Answered step by step

Verified Expert Solution

Question

1 Approved Answer

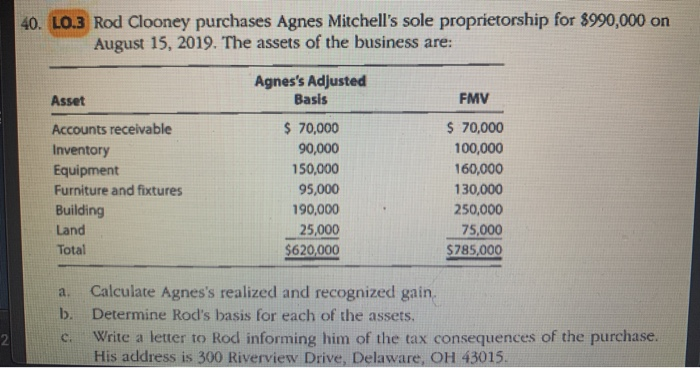

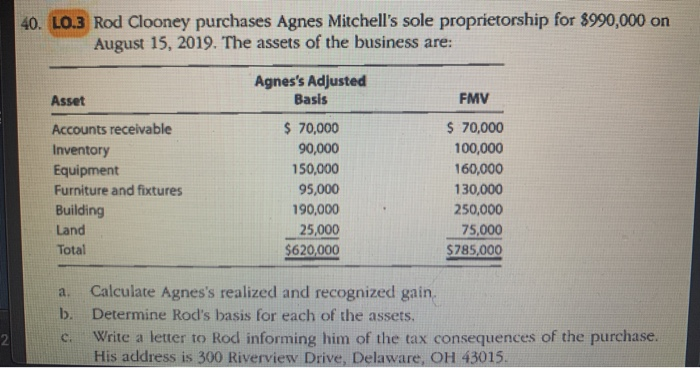

40. LO.3 Rod Clooney purchases Agnes Mitchell's sole proprietorship for $990,000 on August 15, 2019. The assets of the business are: Asset FMV Accounts receivable

40. LO.3 Rod Clooney purchases Agnes Mitchell's sole proprietorship for $990,000 on August 15, 2019. The assets of the business are: Asset FMV Accounts receivable Inventory Equipment Furniture and fixtures Building Land Total Agnes's Adjusted Basis $ 70,000 90,000 150,000 95,000 190,000 25,000 $620,000 $ 70,000 100,000 160,000 130,000 250,000 75,000 $785,000 a. b. Calculate Agnes's realized and recognized gain Determine Rod's basis for each of the assets. Write a letter to Rod informing him of the tax consequences of the purchase. His address is 300 Riverview Drive, Delaware, OH 43015

40. LO.3 Rod Clooney purchases Agnes Mitchell's sole proprietorship for $990,000 on August 15, 2019. The assets of the business are: Asset FMV Accounts receivable Inventory Equipment Furniture and fixtures Building Land Total Agnes's Adjusted Basis $ 70,000 90,000 150,000 95,000 190,000 25,000 $620,000 $ 70,000 100,000 160,000 130,000 250,000 75,000 $785,000 a. b. Calculate Agnes's realized and recognized gain Determine Rod's basis for each of the assets. Write a letter to Rod informing him of the tax consequences of the purchase. His address is 300 Riverview Drive, Delaware, OH 43015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started