Answered step by step

Verified Expert Solution

Question

1 Approved Answer

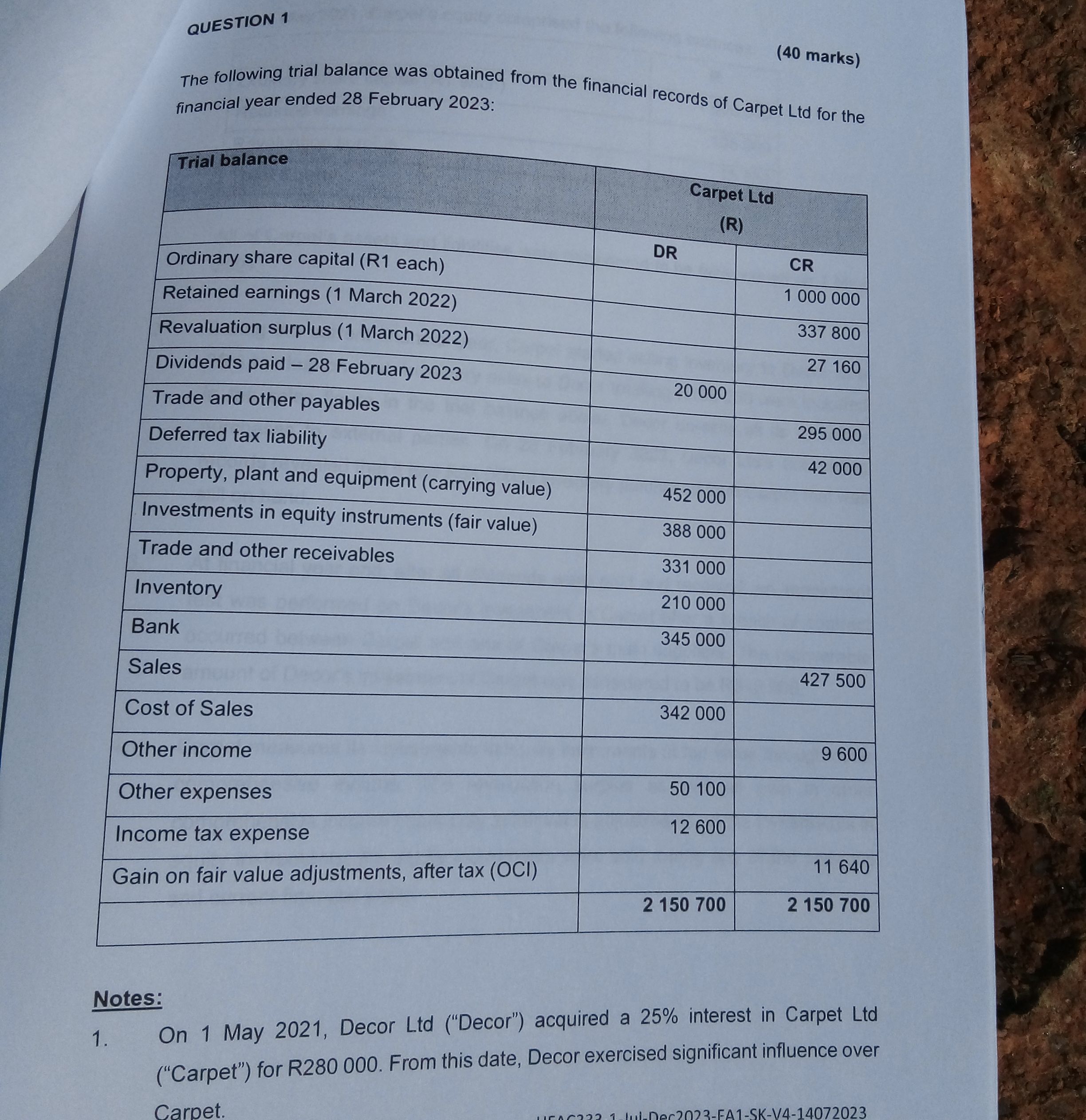

(40 marks) The following trial balance was obtained from the financial records of Carpet Ltd for the financial year ended 28 February 2023 : Notes:

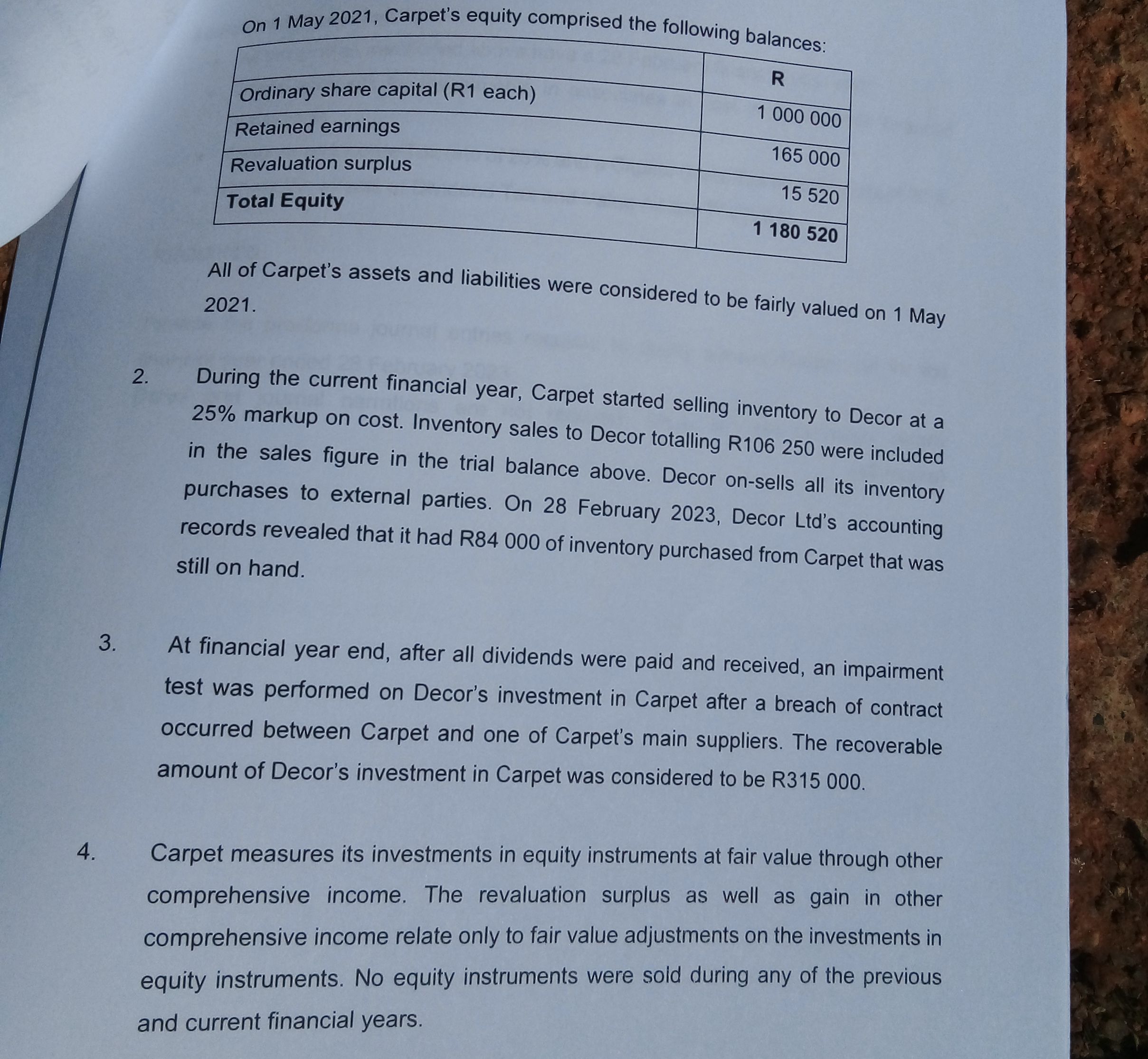

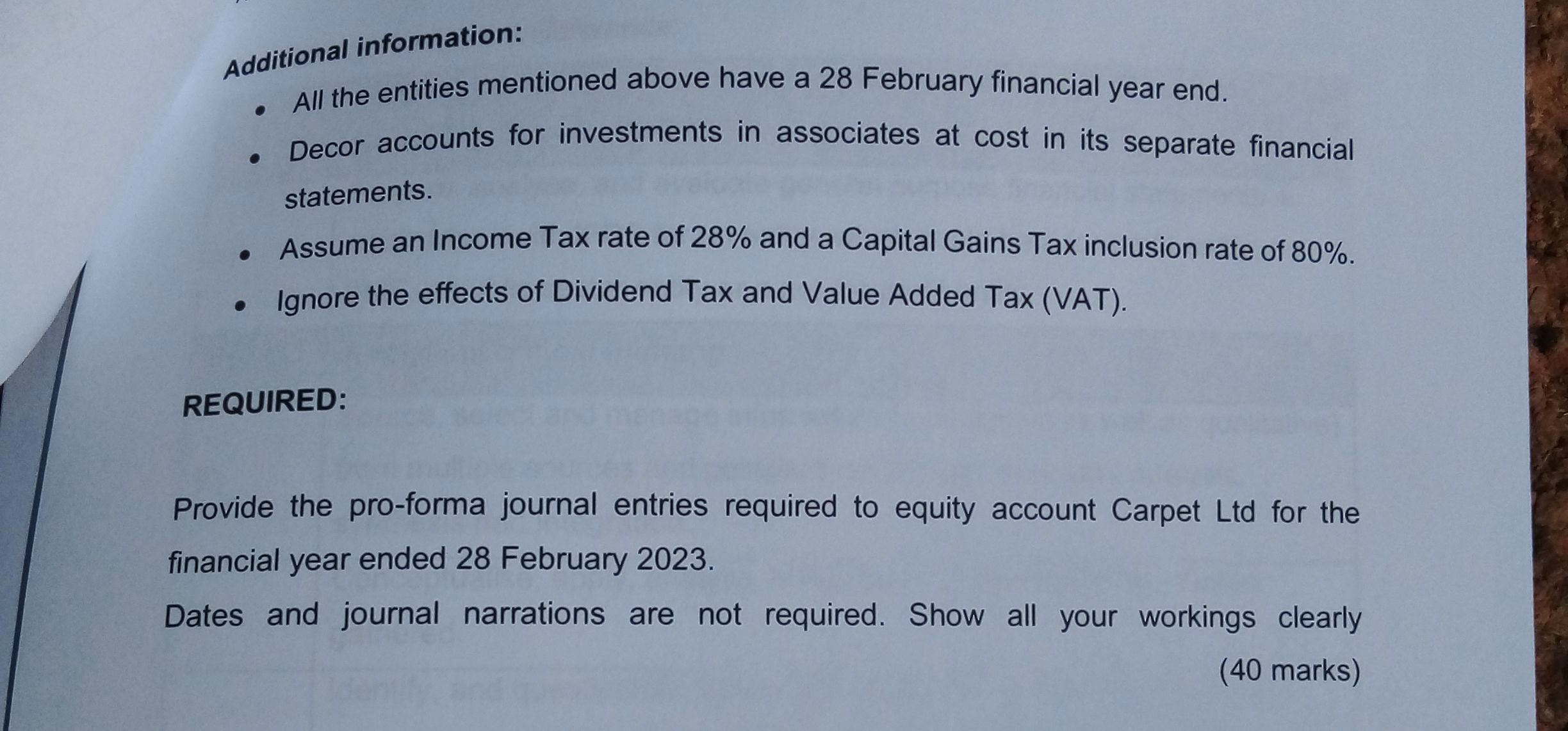

(40 marks) The following trial balance was obtained from the financial records of Carpet Ltd for the financial year ended 28 February 2023 : Notes: 1. On 1 May 2021, Decor Ltd ("Decor") acquired a 25\% interest in Carpet Ltd ("Carpet") for R280 000. From this date, Decor exercised significant influence over Carpet. On 1 May 2021, Carpet's equity comprised the followinn h All of Carpet's assets and liabilities were considered to be fairly valued on 1 May 2021. 2. During the current financial year, Carpet started selling inventory to Decor at a 25\% markup on cost. Inventory sales to Decor totalling R106 250 were included in the sales figure in the trial balance above. Decor on-sells all its inventory purchases to external parties. On 28 February 2023, Decor Ltd's accounting records revealed that it had R84000 of inventory purchased from Carpet that was still on hand. 3. At financial year end, after all dividends were paid and received, an impairment test was performed on Decor's investment in Carpet after a breach of contract occurred between Carpet and one of Carpet's main suppliers. The recoverable amount of Decor's investment in Carpet was considered to be R315 000. 4. Carpet measures its investments in equity instruments at fair value through other comprehensive income. The revaluation surplus as well as gain in other comprehensive income relate only to fair value adjustments on the investments in equity instruments. No equity instruments were sold during any of the previous and current financial years. Additional information: - All the entities mentioned above have a 28 February financial year end. - Decor accounts for investments in associates at cost in its separate financial statements. - Assume an Income Tax rate of 28% and a Capital Gains Tax inclusion rate of 80%. - Ignore the effects of Dividend Tax and Value Added Tax (VAT). REQUIRED: Provide the pro-forma journal entries required to equity account Carpet Ltd for the financial year ended 28 February 2023. Dates and journal narrations are not required. Show all your workings clearly (40 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started