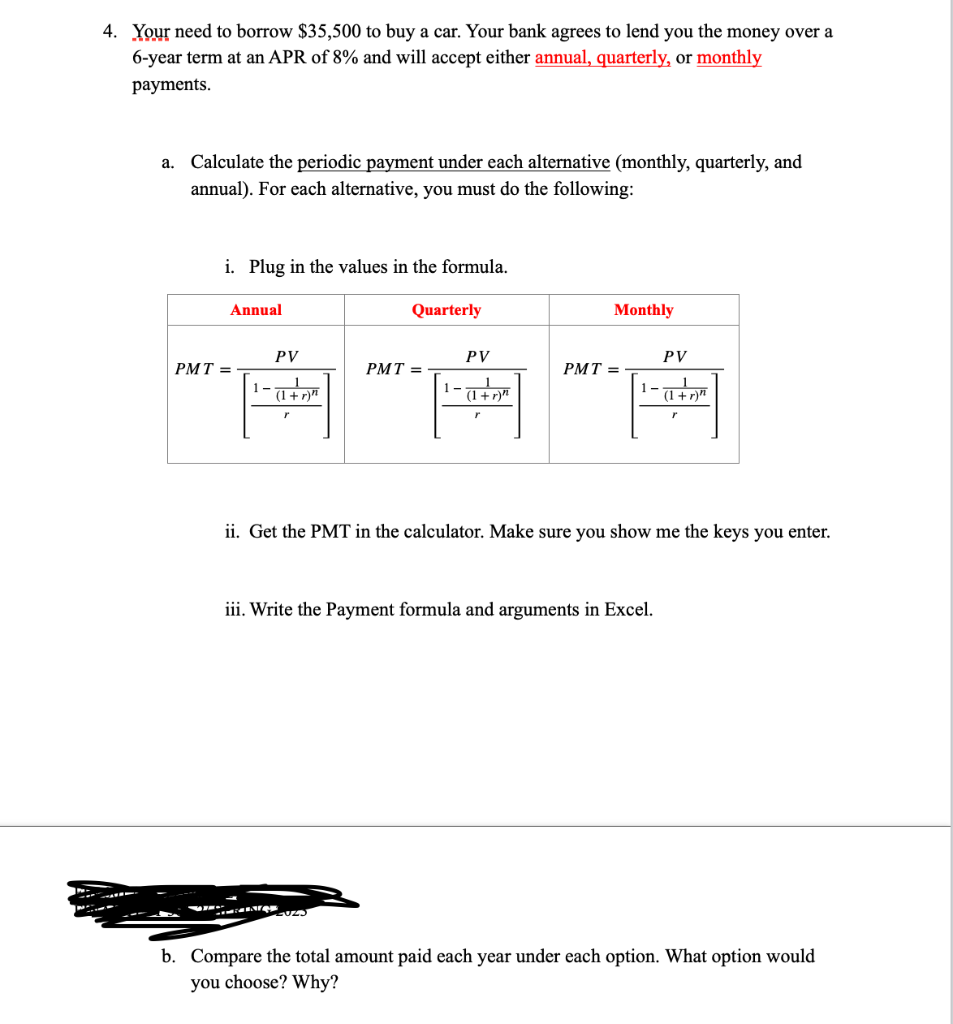

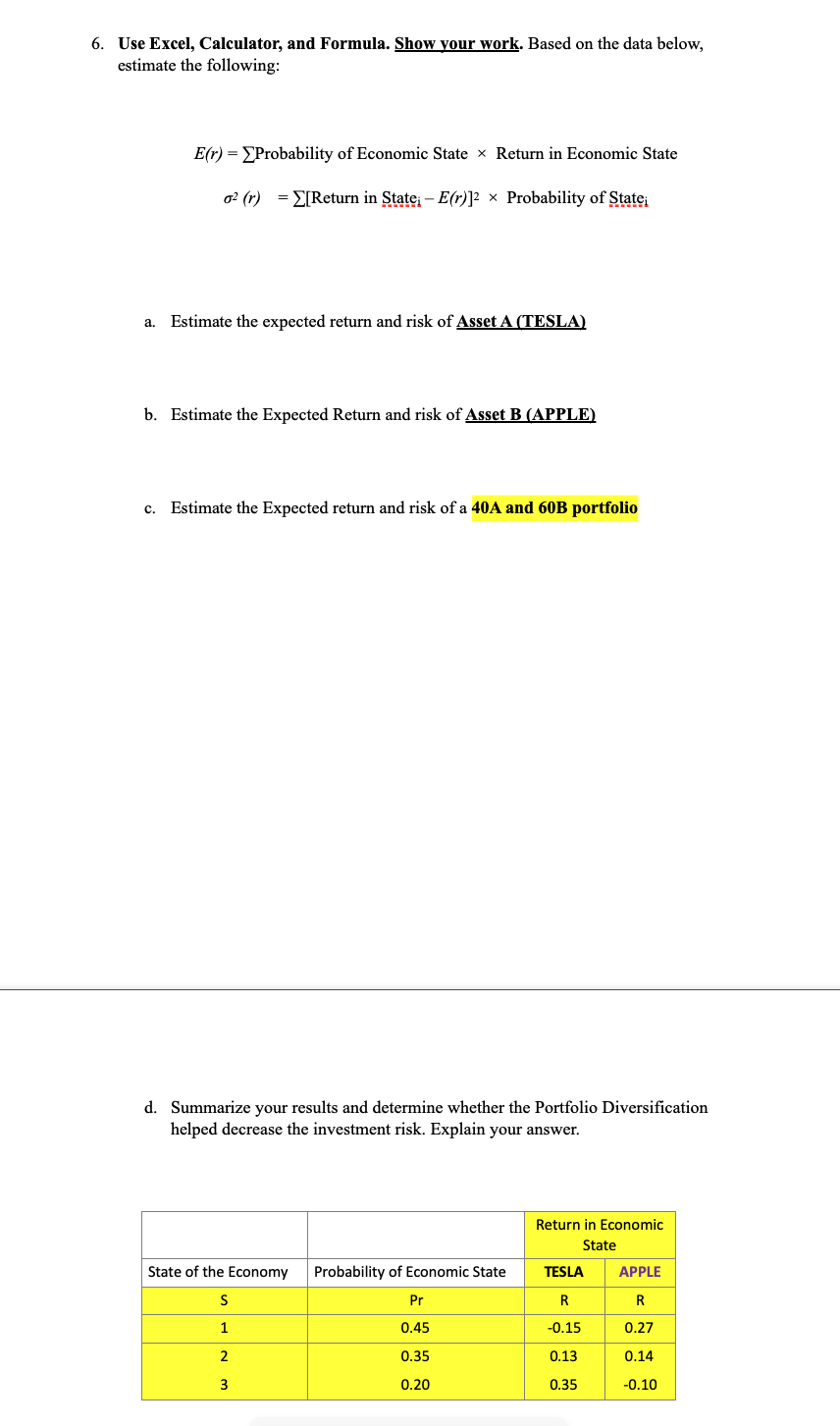

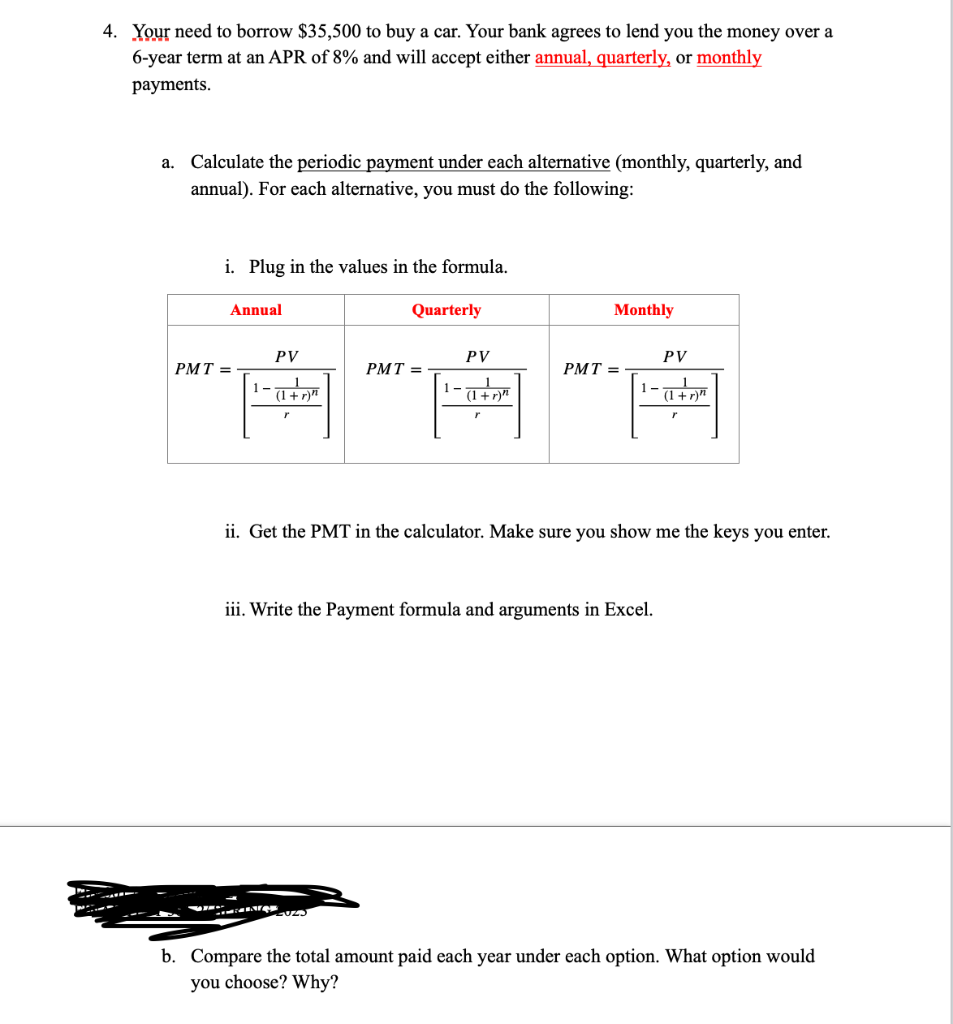

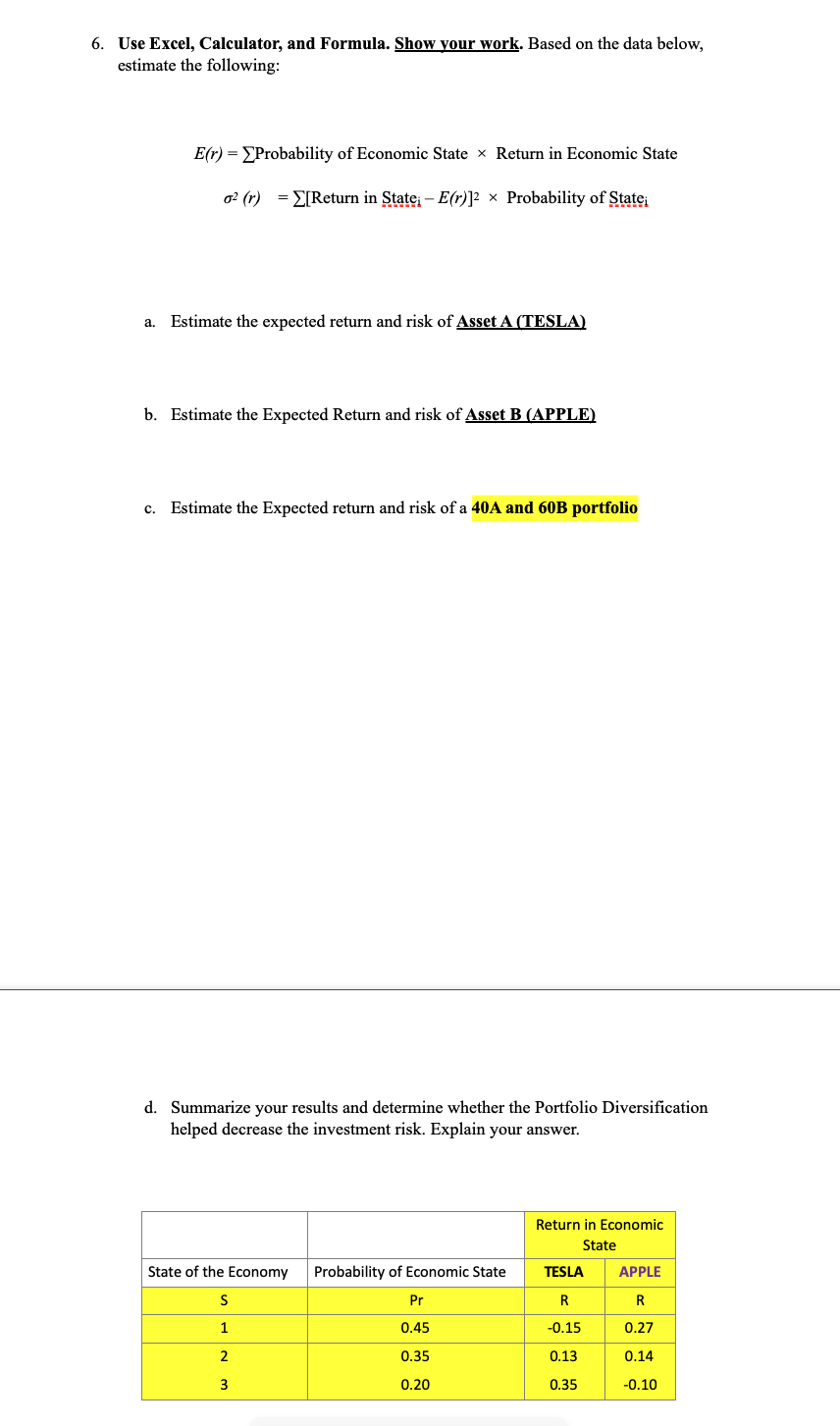

4. Your need to borrow $35,500 to buy a car. Your bank agrees to lend you the money over a 6-year term at an APR of 8% and will accept either annual, quarterly, or monthly payments. a. Calculate the periodic payment under each alternative (monthly, quarterly, and annual). For each alternative, you must do the following: i. Plug in the values in the formula. ii. Get the PMT in the calculator. Make sure you show me the keys you enter. iii. Write the Payment formula and arguments in Excel. b. Compare the total amount paid each year under each option. What option would you choose? Why? 6. Use Excel, Calculator, and Formula. Show vour work. Based on the data below, estimate the following: E(r)=ProbabilityofEconomicStateReturninEconomicState2(r)=[ReturninStateiE(r)]2ProbabilityofStatei a. Estimate the expected return and risk of Asset A (TESLA) b. Estimate the Expected Return and risk of Asset B (APPLE) c. Estimate the Expected return and risk of a 40A and 60B portfolio d. Summarize your results and determine whether the Portfolio Diversification helped decrease the investment risk. Explain your answer. 4. Your need to borrow $35,500 to buy a car. Your bank agrees to lend you the money over a 6-year term at an APR of 8% and will accept either annual, quarterly, or monthly payments. a. Calculate the periodic payment under each alternative (monthly, quarterly, and annual). For each alternative, you must do the following: i. Plug in the values in the formula. ii. Get the PMT in the calculator. Make sure you show me the keys you enter. iii. Write the Payment formula and arguments in Excel. b. Compare the total amount paid each year under each option. What option would you choose? Why? 6. Use Excel, Calculator, and Formula. Show vour work. Based on the data below, estimate the following: E(r)=ProbabilityofEconomicStateReturninEconomicState2(r)=[ReturninStateiE(r)]2ProbabilityofStatei a. Estimate the expected return and risk of Asset A (TESLA) b. Estimate the Expected Return and risk of Asset B (APPLE) c. Estimate the Expected return and risk of a 40A and 60B portfolio d. Summarize your results and determine whether the Portfolio Diversification helped decrease the investment risk. Explain your