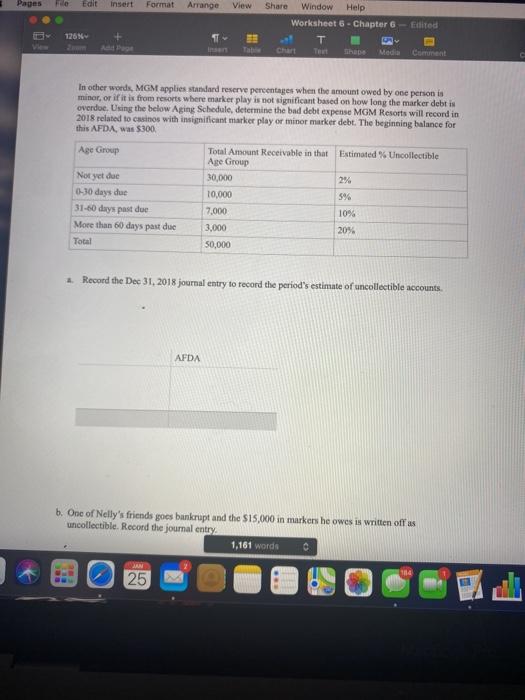

4.0 Add Page Insert Table Chart Text Shape Media Comment Casinos want to make it as easy as possible for people to gamble large amounts of money, so Casinos offer something called markers. Markers are special credits that allow gamblers to receive large amounts of cash on the spot from the casino to gamble in exchange for paying the money back later. Markers are like short-term interest-free loans to gamblers, and therefore represent receivables to the casino. However, there is the potential that some people will not pay the casino back for these markers, especially when people get carried away while gambling and rack up large amounts of marker debt. There are even lawyers in Vegas that specialize in defending you if you can't pay back your market debt. Read about a man who couldn't pay back $625k in marker debt here (optional). Therefore, casinos like MGM Resorts, create an Allowance for Doubtful Accounts to represent the net realizable value of their Accounts Receivable from these markers. Here is an excerpt from the MGM Resorts 2019 Annual Report about their AFDA: We maintain an allowance, or reserve, for doubtful casino accounts at all of our operating casino resorts. The provision for doubtful accounts, an operating expense, increases the allowance for doubtful accounts We regularly evaluate the allowance for doubtful casino accounts. At domestic resorts where marker play is not significant, the allowance is generally established by applying standard reserve percentages to aged account balances. At domestic resorts where marker play is significant, we apply standard reserve percentages to aged account balances under a specified dollar amount and specifically analyze the collectability of each account with a balance over the specified dollar amount, based on the age of the account, the customer's financial condition, collection history and any other known information. MGM China specifically analyzes the collectability of casino receivables on an individual basis taking into account the age of the account, the financial condition and the collection history of the gaming promoter or casino customer In other words, MGM applies standard reserve percentages when the amount owed by one person is minor, or if it is from resorts where marker play is not significant based on how long the marker debt is overdue. Using the below Aging Schedule, determine the bad debt expense MGM Resorts will record in 2018 related to casinos with insignificant marker play or minor marker debt. The beginning balance for this AFDA, was $300. 1,161 words A Groun TARI Estimated Uncolietile BNB JAN 25 FO Edit Insert Format Arrange View Share Window Help Worksheet 6 - Chapter 6 - Elited T Chart Text Media Comment 126 In other words, MGM applies standard reserve percentages when the amount owed by one person is minor, or if it is from resorts where marker play is not significant based on how long the marker debt is overdue. Using the below Aging Schedule, determine the bad debt expense MGM Resorts will record in 2018 related to casinos with insignificant marker play or minor marker debt. The beginning balance for this AFDA, was $300 Age Group Total Amount Receivable in that Estimated Uncollectible Age Group 30,000 294 10,000 7.000 10% 3,000 20% 50,000 Not yet due 0-30 days due 31-60 days past due More than 60 days past due Total 596 4. Record the Dec 31, 2018 journal entry to record the period's estimate of uncollectible accounts. AFDA b. One of Nelly's friends goes bunkrupt and the $15,000 in markers he owes is written off us uncollectible. Record the journal entry 1,161 words c MAN 25 Edit Insert Format Arrange View Share Window Help Worksheet 8 - Chapter 6 - Edited Chant Media Cat 125% AOS DE Com Nelly's friend (against the advice of the Accounting 215 team) gambles his way back to ourn some money. He unexpectedly pays back $10,000 of the amount he owed. Record the cash collection in a journal entry d. According to MGM Resorts' footnote about Critical Accounting Policies and Estimates, specifically for Allowance for Doubtful accounts, (see page 47 of the MGM Resorts 2019 Annual Report), what is the total amount of casino receivables customers owe as of Dec 31, 2019? e What is the amount of these outstanding receivables that MGM expects to be able to collect? f In 2019, Las Vegas Sands" (who owns the Palazzo and the Venetian in Vegas), allowance for doubtful casino accounts was 32.3% of total gross casino receivables. MGM Resorts' allowance was only 22% of casino receivables. What do you think are possible explanations for this difference? What is the incentive for managers for overstating (or understating the provision/allowance? 1,161 words JAI 1014 25