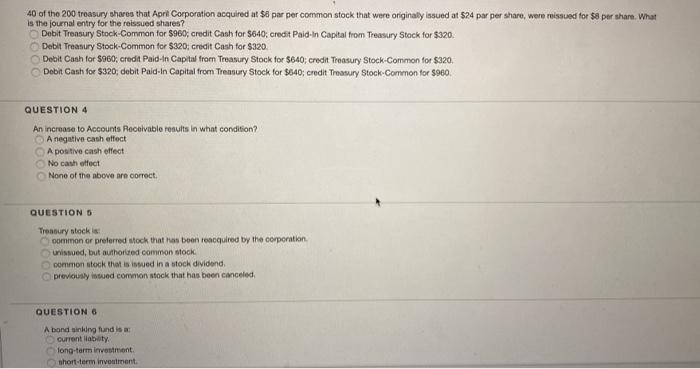

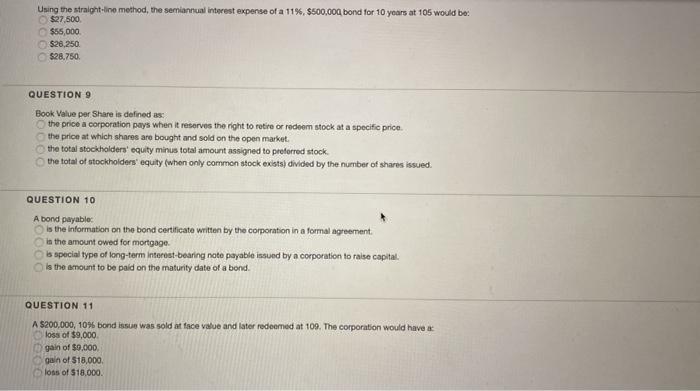

40 of the 200 treasury shares that Aort Corporation acquired at $8 par per common stock that were originally issued at $24 par per share, were reissued for 58 per share. Wh What Debit Treasury Stock-Common for 960, credit Cash for $640; credit Paid-in Capital from Treasury Stack for $320 Debit Treasury Stock-Common for $320 Credit Cash for $320. Debit Cash for $960, credit Paid in Capital from Treasury Stock for $640; credit Treasury Stock-Common for $320, Debit Cash for $320, debit Paid-In Capital from Trensury Stock for $540; credit Treasury Stock-Common for $960 QUESTION 4 An increase to Accounts Receivable results in what condition? A negative cash effect A positive cash effect No cash efect None of the above are correct. QUESTIONS Treasury stock common or preferred stock that has been required by the corporation Unised, but authored common stock common stock that is issued in a stock dividend, previously sed common stock that has been canceled, QUESTION G A bond sinking fand is Current liabuty long-term investment short-term investment Using the straight-line method, the semiannual interest expense of a 11%, $500,000 bond for 10 years at 105 would be $27,500 $55,000 $28,250 $28.750 QUESTION 9 Book Value per Share is defined as: the price a corporation pays when it reserves the right to retire or redeem stock at a specific price the price at which shares are bought and sold on the open market. the total stockholders' equity minus total amount assigned to preferred stock the total of stockholders' equity (when only common stock exists) divided by the number of shares issued. QUESTION 10 A bond payable is the information on the bond certificate written by the corporation in a formal ment in the amount owed for mortgage is special type of long-term interest-bearing note payable issued by a corporation to raise capital. Is the amount to be paid on the maturity date of a bond. QUESTION 11 A $200,000, 10% bond issue was sold at face value and later redeemed at 109. The corporation would have a loss of $9,000 gain of $9,000 gain of 518,000 loss of $18.000