Answered step by step

Verified Expert Solution

Question

1 Approved Answer

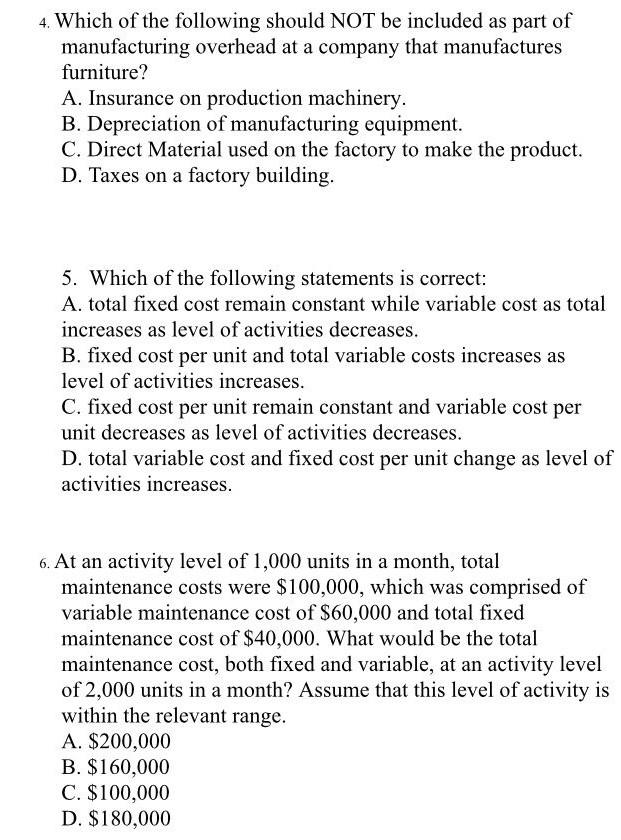

4. Which of the following should NOT be included as part of manufacturing overhead at a company that manufactures furniture? A. Insurance on production machinery.

4. Which of the following should NOT be included as part of manufacturing overhead at a company that manufactures furniture? A. Insurance on production machinery. B. Depreciation of manufacturing equipment. C. Direct Material used on the factory to make the product. D. Taxes on a factory building. 5. Which of the following statements is correct: A. total fixed cost remain constant while variable cost as total increases as level of activities decreases. B. fixed cost per unit and total variable costs increases as level of activities increases. C. fixed cost per unit remain constant and variable cost per unit decreases as level of activities decreases. D. total variable cost and fixed cost per unit change as level of activities increases. 6. At an activity level of 1,000 units in a month, total maintenance costs were $100,000, which was comprised of variable maintenance cost of $60,000 and total fixed maintenance cost of $40,000. What would be the total maintenance cost, both fixed and variable, at an activity level of 2,000 units in a month? Assume that this level of activity is within the relevant range. A. $200,000 B. $160,000 C. $100,000 D. $180,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started