Answered step by step

Verified Expert Solution

Question

1 Approved Answer

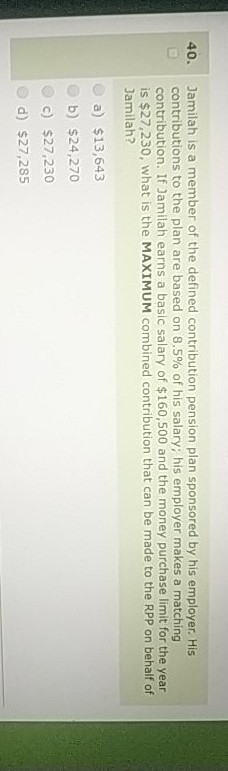

40. Jamilah is a member of the defined contribution pension plan sponsored by his employer. His contributions to the plan are based on 8.5% of

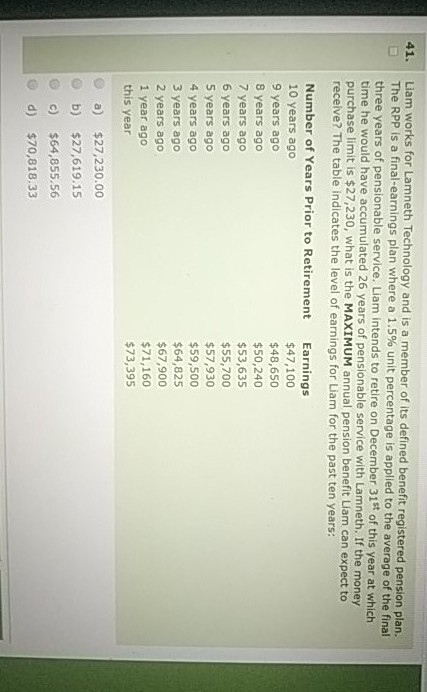

40. Jamilah is a member of the defined contribution pension plan sponsored by his employer. His contributions to the plan are based on 8.5% of his salary; his employer makes a matching contribution. If Jamilah earns a basic salary of $160,500 and the money purchase limit for the year is $27,230, what is the MAXIMUM combined contribution that can be made to the RPP on behalf of Jamilah? a) $13,643 b) $24,270 c) $27,230 41. Liam works for Lamneth Technology and is a member of its defined benefit registered pension plan. The RPP is a final-earnings plan where a 1.5% unit percentage is applied to the average of the final three years of pensionable service. Liam intends to retire on December 31st of this year at which time he would have accumulated 26 years of pensionable service with Lamneth. If the money purchase limit is $27,230, what is the MAXIMUM annual pension benefit Liam can expect to receive? The table indicates the level of earnings for Liam for the past ten years: Number of Years Prior to Retirement Earnings 10 years ago $47,100 9 years ago $48,650 8 years ago $50,240 7 years ago $53,635 6 years ago $55,700 5 years ago $57,930 4 years ago $59,500 3 years ago $64,825 2 years ago $67,900 1 year ago $71,160 this year $73,395 a) $27,230.00 b) $27,619.15 c) $64,855,56 d) $70,818.33 @

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started