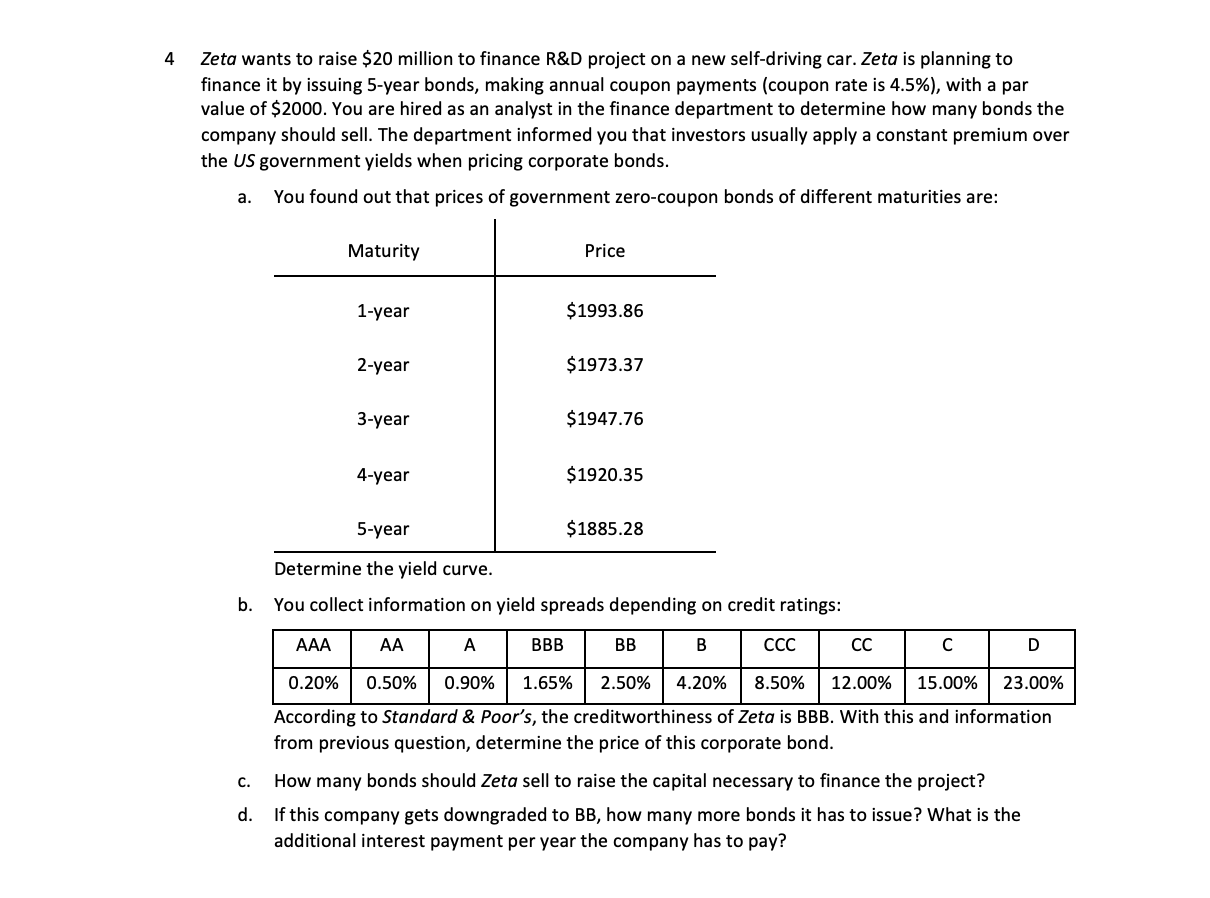

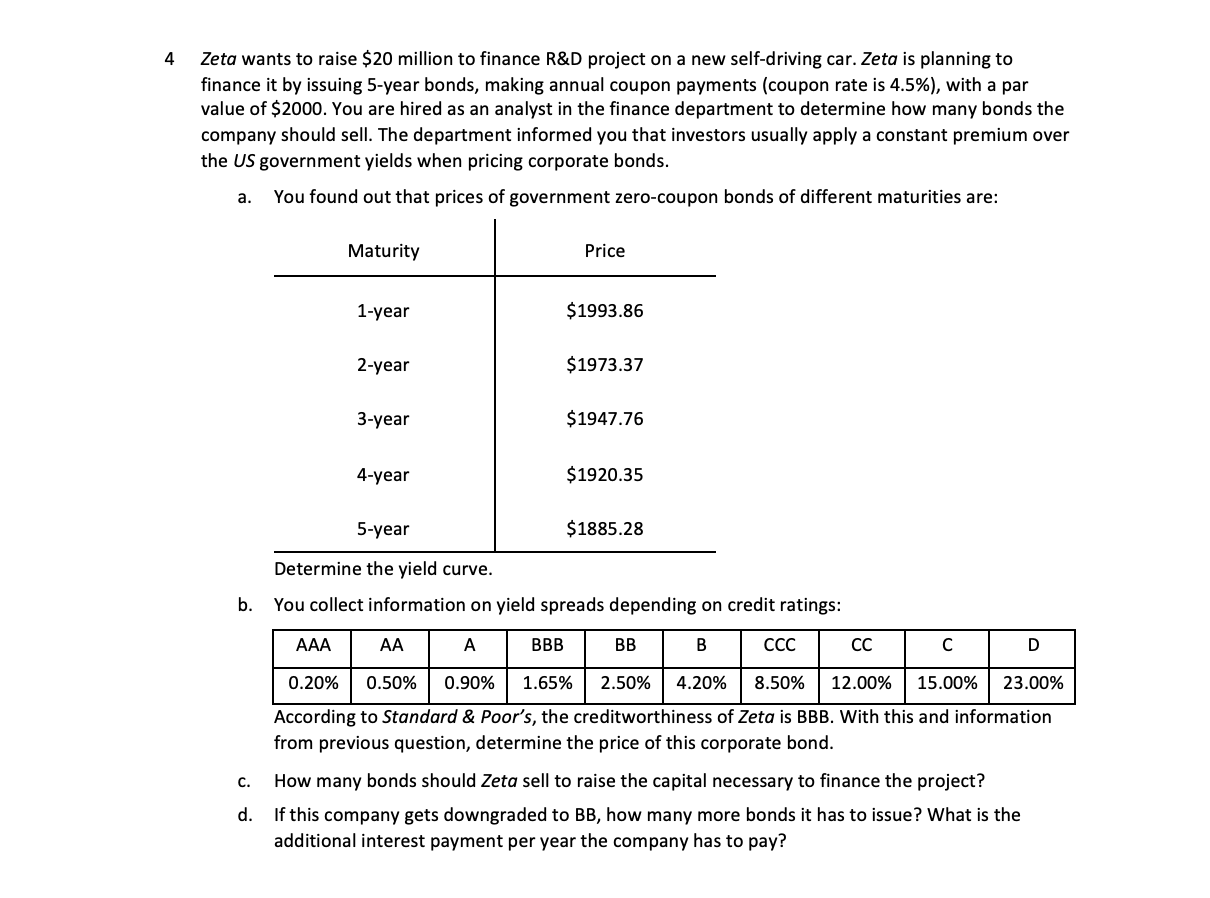

4 Zeta wants to raise $20 million to finance R&D project on a new self-driving car. Zeta is planning to finance it by issuing 5-year bonds, making annual coupon payments (coupon rate is 4.5%), with a par value of $2000. You are hired as an analyst in the finance department to determine how many bonds the company should sell. The department informed you that investors usually apply a constant premium over the US government yields when pricing corporate bonds. You found out that prices of government zero-coupon bonds of different maturities are: a. Maturity Price 1-year $1993.86 2-year $1973.37 3-year $1947.76 4-year $1920.35 5-year $1885.28 Determine the yield curve. You collect information on yield spreads depending on credit ratings: b. D AAA AA A BBB BB B CCC CC C 0.20% 0.50% 0.90% 1.65% 2.50% 4.20% 8.50% 12.00% 15.00% 23.00% According to Standard & Poor's, the creditworthiness of Zeta is BBB. With this and information from previous question, determine the price of this corporate bond. c. d. How many bonds should Zeta sell to raise the capital necessary to finance the project? If this company gets downgraded to BB, how many more bonds it has to issue? What is the additional interest payment per year the company has to pay? 4 Zeta wants to raise $20 million to finance R&D project on a new self-driving car. Zeta is planning to finance it by issuing 5-year bonds, making annual coupon payments (coupon rate is 4.5%), with a par value of $2000. You are hired as an analyst in the finance department to determine how many bonds the company should sell. The department informed you that investors usually apply a constant premium over the US government yields when pricing corporate bonds. You found out that prices of government zero-coupon bonds of different maturities are: a. Maturity Price 1-year $1993.86 2-year $1973.37 3-year $1947.76 4-year $1920.35 5-year $1885.28 Determine the yield curve. You collect information on yield spreads depending on credit ratings: b. D AAA AA A BBB BB B CCC CC C 0.20% 0.50% 0.90% 1.65% 2.50% 4.20% 8.50% 12.00% 15.00% 23.00% According to Standard & Poor's, the creditworthiness of Zeta is BBB. With this and information from previous question, determine the price of this corporate bond. c. d. How many bonds should Zeta sell to raise the capital necessary to finance the project? If this company gets downgraded to BB, how many more bonds it has to issue? What is the additional interest payment per year the company has to pay