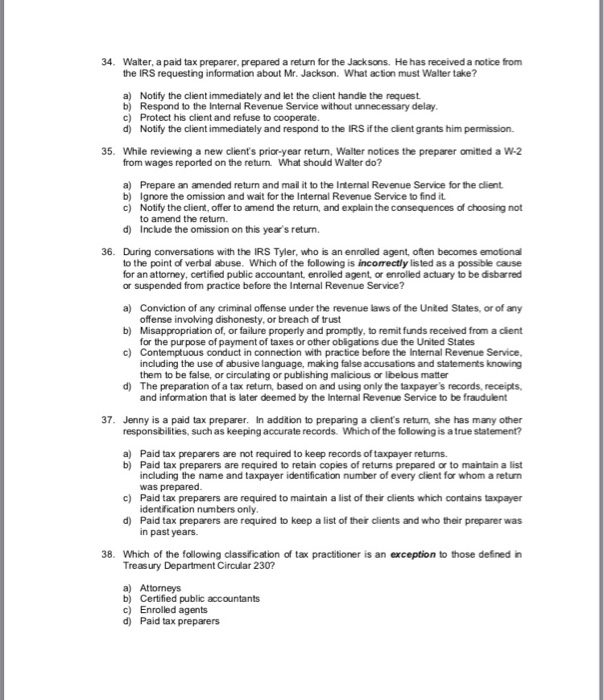

4. Walter, a paid tax preparer, prepared a return for the Jacksons. He has received a notice from the IRS requesting information about Mr. Jackson. What action must Walter take? a) Notify the client immediately and let the client handle the request b) Respond to the Internal Revenue Service without unnecessary delay c) Protect his client and refuse to cooperate d) Notify the client immediately and respond to the IRS if the cient grants him permission. 35. Whle reviewing a new client's prior-year return, Walter notices the preparer omitted a W-2 from wages reported on the return. What should Walter do? a) Prepare an amended return and mail it to the Internal Revenue Service for the client b) Ignore the omission and wait for the Internal Revenue Service to find it c) Notify the client, offer to amend the return, and explain the consequences of choosing not to amend the return. d) Include the omission on this year's return. 36. During conversations with the IRS Tyler, who is an enrolled agent, often becomes emotional to the point of verbal abuse. Which of the following is incorrectly lis ted as a possible cause for an attorney, certified public accountant enrolled agent, or enrolled actuary to be disbarred or suspended from practice before the Internal Revenue Service? a) Conviction of any criminal offense under the revenue laws of the Unted States, or of any offense involving dishonesty, or breach of trust b) Misappropriation of, or failure properly and promptly, to remit funds received from a cient for the purpose of payment of taxes or other obigations due the United States c) Contemptuous conduct in connection with practice before the Internal Revenue Service, including the use of abusive language, making false accusations and statements knowing d) The preparation of a tax return, based on and using only the taxpayer's records, receipts, 37. Jenny is a paid tax preparer. In addition to preparing a cients return, she has many other them to be false, or circulating or publishing malicious or libelous matter and information that is later deemed by the Internal Revenue Service to be fraudulent responsbilities, such as keeping accurate records. Which of the following is a true statement? a) Paid tax preparers are not required to keep records of taxpayer returns. b) Paid tax preparers are required to retain copies of returns prepared or to maintain a list including the name and taxpayer identification number of every client for whom a return c) Paid tax preparers are required to maintain a list of their clients which contains taxpayer d) Paid tax preparers are required to keep a list of their clients and who their preparer was 38. Which of the following classfication of tax practitioner is an exception to those defined in identfication numbers only in past years. Treasury Department Circular 230? a) Attorneys b) Certified public accountants c Enrolled agents d) Paid tax preparers