Question

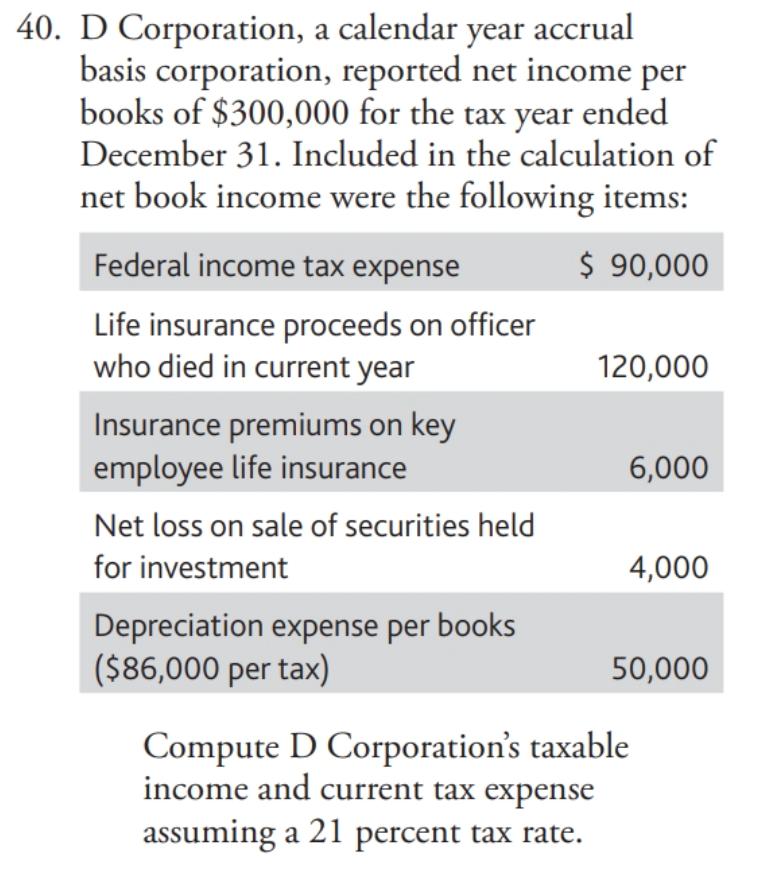

40. D Corporation, a calendar year accrual basis corporation, reported net income per books of $300,000 for the tax year ended December 31. Included

40. D Corporation, a calendar year accrual basis corporation, reported net income per books of $300,000 for the tax year ended December 31. Included in the calculation of net book income were the following items: $ 90,000 Federal income tax expense Life insurance proceeds on officer who died in current year Insurance premiums on key employee life insurance Net loss on sale of securities held for investment Depreciation expense per books ($86,000 per tax) 120,000 6,000 4,000 50,000 Compute D Corporation's taxable income and current tax expense assuming a 21 percent tax rate.

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The D corps taxable incoms for 2014 is calculated with the use of follow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Taxation For Business And Investment Planning 2016 Edition

Authors: Sally Jones, Shelley Rhoades Catanach

19th Edition

1259549259, 978-1259618536, 1259618536, 978-1259549250

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App