Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. You decide to invest your money in a stock portfolio consisting of 30% TATA motors and 70% in Flipkart. Using the data in the

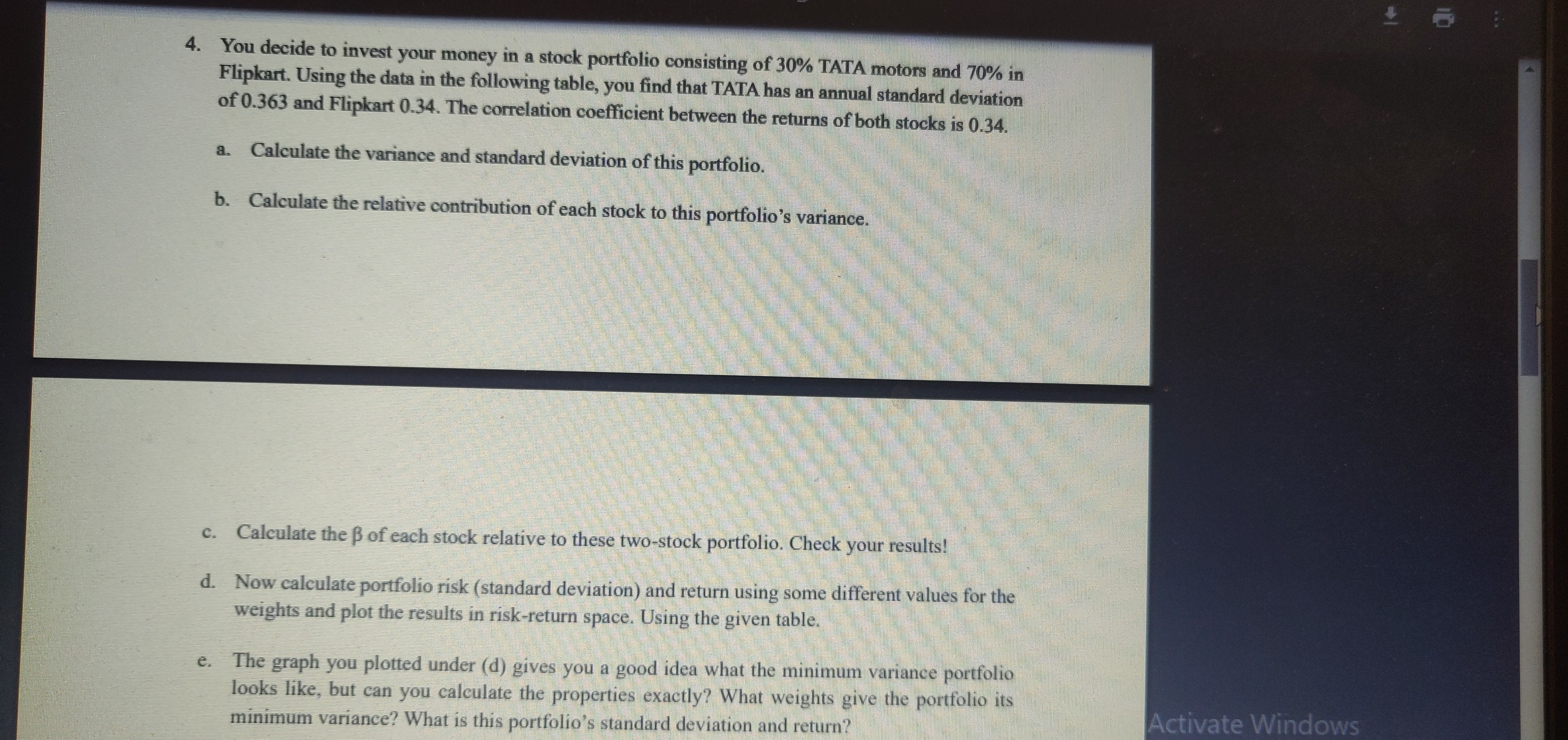

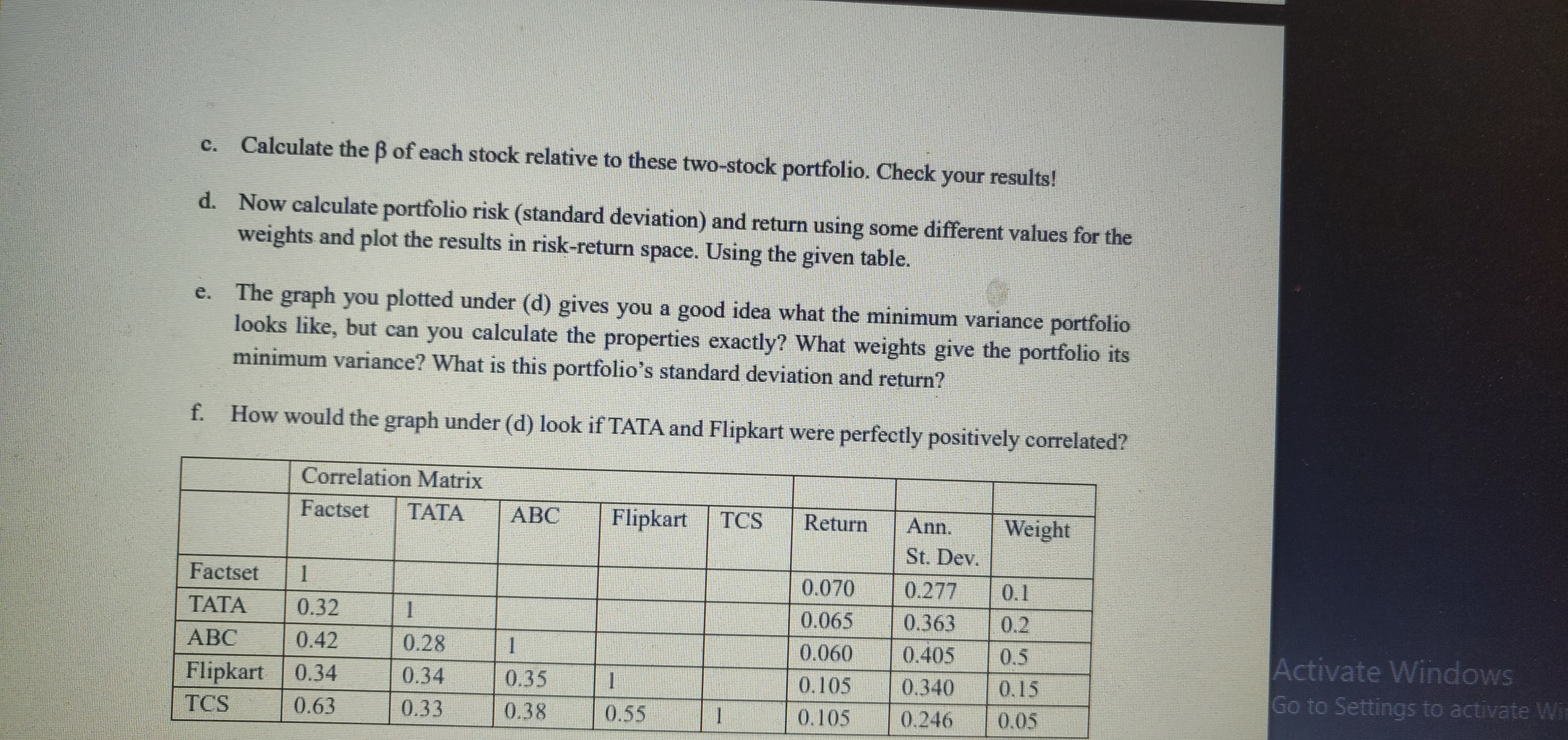

4. You decide to invest your money in a stock portfolio consisting of 30% TATA motors and 70% in Flipkart. Using the data in the following table, you find that TATA has an annual standard deviation of 0.363 and Flipkart 0.34 . The correlation coefficient between the returns of both stocks is 0.34 . a. Calculate the variance and standard deviation of this portfolio. b. Calculate the relative contribution of each stock to this portfolio's variance. c. Calculate the of each stock relative to these two-stock portfolio. Check your results! d. Now calculate porffolio risk (standard deviation) and return using some different values for the weights and plot the results in risk-return space. Using the given table. e. The graph you plotted under (d) gives you a good idea what the minimum variance portfolio looks like, but can you calculate the properties exactly? What weights give the portfolio its minimum variance? What is this portfolio's standard deviation and return? c. Calculate the of each stock relative to these two-stock portfolio. Check your results! d. Now calculate portfolio risk (standard deviation) and return using some different values for the weights and plot the results in risk-return space. Using the given table. e. The graph you plotted under (d) gives you a good idea what the minimum variance portfolio looks like, but can you calculate the properties exactly? What weights give the portfolio its minimum variance? What is this portfolio's standard deviation and return? f. How would the graph under (d) look if TATA and Flipkart were perfectly positively correlated

4. You decide to invest your money in a stock portfolio consisting of 30% TATA motors and 70% in Flipkart. Using the data in the following table, you find that TATA has an annual standard deviation of 0.363 and Flipkart 0.34 . The correlation coefficient between the returns of both stocks is 0.34 . a. Calculate the variance and standard deviation of this portfolio. b. Calculate the relative contribution of each stock to this portfolio's variance. c. Calculate the of each stock relative to these two-stock portfolio. Check your results! d. Now calculate porffolio risk (standard deviation) and return using some different values for the weights and plot the results in risk-return space. Using the given table. e. The graph you plotted under (d) gives you a good idea what the minimum variance portfolio looks like, but can you calculate the properties exactly? What weights give the portfolio its minimum variance? What is this portfolio's standard deviation and return? c. Calculate the of each stock relative to these two-stock portfolio. Check your results! d. Now calculate portfolio risk (standard deviation) and return using some different values for the weights and plot the results in risk-return space. Using the given table. e. The graph you plotted under (d) gives you a good idea what the minimum variance portfolio looks like, but can you calculate the properties exactly? What weights give the portfolio its minimum variance? What is this portfolio's standard deviation and return? f. How would the graph under (d) look if TATA and Flipkart were perfectly positively correlated Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started