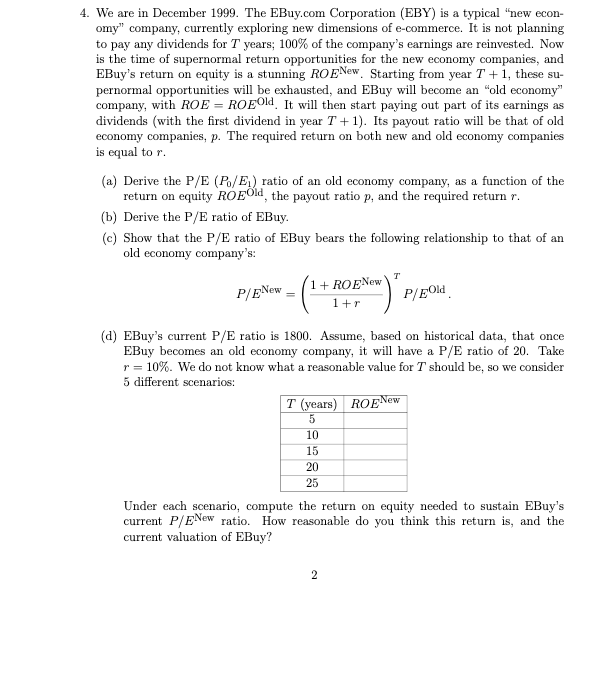

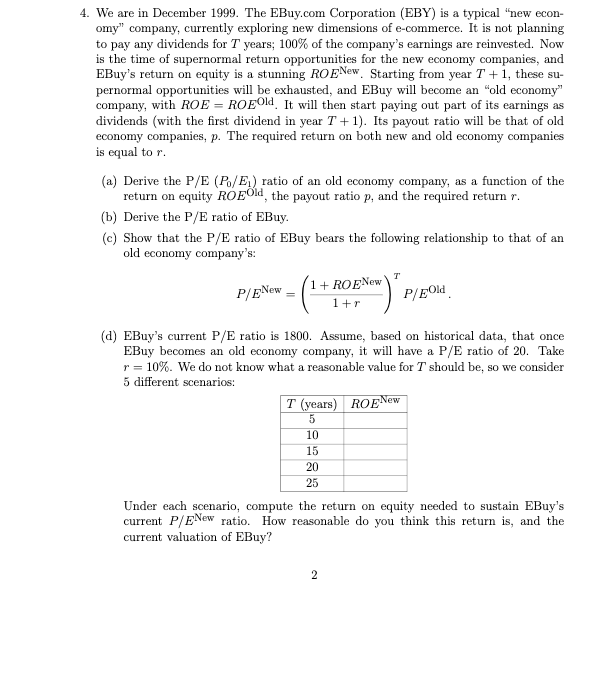

4. We are in December 1999. The EBuy.com Corporation (EBY) is a typical "new econ- omy" company, currently exploring new dimensions of e-commerce. It is not planning to pay any dividends for T years; 100% of the company's earnings are reinvested. Now is the time of supernormal return opportunities for the new economy companies, and EBuy's return on equity is a stunning RO ENew Starting from year 7 + i, these su- pernormal opportunities will be exhausted, and EBuy will become an "old economy" company, with ROE = ROEOld It will then start paying out part of its earnings as dividends (with the first dividend in year T +1). Its payout ratio will be that of old economy companies, p. The required return on both new and old economy companies is equal to r. (a) Derive the P/E (P/E) ratio of an old economy company, as a function of the return on equity ROEOld, the payout ratio p, and the required return r. (b) Derive the P/E ratio of EBuy. (c) Show that the P/E ratio of EBuy bears the following relationship to that of an old economy company's: T 1 + ROE New P/ENew P/EOld (d) EBuy's current P/E ratio is 1800. Assume, based on historical data, that once EBuy becomes an old economy company, it will have a P/E ratio of 20. Take r = 10%. We do not know what a reasonable value for T should be, so we consider 5 different scenarios: T (years) ROE New 5 10 15 20 25 Under each scenario, compute the return on equity needed to sustain EBuy's current P/ENew ratio. How reasonable do you think this return is, and the current valuation of EBuy? 2 4. We are in December 1999. The EBuy.com Corporation (EBY) is a typical "new econ- omy" company, currently exploring new dimensions of e-commerce. It is not planning to pay any dividends for T years; 100% of the company's earnings are reinvested. Now is the time of supernormal return opportunities for the new economy companies, and EBuy's return on equity is a stunning RO ENew Starting from year 7 + i, these su- pernormal opportunities will be exhausted, and EBuy will become an "old economy" company, with ROE = ROEOld It will then start paying out part of its earnings as dividends (with the first dividend in year T +1). Its payout ratio will be that of old economy companies, p. The required return on both new and old economy companies is equal to r. (a) Derive the P/E (P/E) ratio of an old economy company, as a function of the return on equity ROEOld, the payout ratio p, and the required return r. (b) Derive the P/E ratio of EBuy. (c) Show that the P/E ratio of EBuy bears the following relationship to that of an old economy company's: T 1 + ROE New P/ENew P/EOld (d) EBuy's current P/E ratio is 1800. Assume, based on historical data, that once EBuy becomes an old economy company, it will have a P/E ratio of 20. Take r = 10%. We do not know what a reasonable value for T should be, so we consider 5 different scenarios: T (years) ROE New 5 10 15 20 25 Under each scenario, compute the return on equity needed to sustain EBuy's current P/ENew ratio. How reasonable do you think this return is, and the current valuation of EBuy? 2