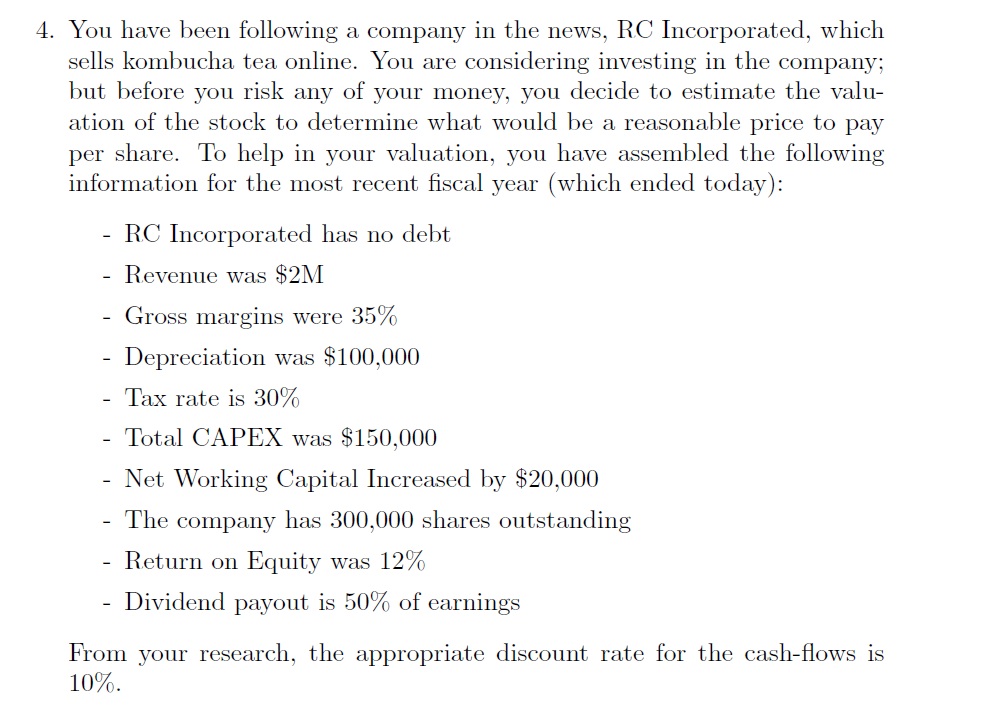

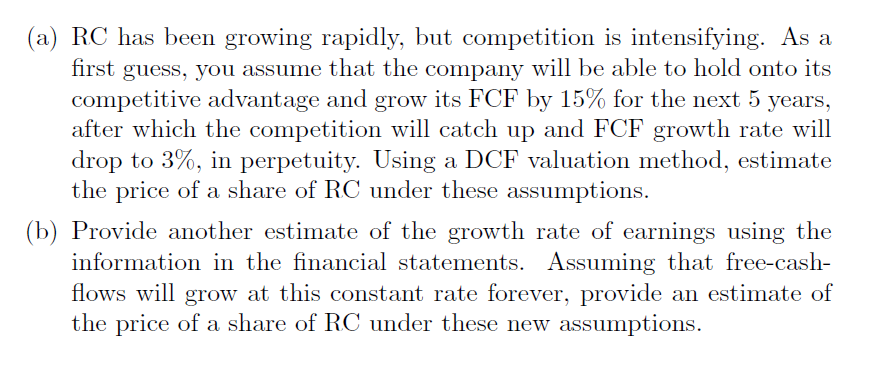

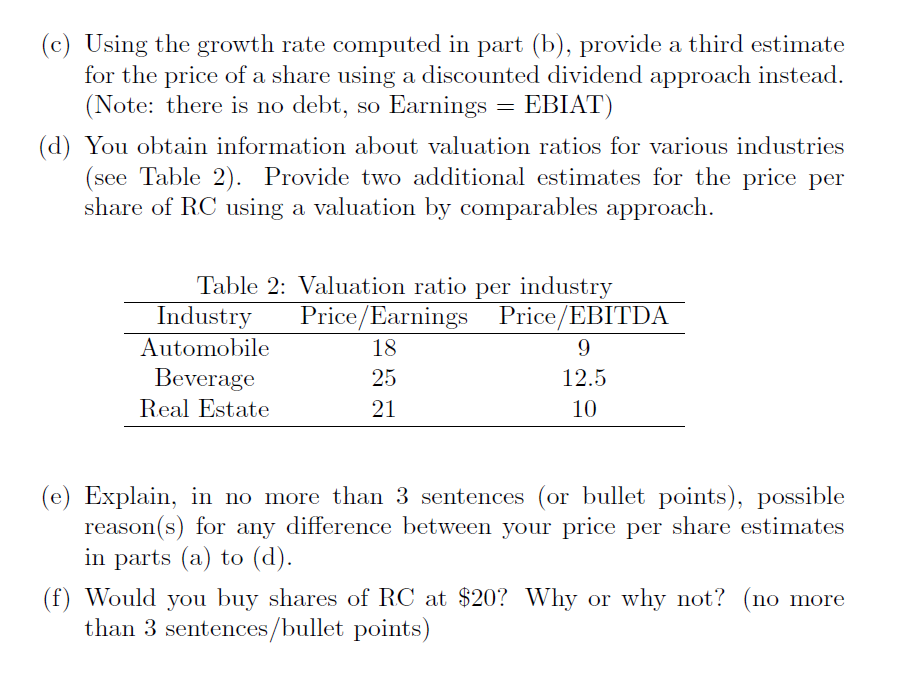

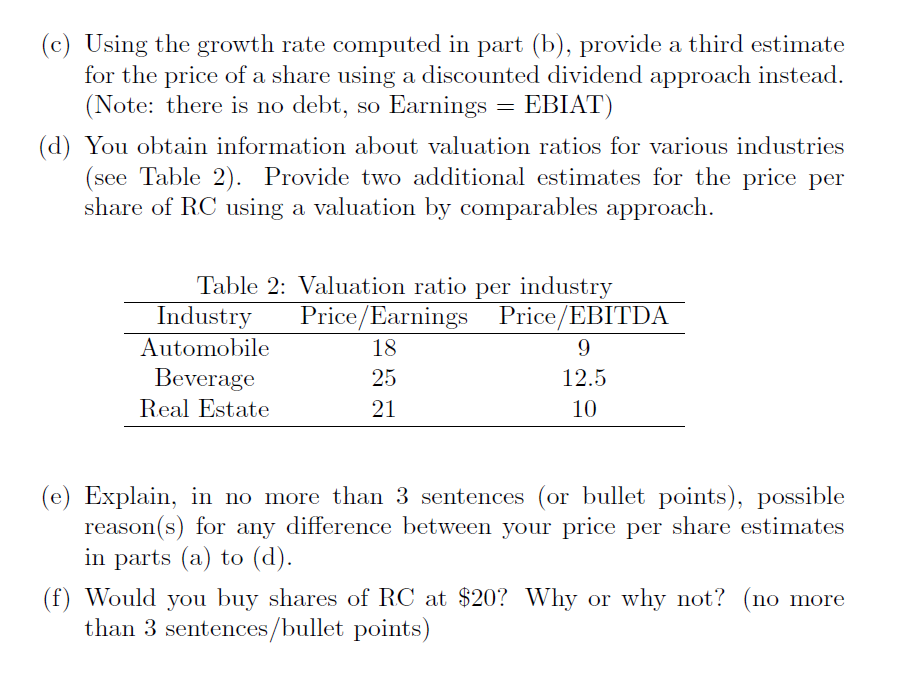

4. You have been following a company in the news, RC Incorporated, which sells kombucha tea online. You are considering investing in the company; but before you risk any of your money, you decide to estimate the valu- ation of the stock to determine what would be a reasonable price to pay per share. To help in your valuation, you have assembled the following information for the most recent fiscal year (which ended today): - RC Incorporated has no debt - Revenue was $2M - Gross margins were 35% - Depreciation was $100,000 - Tax rate is 30% - Total CAPEX was $150,000 - Net Working Capital Increased by $20,000 - The company has 300,000 shares outstanding - Return on Equity was 12% - Dividend payout is 50% of earnings From your research, the appropriate discount rate for the cash-flows is 10%. (a) RC has been growing rapidly, but competition is intensifying. As a first guess, you assume that the company will be able to hold onto its competitive advantage and grow its FCF by 15% for the next 5 years, after which the competition will catch up and FCF growth rate will drop to 3%, in perpetuity. Using a DCF valuation method, estimate the price of a share of RC under these assumptions. Provide another estimate of the growth rate of earnings using the information in the financial statements. Assuming that free-cash- flows will grow at this constant rate forever, provide an estimate of the price of a share of RC under these new assumptions. (c) Using the growth rate computed in part (b), provide a third estimate for the price of a share using a discounted dividend approach instead. (Note: there is no debt, so Earnings = EBIAT) (d) You obtain information about valuation ratios for various industries (see Table 2). Provide two additional estimates for the price per share of RC using a valuation by comparables approach. Table 2: Valuation ratio per industry Industry Price/Earnings Price/EBITDA Automobile Beverage 12.5 Real Estate 21 10 18 25 (e) Explain, in no more than 3 sentences (or bullet points), possible reason(s) for any difference between your price per share estimates in parts (a) to (d). (f) Would you buy shares of RC at $20? Why or why not? (no more than 3 sentences/bullet points) 4. You have been following a company in the news, RC Incorporated, which sells kombucha tea online. You are considering investing in the company; but before you risk any of your money, you decide to estimate the valu- ation of the stock to determine what would be a reasonable price to pay per share. To help in your valuation, you have assembled the following information for the most recent fiscal year (which ended today): - RC Incorporated has no debt - Revenue was $2M - Gross margins were 35% - Depreciation was $100,000 - Tax rate is 30% - Total CAPEX was $150,000 - Net Working Capital Increased by $20,000 - The company has 300,000 shares outstanding - Return on Equity was 12% - Dividend payout is 50% of earnings From your research, the appropriate discount rate for the cash-flows is 10%. (a) RC has been growing rapidly, but competition is intensifying. As a first guess, you assume that the company will be able to hold onto its competitive advantage and grow its FCF by 15% for the next 5 years, after which the competition will catch up and FCF growth rate will drop to 3%, in perpetuity. Using a DCF valuation method, estimate the price of a share of RC under these assumptions. Provide another estimate of the growth rate of earnings using the information in the financial statements. Assuming that free-cash- flows will grow at this constant rate forever, provide an estimate of the price of a share of RC under these new assumptions. (c) Using the growth rate computed in part (b), provide a third estimate for the price of a share using a discounted dividend approach instead. (Note: there is no debt, so Earnings = EBIAT) (d) You obtain information about valuation ratios for various industries (see Table 2). Provide two additional estimates for the price per share of RC using a valuation by comparables approach. Table 2: Valuation ratio per industry Industry Price/Earnings Price/EBITDA Automobile Beverage 12.5 Real Estate 21 10 18 25 (e) Explain, in no more than 3 sentences (or bullet points), possible reason(s) for any difference between your price per share estimates in parts (a) to (d). (f) Would you buy shares of RC at $20? Why or why not? (no more than 3 sentences/bullet points)