Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. You have heen recently appainted as a carporate manager in EXIM Bank Malaysia. Your new corporate client, the Limkokwing University of Creative Technology Sdn.

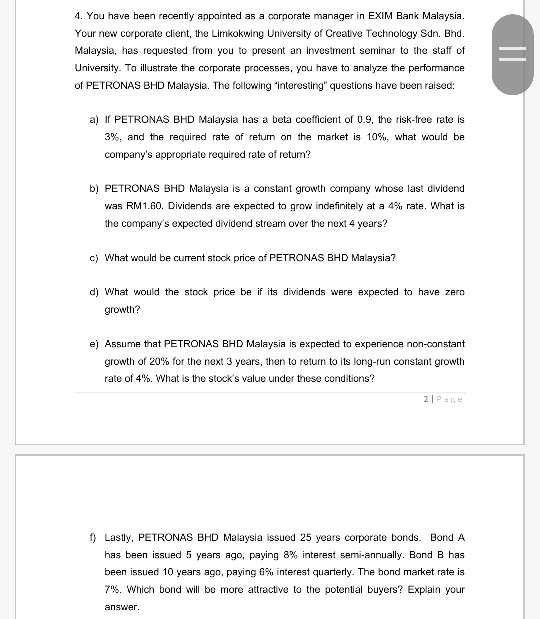

4. You have heen recently appainted as a carporate manager in EXIM Bank Malaysia. Your new corporate client, the Limkokwing University of Creative Technology Sdn. Bhd. Malaysia, has requested from you to present an investment seminar to the staff of University. To illustrate the corporate processes, you have to analyze the performance of PETRONAS BHD Malaysia. The following "interesting" questions have been raised: a) If PETRONAS BHD Malaysia has a beta coefficient of 0.9, the risk-free rate is 3%, and the required rate of return on the market is 10%. what would be company's appropriate required rate of return? b) PETRONAS BHD Malaysia is a constant growth company whose last dividend was RM1.60. Dividends are expected to grow indefinitely at a 4% rate. What is the company's expected dividend stream over the next 4 years? c) What wauld be current stock price of PETRONAS BHD Malaysia? di What would the stock price be if its dividends were expected to have zero growth? e Assume that PETRONAS BHD Malaysia is expected to experience non-nstant growth of 20% for the next 3 years, then to return to its long-run constant growth rate of 4%. "what is the stock's value under these conditions? f Lastly, PETRONAS BHD Malaysia issued 25 years corporate bonds. Bond A has been issued 5 years ago, paying 8% interest semi-annually. Bond B has been issued 10 years ago, paying 6% interest quarterly. The bond market rate is 7%, which bond will be more attractive to the potential buyers? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started