Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. You are bearish on FBA and decide to sell short 3,000 shares at the current market price of $45 per share. FBA pays

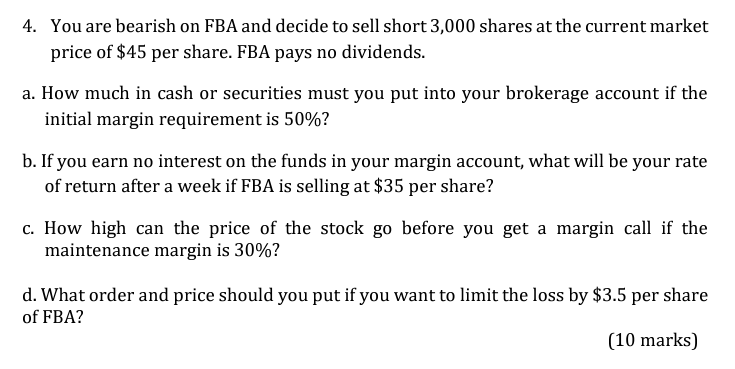

4. You are bearish on FBA and decide to sell short 3,000 shares at the current market price of $45 per share. FBA pays no dividends. a. How much in cash or securities must you put into your brokerage account if the initial margin requirement is 50%? b. If you earn no interest on the funds in your margin account, what will be your rate of return after a week if FBA is selling at $35 per share? c. How high can the price of the stock go before you get a margin call if the maintenance margin is 30%? d. What order and price should you put if you want to limit the loss by $3.5 per share of FBA? (10 marks) 4. You are bearish on FBA and decide to sell short 3,000 shares at the current market price of $45 per share. FBA pays no dividends. a. How much in cash or securities must you put into your brokerage account if the initial margin requirement is 50%? b. If you earn no interest on the funds in your margin account, what will be your rate of return after a week if FBA is selling at $35 per share? c. How high can the price of the stock go before you get a margin call if the maintenance margin is 30%? d. What order and price should you put if you want to limit the loss by $3.5 per share of FBA? (10 marks) 4. You are bearish on FBA and decide to sell short 3,000 shares at the current market price of $45 per share. FBA pays no dividends. a. How much in cash or securities must you put into your brokerage account if the initial margin requirement is 50%? b. If you earn no interest on the funds in your margin account, what will be your rate of return after a week if FBA is selling at $35 per share? c. How high can the price of the stock go before you get a margin call if the maintenance margin is 30%? d. What order and price should you put if you want to limit the loss by $3.5 per share of FBA? (10 marks)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To determine how much cash or securities you must put into your brokerage account when selling sho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started