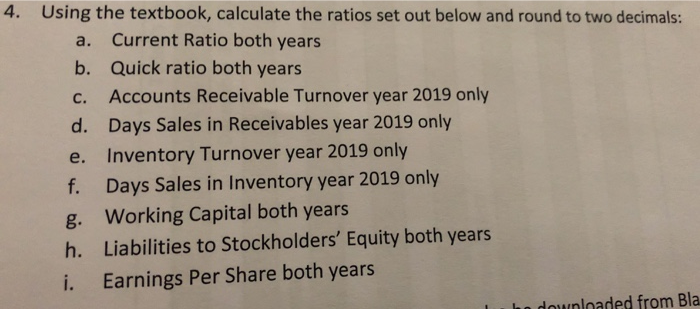

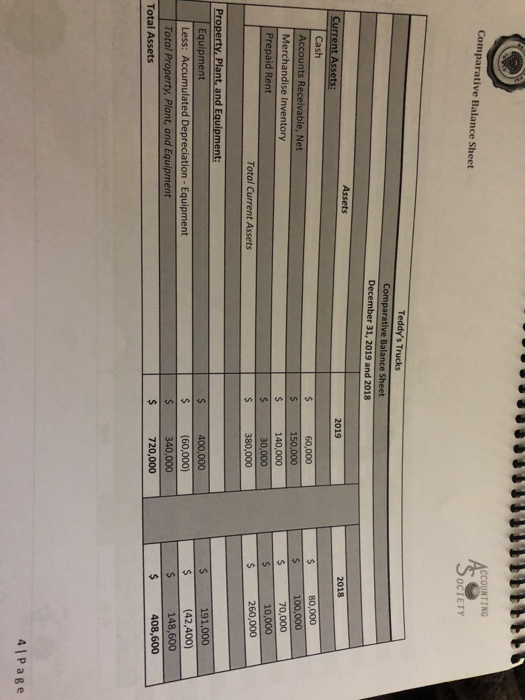

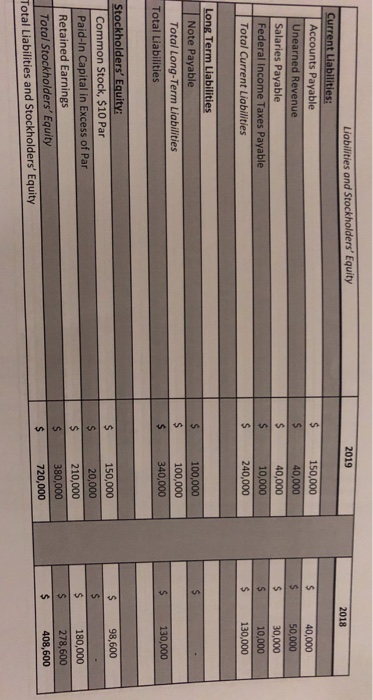

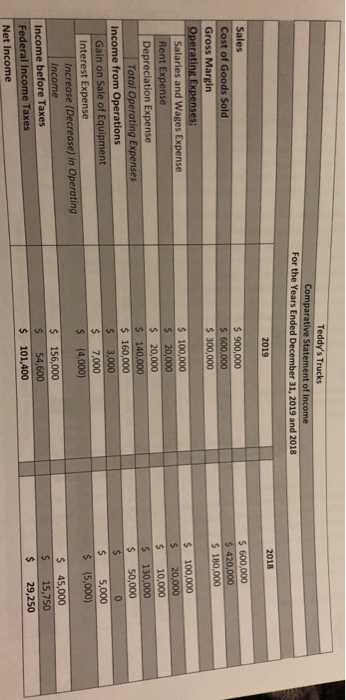

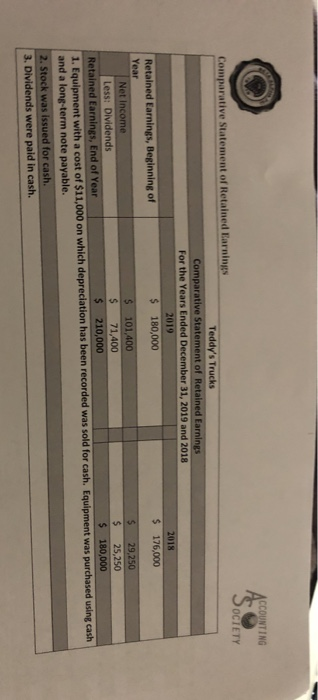

4. Using the textbook, calculate the ratios set out below and round to two decimals: Current Ratio both years a. Quick ratio both years b. Accounts Receivable Turnover year 2019 only c. Days Sales in Receivables year 2019 only d. Inventory Turnover year 2019 only e. Days Sales in Inventory year 2019 only f. Working Capital both years g. Liabilities to Stockholders' Equity both years h. Earnings Per Share both years i. downloaded from Bla Liabilities and Stockholders' Equity 2019 2018 Current Liabilities: Accounts Payable S 150,000 $ 40,000 Unearned Revenue 40,000 $ 50,000 Salaries Payable 40,000 30,000 Federal Income Taxes Payable S 10,000 10,000 Total Current Liabilities 240,000 130,000 Long Term Liabilities Note Payable 100,000 Total Long-Term Liabilities 100,000 340,000 S 130,000 Total Liabilities Stockholders' Equity: 150,000 98,600 Common Stock, $10 Par 20,000 Paid-In Capital in Excess of Par 180,000 210,000 Retained Earnings 278,600 380,000 Total Stockholders' Equity $ 408,600 720,000 Total Liabilities and Stockholders' Equity Teddy's Trucks Comparative Statement of Income For the Years Ended December 31, 2019 and 2018 2019 2018 Sales 900,000 S 600,000 Cost of Goods Sold $ 420,000 $ 180,000 $ 600,000 Gross Margin Operating Expenses: 300,000 100,000 20,000 Salaries and Wages Expense $ 100,000 $ 20,000 Rent Expense Depreciation Expense Total Operating Expenses 20,000 10,000 $ 140,000 130,000 50,000 $ 160,000 3,000 7,000 (4,000) Income from Operations S Gain on Sale of Equipment $ 5,000 Interest Expense Increase (Decrease) in Operating Income (5,000) $ 156,000 45,000 Income before Taxes 54,600 $ 15,750 Federal Income Taxes $ 101,400 $ 29,250 Net Income CCOUNTING 'SOCIETY Comparative Statement of Retained Earnings Teddy's Trucks Comparative Statement of Retained Earnings For the Years Ended December 31, 2019 and 2018 2019 2018 Retained Earnings, Beginning of 180,000 176,000 Year S 101,400 71,400 210,000 Net Income S 29,250 25,250 $ 180,000 Less: Dividends Retained Earnings, End of Year 1. Equipment with a cost of $11,000 on which depreciation has been recorded was sold for cash. Equipment was purchased using cash and a long-term note payable. 2. Stock was issued for cash. 3. Dividends were paid in cash