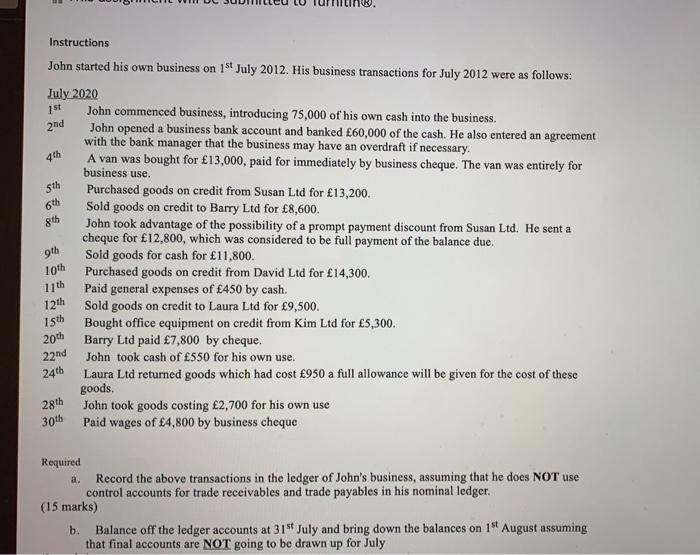

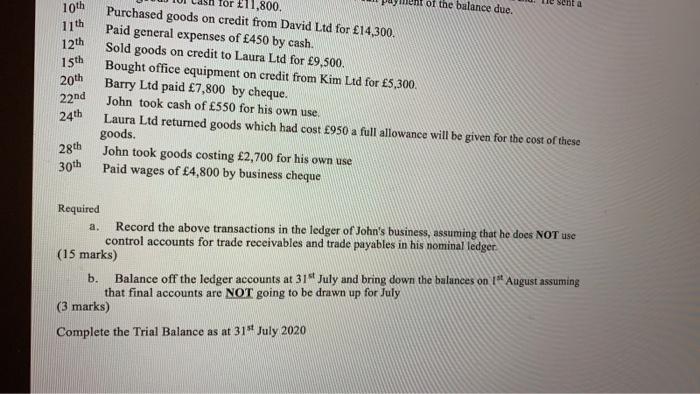

40 5 6th 805 Instructions John started his own business on 1st July 2012. His business transactions for July 2012 were as follows: July 2020 151 John commenced business, introducing 75,000 of his own cash into the business 2nd John opened a business bank account and banked 60,000 of the cash. He also entered an agreement with the bank manager that the business may have an overdraft if necessary. A van was bought for 13,000, paid for immediately by business cheque. The van was entirely for business use. Purchased goods on credit from Susan Ltd for 13,200. Sold goods on credit to Barry Ltd for 8,600. John took advantage of the possibility of a prompt payment discount from Susan Ltd. He sent a cheque for 12,800, which was considered to be full payment of the balance due. Sold goods for cash for 11,800. Purchased goods on credit from David Ltd for 14,300. Paid general expenses of 450 by cash. Sold goods on credit to Laura Ltd for 9,500. Bought office equipment on credit from Kim Ltd for 5,300. Barry Ltd paid 7,800 by cheque. 22nd John took cash of 550 for his own use. Laura Ltd returned goods which had cost 950 a full allowance will be given for the cost of these goods. John took goods costing 2,700 for his own use Paid wages of 4,800 by business cheque 9th Tot 11th 12th Isth 20th 24th 28th 30th Required a. Record the above transactions in the ledger of John's business, assuming that he does NOT use control accounts for trade receivables and trade payables in his nominal ledger. (15 marks) Balance off the ledger accounts at 31st July and bring down the balances on 1st August assuming that final accounts are NOT going to be drawn up for July b. schta 10th 11th 12th 15th 20th 22nd 24th of the balance due. 11,800 Purchased goods on credit from David Ltd for 14,300. Paid general expenses of 450 by cash. Sold goods on credit to Laura Ltd for 9,500. Bought office equipment on credit from Kim Ltd for 5,300 Barry Ltd paid 7,800 by cheque. John took cash of 550 for his own use. Laura Ltd returned goods which had cost 950 a full allowance will be given for the cost of these goods. John took goods costing 2,700 for his own use Paid wages of 4,800 by business cheque 28th 30th Required a. Record the above transactions in the ledger of John's business, assuming that he does NOT use control accounts for trade receivables and trade payables in his nominal ledger (15 marks) b. Balance off the ledger accounts at 31 July and bring down the balances on 1 August assuming that final accounts are NOT going to be drawn up for July (3 marks) Complete the Trial Balance as at 31st July 2020