Answered step by step

Verified Expert Solution

Question

1 Approved Answer

40. please help A-C A B C added graphs You have been offered a very long-term investment opportunity to increase your money one hundredfold. You

40. please help A-C

A

B

C

added graphs

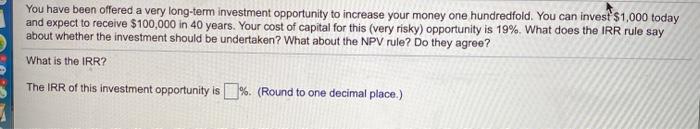

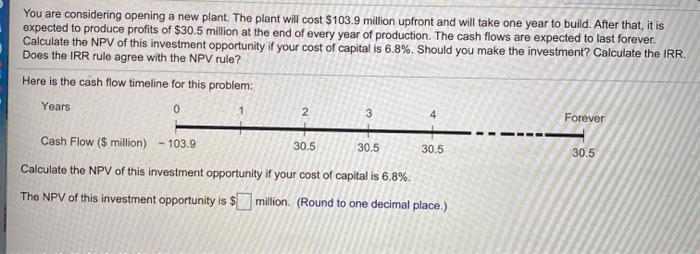

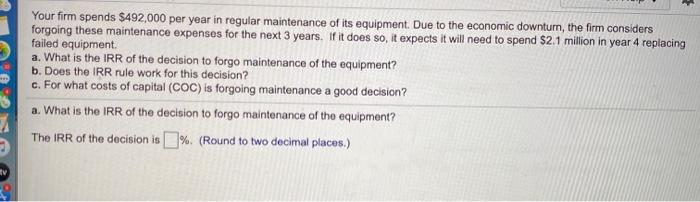

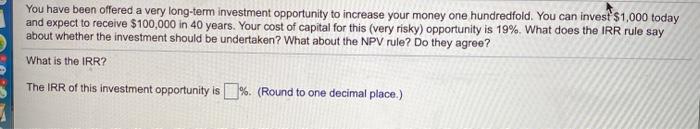

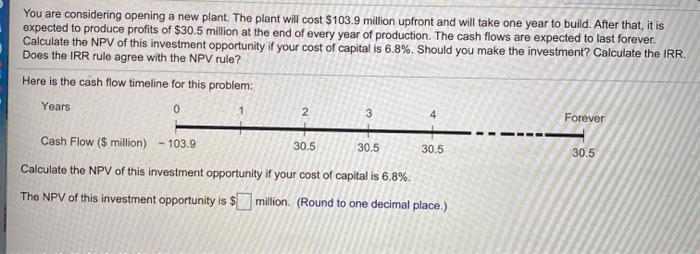

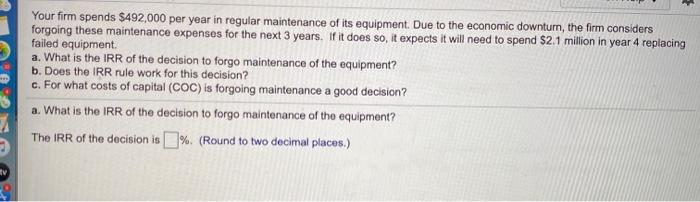

You have been offered a very long-term investment opportunity to increase your money one hundredfold. You can invest's1,000 today and expect to receive $100,000 in 40 years. Your cost of capital for this (very risky) opportunity is 19%. What does the IRR rule say about whether the investment should be undertaken? What about the NPV rule? Do they agree? What is the IRR? The IRR of this investment opportunity is 1% (Round to one decimal place.) You are considering opening a new plant. The plant will cost $103.9 million upfront and will take one year to build. After that, it is expected to produce profits of $30.5 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 6.8%. Should you make the investment? Calculate the IRR. Does the IRR rule agree with the NPV rule? Here is the cash flow timeline for this problem: Years 0 2 3 Forever 4 Cash Flow ($ million) - 103.9 30.5 30.5 30.5 30.5 Calculate the NPV of this investment opportunity if your cost of capital is 6.8%. The NPV of this investment opportunity is $million. (Round to one decimal place) Your firm spends $492,000 per year in regular maintenance of its equipment. Due to the economic downturn, the firm considers forgoing these maintenance expenses for the next 3 years. If it does so, it expects it will need to spend $2.1 million in year 4 replacing failed equipment a. What is the IRR of the decision to forgo maintenance of the equipment? b. Does the IRR rule work for this decision? c. For what costs of capital (COC) is forgoing maintenance a good decision? a. What is the IRR of the decision to forgo maintenance of the equipment? The IRR of the decision is % (Round to two decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started