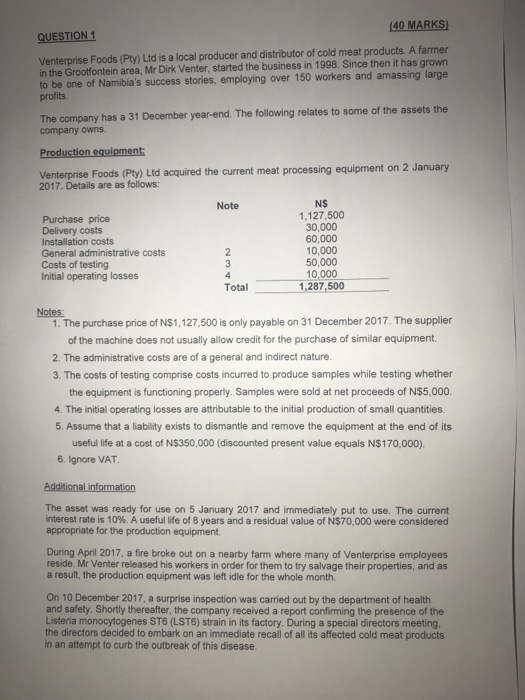

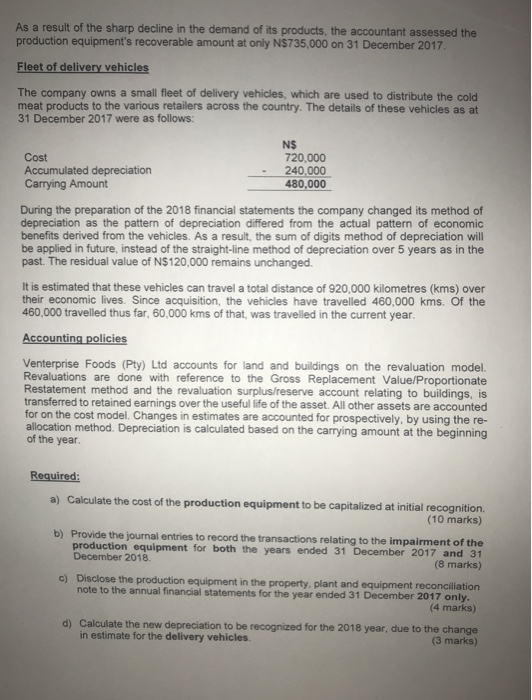

40 MARKS) QUESTION 1 Venterprise Foods (Pty) Ltd is a local producer and distributor of cold meat products. A farmer in the Grootfontein area, Mr Dirk Venter, started the business in 1998. Since then it has grown to be one of Namibia's success stories, employing over 150 workers and amassing profits The company has a 31 December year-end. The following relates to some of the assets the company owns. Venterprise Foods (Pty) Ltd acquired the current meat processing equipment on 2 January 2017. Details are as follows: NS 1,127,500 30,000 60,000 10,000 50,000 10,000 1,287,500 Note Purchase price Delivery costs Installation costs General administrative costs Costs of testing Initial operating losses Total Notes 1. The purchase price of N$1,127,500 is only payable on 31 December 2017. The supplier of the machine does not usually allow credit for the purchase of similar equipment. 2. The administrative costs are of a general and indirect nature. 3. The costs of testing comprise costs incurred to produce samples while testing whether the equipment is functioning properly. Samples were sold at net proceeds of N$5,000. 4. The initial operating losses are attributable to the initial production of small quantities. 5. Assume that a liability exists to dismantle and remove the equipment at the end of its useful life at a cost of N$350,000 (discounted present value equals N$170,000). 6. Ignore VAT The asset was ready for use on 5 January 2017 and immediately put to use. The current interest rate is 10%. A useful life of 8 years and a residual value of N$70,000 were considered appropriate for the production equipment. During April 2017, a fire broke out on a nearby farm where many of Venterprise employees reside. Mr Venter released his workers in order for them to try salvage their properties, and as a result, the production equipment was left idle for the whole month. On 10 December 2017, a surprise inspection was carried out by the department of health and safety. Shortly thereafter, the company received a report confirming the presence of the Listeria monocytogenes ST6 (LST6) strain in its factory. During a special directors meeting, the directors decided to embark on an immediate recall of all its affected cold meat products in an attempt to curb the outbreak of this disease. As a result of the sharp decline in the demand of its products, the accountant assessed the production equipment's recoverable amount at only N$735,000 on 31 December 2017 The company owns a small fleet of delivery vehicles, which are used to distribute the cold meat products to the various retailers across the country. The details of these vehicles as at 31 December 2017 were as follows: N$ 720,000 240.,000 Cost Carrying Amount 480,000 During the preparation of the 2018 financial statements the company changed its method of depreciation as the pattern of depreciation differed from the actual pattern of economic benefits derived from the vehicles. As a result, the sum of digits method of depreciation will be applied in future, instead of the straight-line method of depreciation over 5 years as in the past. The residual value of N$120,000 remains unchanged. It is estimated that these vehicles can travel a total distance of 920,000 kilometres (kms) over their economic lives. Since acquisition, the vehicles have travelled 460,000 kms. Of the 460,000 travelled thus far, 60,000 kms of that, was travelled in the current year Accounting policies Venterprise Foods (Pty) Ltd accounts for land and buildings on the revaluation model. Revaluations are done with reference to the Gross Replacement Value/Proportionate Restatement method and the revaluation surplus/reserve account relating to buildings, is transferred to retained earnings over the useful life of the asset. All other assets are accounted for on the cost model. Changes in estimates are accounted for prospectively, by using the re- allocation method. Depreciation is calculated based on the carrying amount at the beginning of the year Required a) Calculate the cost of the production equipment to be capitalized at initial recognition. (10 marks) b) Provide the journal entries to record the transactions relating to the impairment of the 2017 and 31 (8 marks) c) Disclose the production equipment in the property. plant and equipment reconciliation production equipment for both the years ended 31 December December 2018. note to the annual financial statements for the year ended 31 December 2017 only. (4 marks) d) Calculate the new depreciation to be recognized for the 2018 year, due to the change (3 marks) in estimate for the delivery vehicles. 40 MARKS) QUESTION 1 Venterprise Foods (Pty) Ltd is a local producer and distributor of cold meat products. A farmer in the Grootfontein area, Mr Dirk Venter, started the business in 1998. Since then it has grown to be one of Namibia's success stories, employing over 150 workers and amassing profits The company has a 31 December year-end. The following relates to some of the assets the company owns. Venterprise Foods (Pty) Ltd acquired the current meat processing equipment on 2 January 2017. Details are as follows: NS 1,127,500 30,000 60,000 10,000 50,000 10,000 1,287,500 Note Purchase price Delivery costs Installation costs General administrative costs Costs of testing Initial operating losses Total Notes 1. The purchase price of N$1,127,500 is only payable on 31 December 2017. The supplier of the machine does not usually allow credit for the purchase of similar equipment. 2. The administrative costs are of a general and indirect nature. 3. The costs of testing comprise costs incurred to produce samples while testing whether the equipment is functioning properly. Samples were sold at net proceeds of N$5,000. 4. The initial operating losses are attributable to the initial production of small quantities. 5. Assume that a liability exists to dismantle and remove the equipment at the end of its useful life at a cost of N$350,000 (discounted present value equals N$170,000). 6. Ignore VAT The asset was ready for use on 5 January 2017 and immediately put to use. The current interest rate is 10%. A useful life of 8 years and a residual value of N$70,000 were considered appropriate for the production equipment. During April 2017, a fire broke out on a nearby farm where many of Venterprise employees reside. Mr Venter released his workers in order for them to try salvage their properties, and as a result, the production equipment was left idle for the whole month. On 10 December 2017, a surprise inspection was carried out by the department of health and safety. Shortly thereafter, the company received a report confirming the presence of the Listeria monocytogenes ST6 (LST6) strain in its factory. During a special directors meeting, the directors decided to embark on an immediate recall of all its affected cold meat products in an attempt to curb the outbreak of this disease. As a result of the sharp decline in the demand of its products, the accountant assessed the production equipment's recoverable amount at only N$735,000 on 31 December 2017 The company owns a small fleet of delivery vehicles, which are used to distribute the cold meat products to the various retailers across the country. The details of these vehicles as at 31 December 2017 were as follows: N$ 720,000 240.,000 Cost Carrying Amount 480,000 During the preparation of the 2018 financial statements the company changed its method of depreciation as the pattern of depreciation differed from the actual pattern of economic benefits derived from the vehicles. As a result, the sum of digits method of depreciation will be applied in future, instead of the straight-line method of depreciation over 5 years as in the past. The residual value of N$120,000 remains unchanged. It is estimated that these vehicles can travel a total distance of 920,000 kilometres (kms) over their economic lives. Since acquisition, the vehicles have travelled 460,000 kms. Of the 460,000 travelled thus far, 60,000 kms of that, was travelled in the current year Accounting policies Venterprise Foods (Pty) Ltd accounts for land and buildings on the revaluation model. Revaluations are done with reference to the Gross Replacement Value/Proportionate Restatement method and the revaluation surplus/reserve account relating to buildings, is transferred to retained earnings over the useful life of the asset. All other assets are accounted for on the cost model. Changes in estimates are accounted for prospectively, by using the re- allocation method. Depreciation is calculated based on the carrying amount at the beginning of the year Required a) Calculate the cost of the production equipment to be capitalized at initial recognition. (10 marks) b) Provide the journal entries to record the transactions relating to the impairment of the 2017 and 31 (8 marks) c) Disclose the production equipment in the property. plant and equipment reconciliation production equipment for both the years ended 31 December December 2018. note to the annual financial statements for the year ended 31 December 2017 only. (4 marks) d) Calculate the new depreciation to be recognized for the 2018 year, due to the change (3 marks) in estimate for the delivery vehicles