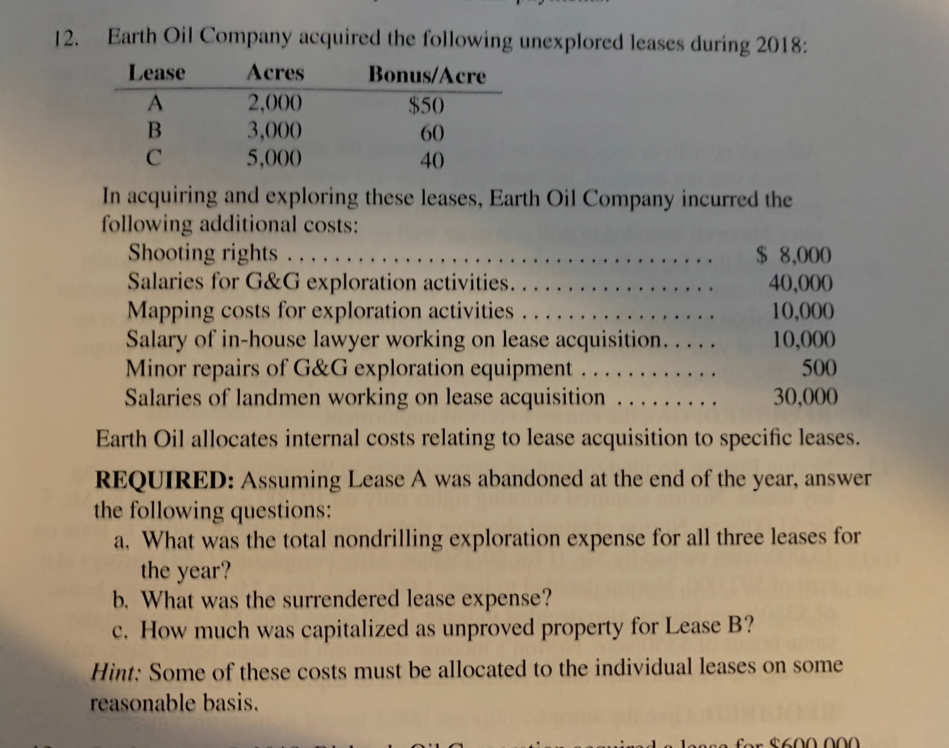

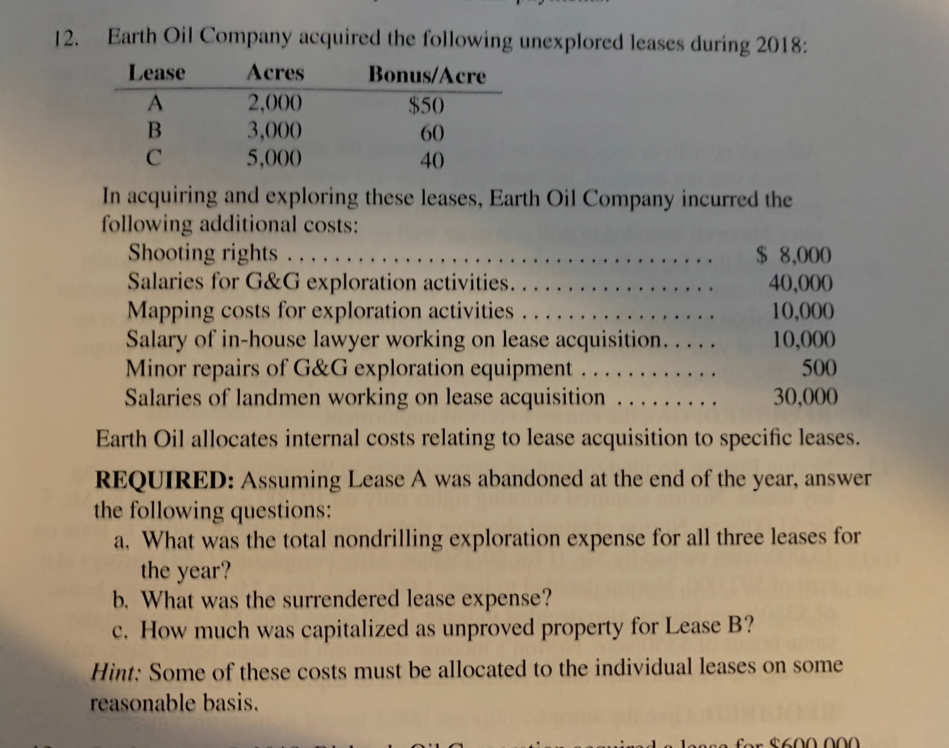

40 12. Earth Oil Company acquired the following unexplored leases during 2018: Lease Acres Bonus/Acre 2,000 $50 B 3,000 60 5,000 In acquiring and exploring these leases, Earth Oil Company incurred the following additional costs: Shooting rights ..................... $ 8,000 Salaries for G&G exploration activities............ 40,000 Mapping costs for exploration activities ...... 10,000 Salary of in-house lawyer working on lease acquisition. .... 10,000 Minor repairs of G&G exploration equipment ............ 500 Salaries of landmen working on lease acquisition .....! 30,000 Earth Oil allocates internal costs relating to lease acquisition to specific leases. REQUIRED: Assuming Lease A was abandoned at the end of the year, answer the following questions: a. What was the total nondrilling exploration expense for all three leases for the year? b. What was the surrendered lease expense? c. How much was capitalized as unproved property for Lease B? Hint: Some of these costs must be allocated to the individual leases on some reasonable basis. Guido 1000 for $600.000 40 12. Earth Oil Company acquired the following unexplored leases during 2018: Lease Acres Bonus/Acre 2,000 $50 B 3,000 60 5,000 In acquiring and exploring these leases, Earth Oil Company incurred the following additional costs: Shooting rights ..................... $ 8,000 Salaries for G&G exploration activities............ 40,000 Mapping costs for exploration activities ...... 10,000 Salary of in-house lawyer working on lease acquisition. .... 10,000 Minor repairs of G&G exploration equipment ............ 500 Salaries of landmen working on lease acquisition .....! 30,000 Earth Oil allocates internal costs relating to lease acquisition to specific leases. REQUIRED: Assuming Lease A was abandoned at the end of the year, answer the following questions: a. What was the total nondrilling exploration expense for all three leases for the year? b. What was the surrendered lease expense? c. How much was capitalized as unproved property for Lease B? Hint: Some of these costs must be allocated to the individual leases on some reasonable basis. Guido 1000 for $600.000