7 0.9968 1550 1374.7 26 SPX190816C01575000 1348.5 1351.5 0.9952 1575 1350 27 SPXW190816001575000 1345.7 1353,8 0.9941 1575 1349.75 28 SPXI0 1326.6 anon .... Futures Options Sheet Sheet2 + Ready 150%