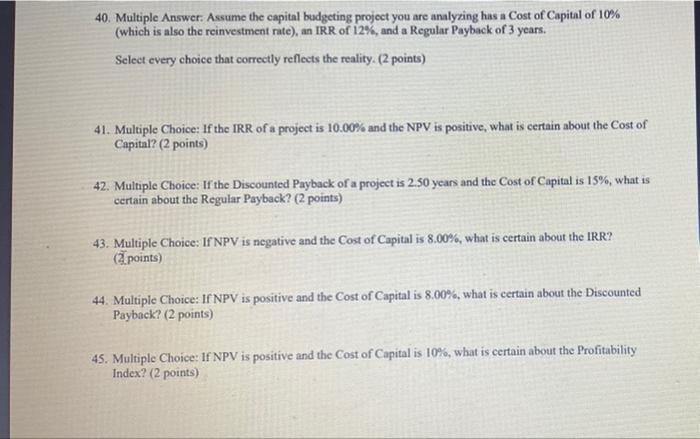

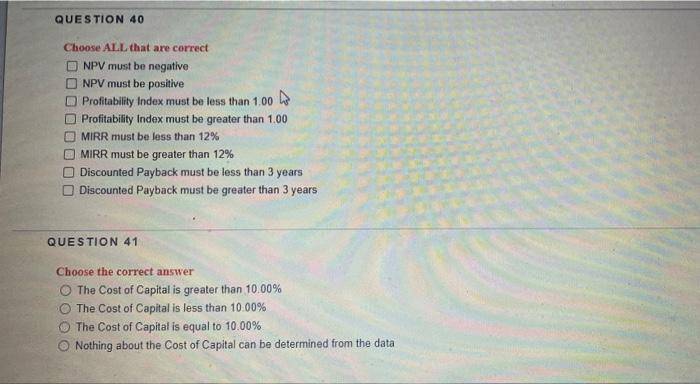

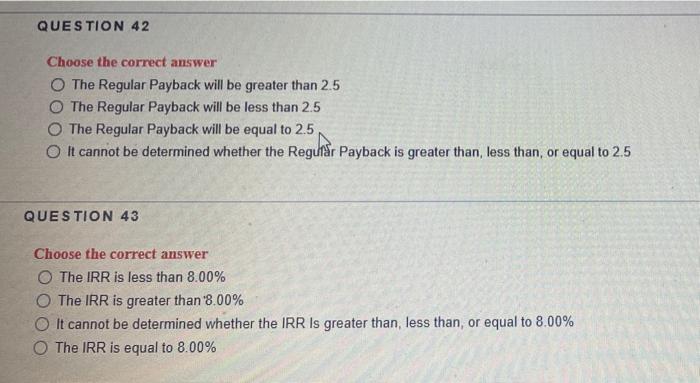

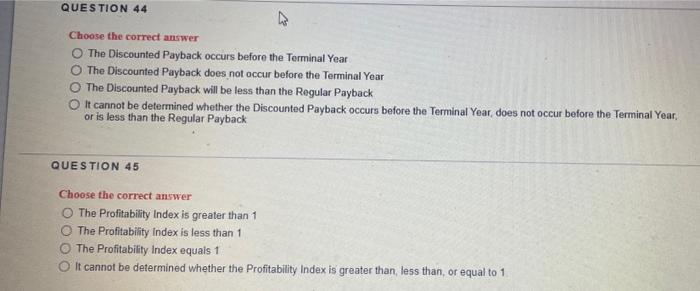

40. Multiple Answer: Assume the capital budgeting project you are analyzing has a Cost of Capital of 10% (which is also the reinvestment rate), an IRR of 12%, and a Regular Payback of 3 years. Select every choice that correctly reflects the reality. (2 points) 41. Multiple Choice: If the IRR of a project is 10.00% and the NPV is positive, what is certain about the Cost of Capital? (2 points) 42. Multiple Choice: If the Discounted Payback of a project is 2.50 years and the Cost of Capital is 15%, what is certain about the Regular Payback? (2 points) 43. Multiple Choice: If NPV is negative and the Cost of Capital is 8.00%, what is certain about the IRR? (2 points) 44. Multiple Choice: If NPV is positive and the Cost of Capital is 8.00%, what is certain about the Discounted Payback? (2 points) 45. Multiple Choice: If NPV is positive and the Cost of Capital is 10%, what is certain about the Profitability Index? (2 points) QUESTION 40 Choose ALL that are correct NPV must be negative NPV must be positive Profitability Index must be less than 1.00 Profitability Index must be greater than 1.00 MIRR must be less than 12% MIRR must be greater than 12% Discounted Payback must be less than 3 years Discounted Payback must be greater than 3 years QUESTION 41 Choose the correct answer O The Cost of Capital is greater than 10.00% The Cost of Capital is less than 10.00% The Cost of Capital is equal to 10.00% Nothing about the Cost of Capital can be determined from the data QUESTION 42 Choose the correct answer O The Regular Payback will be greater than 2.5 The Regular Payback will be less than 2.5 O The Regular Payback will be equal to 2.5 O It cannot be determined whether the Regular Payback is greater than, less than, or equal to 2.5 QUESTION 43 Choose the correct answer The IRR is less than 8.00% O The IRR is greater than 8.00% OIt cannot be determined whether the IRR Is greater than, less than, or equal to 8.00% The IRR is equal to 8.00% QUESTION 44 Choose the correct answer O The Discounted Payback occurs before the Terminal Year O The Discounted Payback does not occur before the Terminal Year The Discounted Payback will be less than the Regular Payback O It cannot be determined whether the Discounted Payback occurs before the Terminal Year, does not occur before the Terminal Year, or is less than the Regular Payback QUESTION 45 Choose the correct answer O The Profitability Index is greater than 1 O The Profitability Index is less than 1 The Profitability Index equals 1 It cannot be determined whether the Profitability Index is greater than, less than, or equal to 1