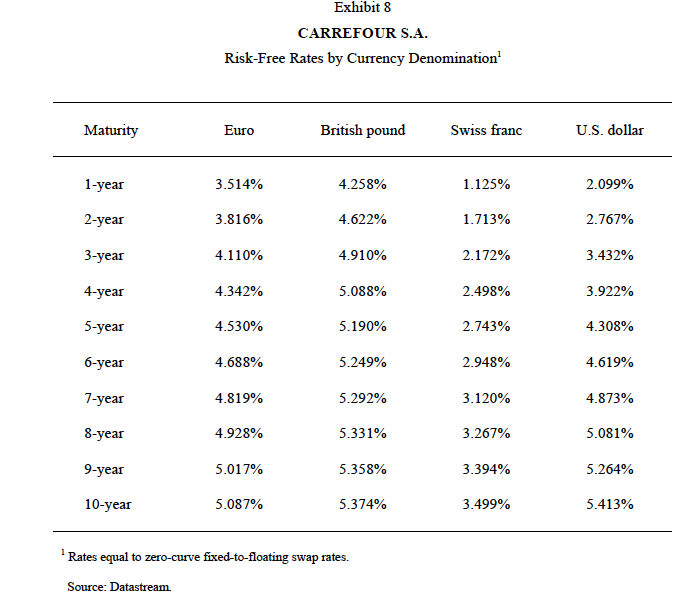

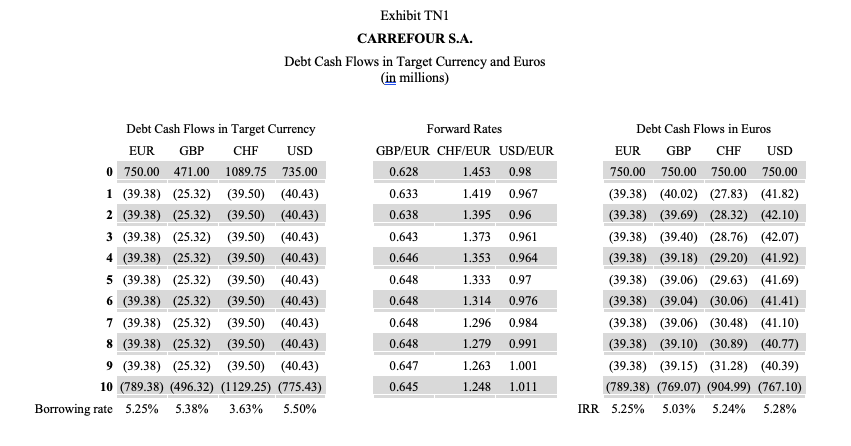

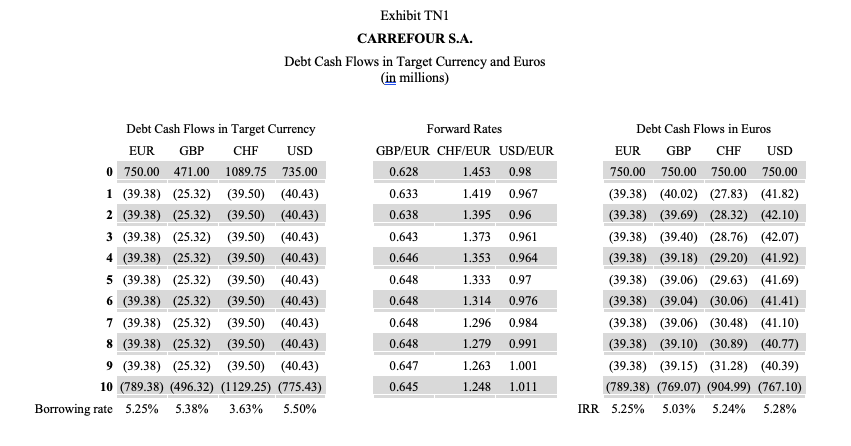

4. Using the parity forward rates, what is the cost of borrowing in Swiss Francs? British pounds? U.S. dollars? What should Carrefour do? you can assume that the bonds are issued at par (EUR 750 million), think about what will be the cost in euros of each of the bond alternatives.

(The answer is in last pic, I need the step-by-step solution shows every calculation!)

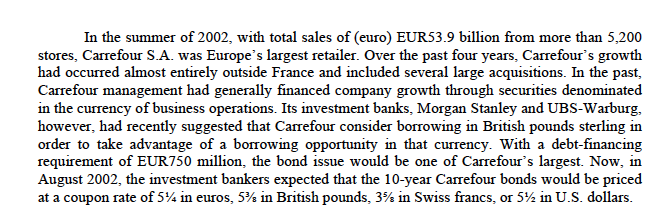

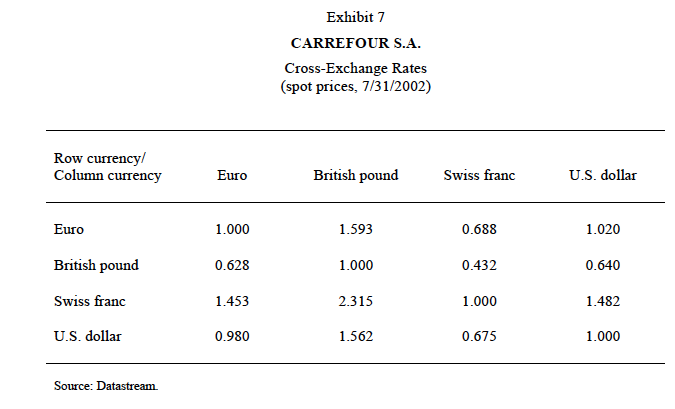

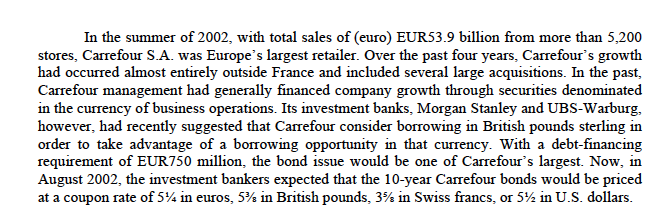

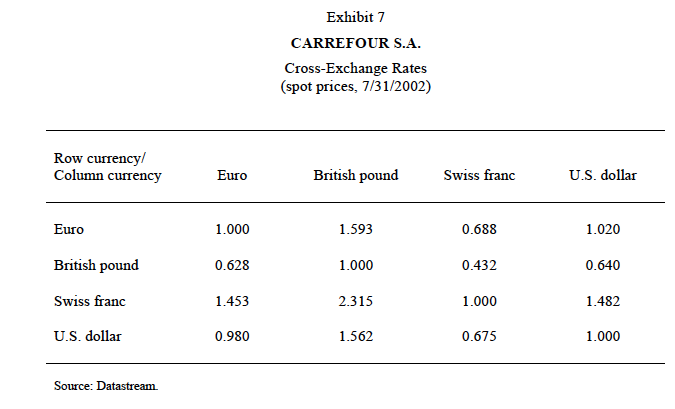

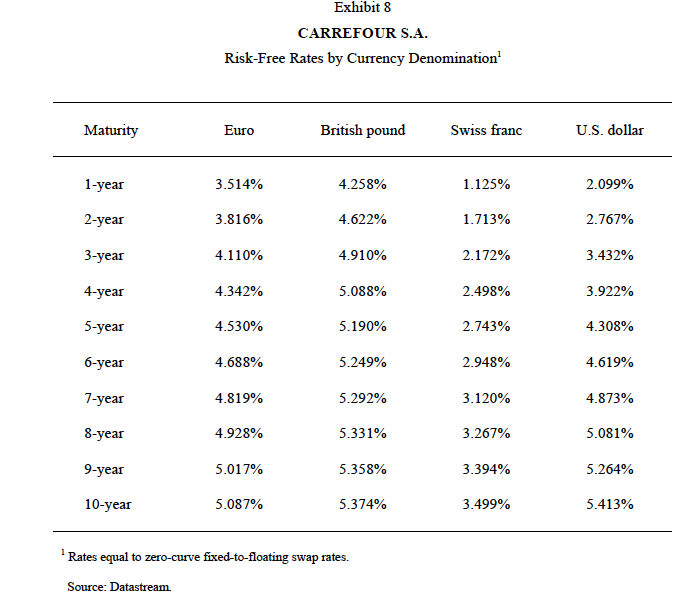

In the summer of 2002, with total sales of (euro) EUR53.9 billion from more than 5,200 stores, Carrefour S.A. was Europe's largest retailer. Over the past four years, Carrefour's growth had occurred almost entirely outside France and included several large acquisitions. In the past, Carrefour management had generally financed company growth through securities denominated in the currency of business operations. Its investment banks, Morgan Stanley and UBS-Warburg, however, had recently suggested that Carrefour consider borrowing in British pounds sterling in order to take advantage of a borrowing opportunity in that currency. With a debt-financing requirement of EUR 750 million, the bond issue would be one of Carrefour's largest. Now, in August 2002, the investment bankers expected that the 10-year Carrefour bonds would be priced at a coupon rate of 5% in euros, 5% in British pounds, 3% in Swiss francs, or 5% in U.S. dollars. Exhibit 7 CARREFOUR S.A. Cross-Exchange Rates (spot prices, 7/31/2002) Row currency/ Column currency Euro British pound Swiss franc U.S. dollar Euro 1.000 1.593 0.688 1.020 British pound 0.628 1.000 0.432 0.640 Swiss franc 1.453 2.315 1.000 1.482 U.S. dollar 0.980 1.562 0.675 1.000 Source: Datastream Exhibit 8 CARREFOUR S.A. Risk-Free Rates by Currency Denomination' Maturity Euro British pound Swiss franc U.S. dollar 1-year 3.514% 4.258% 1.125% 2.099% 2-year 3.816% 4.622% 1.713% 2.767% 3-year 4.110% 4.910% 2.172% 3.432% 4-year 4.342% 5.088% 2.498% 3.922% 5-year 4.530% 5.190% 2.743% 4.308% 6-year 4.688% 5.249% 2.948% 4.619% 7-year 4.819% 5.292% 3.120% 4.873% 8-year 4.928% 5.331% 3.267% 5.081% 9-year 5.017% 5.358% 3.394% 5.264% 10-year 5.087% 5.374% 3.499% 5.413% Rates equal to zero-curve fixed-to-floating swap rates. Source: Datastream. Exhibit TN1 CARREFOUR S.A. Debt Cash Flows in Target Currency and Euros (in millions) Debt Cash Flows in Target Currency EUR GBP CHF USD 0 750.00 471.00 1089.75 735.00 1 (39.38) (25.32) (39.50) (40.43) 2 (39.38) (25.32) (39.50) (40.43) 3 (39.38) (25.32) (39.50) (40.43) 4 (39.38) (25.32) (39.50) (40.43) 5 (39.38) (25.32) (39.50) (40.43) 6 (39.38) (25.32) (39.50) (40.43) 7 (39.38) (25.32) (39.50) (40.43) 8 (39.38) (25.32) (39.50) (40.43) 9 (39.38) (25.32) (39.50) (40.43) 10 (789.38) (496.32) (1129.25) (775.43) Borrowing rate 5.25% 5.38% 3.63% 5.50% Forward Rates GBP/EUR CHF/EUR USD/EUR 0.628 1.453 0.98 0.633 1.419 0.967 0.638 1.395 0.96 0.643 1.373 0.961 0.646 1.353 0.964 0.648 1.333 0.97 0.648 1.314 0.976 0.648 1.296 0.984 0.648 1.279 0.991 0.647 1.263 1.001 0.645 1.248 1.011 Debt Cash Flows in Euros EUR GBP CHF USD 750.00 750.00 750.00 750.00 (39.38) (40.02) (27.83) (41.82) (39.38) (39.69) (28.32) (42.10) (39.38) (39.40) (28.76) (42.07) (39.38) (39.18) (29.20) (41.92) (39.38) (39.06) (29.63) (41.69) (39.38) (39.04) (30.06) (41.41) (39.38) (39.06) (30.48) (41.10) (39.38) (39.10) (30.89) (40.77) (39.38) (39.15) (31.28) (40.39) (789.38) (769.07) (904.99) (767.10) IRR 5.25% 5.03% 5.24% 5.28% In the summer of 2002, with total sales of (euro) EUR53.9 billion from more than 5,200 stores, Carrefour S.A. was Europe's largest retailer. Over the past four years, Carrefour's growth had occurred almost entirely outside France and included several large acquisitions. In the past, Carrefour management had generally financed company growth through securities denominated in the currency of business operations. Its investment banks, Morgan Stanley and UBS-Warburg, however, had recently suggested that Carrefour consider borrowing in British pounds sterling in order to take advantage of a borrowing opportunity in that currency. With a debt-financing requirement of EUR 750 million, the bond issue would be one of Carrefour's largest. Now, in August 2002, the investment bankers expected that the 10-year Carrefour bonds would be priced at a coupon rate of 5% in euros, 5% in British pounds, 3% in Swiss francs, or 5% in U.S. dollars. Exhibit 7 CARREFOUR S.A. Cross-Exchange Rates (spot prices, 7/31/2002) Row currency/ Column currency Euro British pound Swiss franc U.S. dollar Euro 1.000 1.593 0.688 1.020 British pound 0.628 1.000 0.432 0.640 Swiss franc 1.453 2.315 1.000 1.482 U.S. dollar 0.980 1.562 0.675 1.000 Source: Datastream Exhibit 8 CARREFOUR S.A. Risk-Free Rates by Currency Denomination' Maturity Euro British pound Swiss franc U.S. dollar 1-year 3.514% 4.258% 1.125% 2.099% 2-year 3.816% 4.622% 1.713% 2.767% 3-year 4.110% 4.910% 2.172% 3.432% 4-year 4.342% 5.088% 2.498% 3.922% 5-year 4.530% 5.190% 2.743% 4.308% 6-year 4.688% 5.249% 2.948% 4.619% 7-year 4.819% 5.292% 3.120% 4.873% 8-year 4.928% 5.331% 3.267% 5.081% 9-year 5.017% 5.358% 3.394% 5.264% 10-year 5.087% 5.374% 3.499% 5.413% Rates equal to zero-curve fixed-to-floating swap rates. Source: Datastream. Exhibit TN1 CARREFOUR S.A. Debt Cash Flows in Target Currency and Euros (in millions) Debt Cash Flows in Target Currency EUR GBP CHF USD 0 750.00 471.00 1089.75 735.00 1 (39.38) (25.32) (39.50) (40.43) 2 (39.38) (25.32) (39.50) (40.43) 3 (39.38) (25.32) (39.50) (40.43) 4 (39.38) (25.32) (39.50) (40.43) 5 (39.38) (25.32) (39.50) (40.43) 6 (39.38) (25.32) (39.50) (40.43) 7 (39.38) (25.32) (39.50) (40.43) 8 (39.38) (25.32) (39.50) (40.43) 9 (39.38) (25.32) (39.50) (40.43) 10 (789.38) (496.32) (1129.25) (775.43) Borrowing rate 5.25% 5.38% 3.63% 5.50% Forward Rates GBP/EUR CHF/EUR USD/EUR 0.628 1.453 0.98 0.633 1.419 0.967 0.638 1.395 0.96 0.643 1.373 0.961 0.646 1.353 0.964 0.648 1.333 0.97 0.648 1.314 0.976 0.648 1.296 0.984 0.648 1.279 0.991 0.647 1.263 1.001 0.645 1.248 1.011 Debt Cash Flows in Euros EUR GBP CHF USD 750.00 750.00 750.00 750.00 (39.38) (40.02) (27.83) (41.82) (39.38) (39.69) (28.32) (42.10) (39.38) (39.40) (28.76) (42.07) (39.38) (39.18) (29.20) (41.92) (39.38) (39.06) (29.63) (41.69) (39.38) (39.04) (30.06) (41.41) (39.38) (39.06) (30.48) (41.10) (39.38) (39.10) (30.89) (40.77) (39.38) (39.15) (31.28) (40.39) (789.38) (769.07) (904.99) (767.10) IRR 5.25% 5.03% 5.24% 5.28%