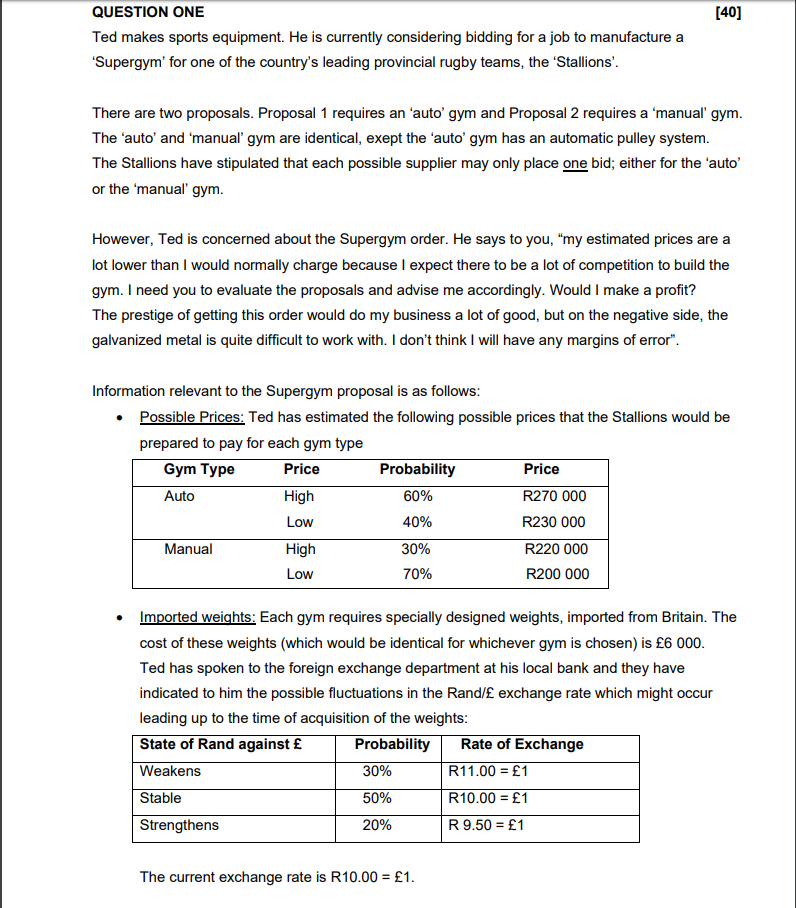

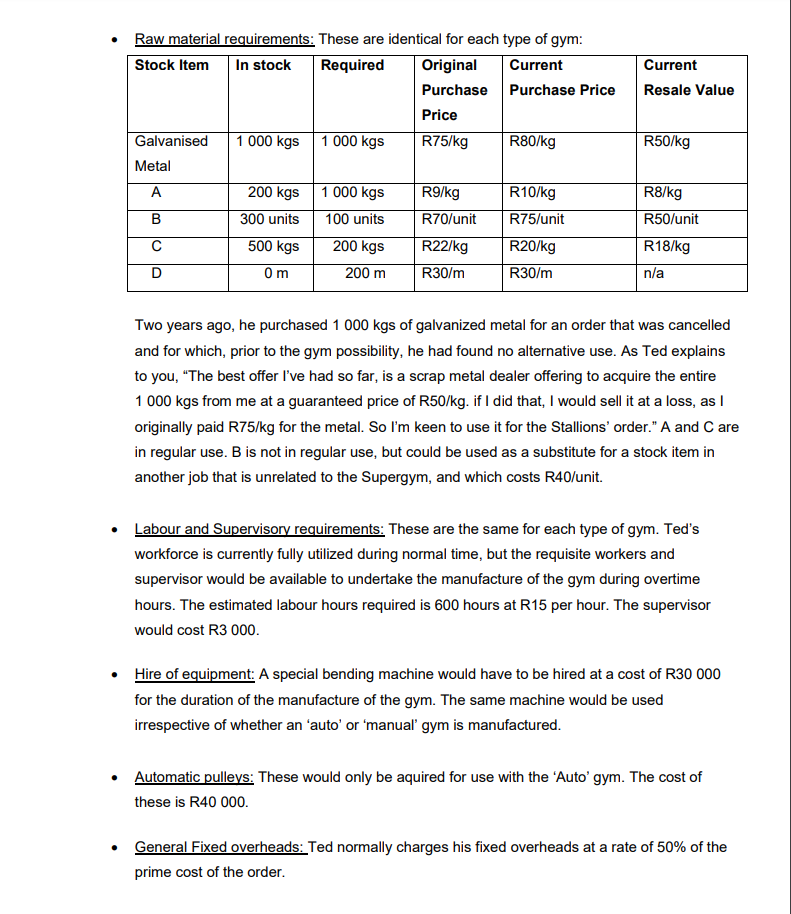

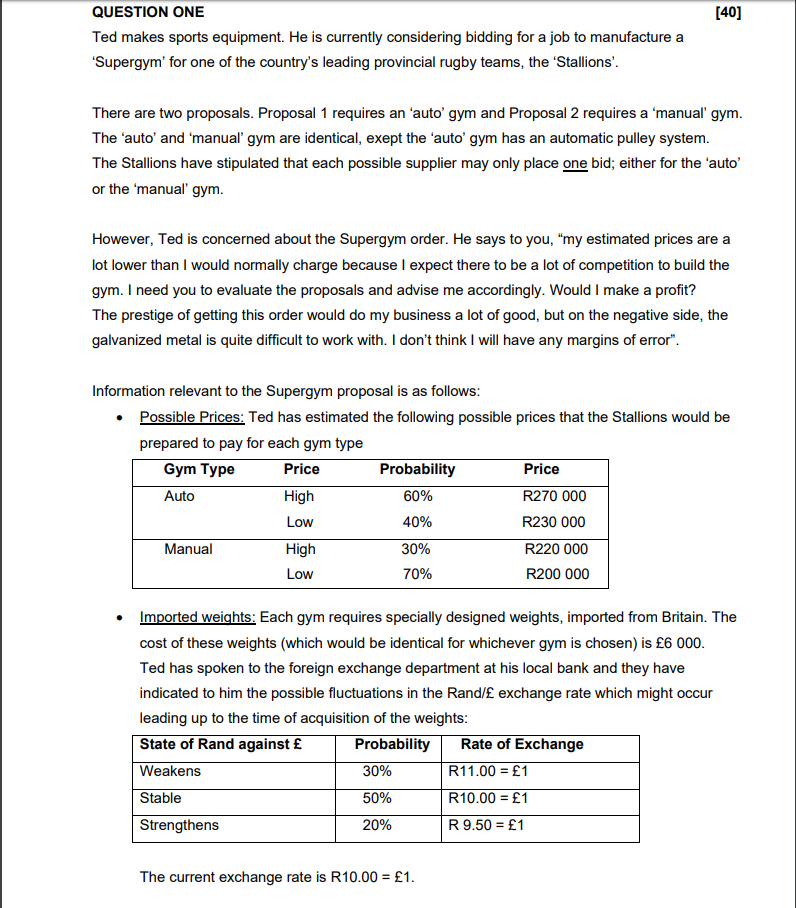

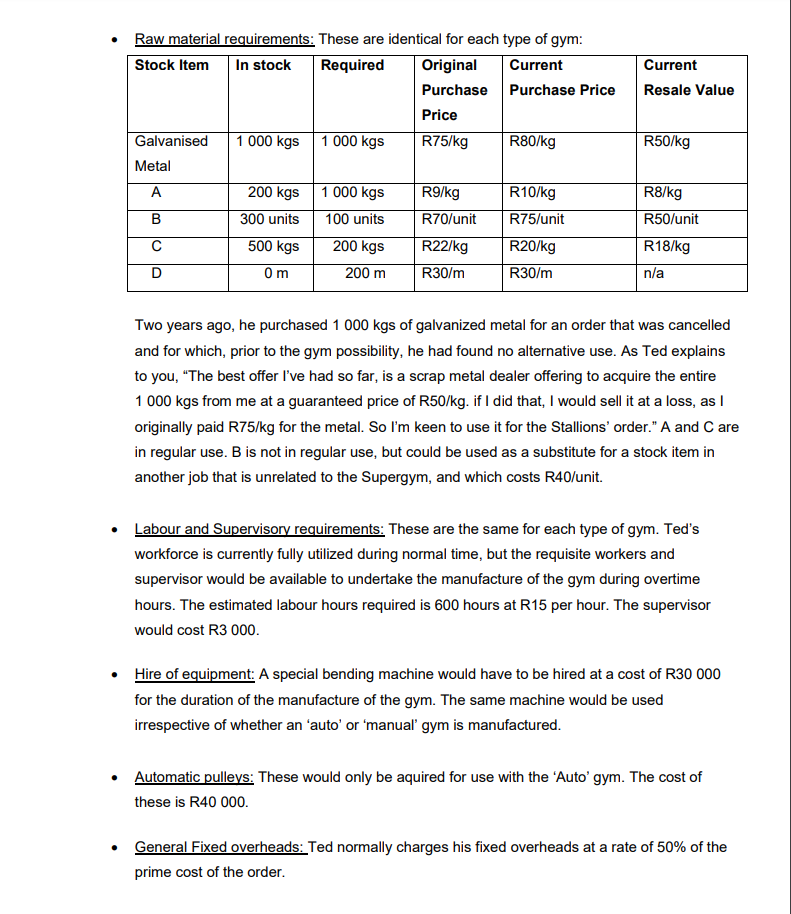

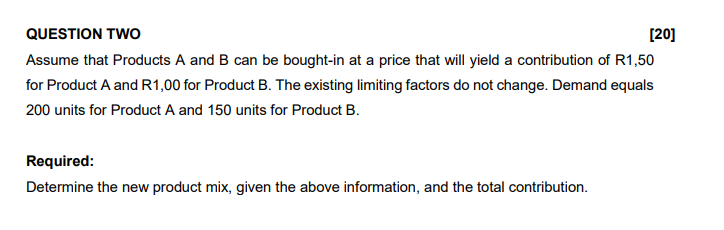

[40] QUESTION ONE Ted makes sports equipment. He is currently considering bidding for a job to manufacture a 'Supergym' for one of the country's leading provincial rugby teams, the 'Stallions'. There are two proposals. Proposal 1 requires an 'auto' gym and Proposal 2 requires a 'manual' gym. The 'auto' and 'manual gym are identical, exept the 'auto' gym has an automatic pulley system. The Stallions have stipulated that each possible supplier may only place one bid; either for the 'auto' or the 'manual' gym. However, Ted is concerned about the Supergym order. He says to you, "my estimated prices are a lot lower than I would normally charge because I expect there to be a lot of competition to build the gym. I need you to evaluate the proposals and advise me accordingly. Would I make a profit? The prestige of getting this order would do my business a lot of good, but on the negative side, the galvanized metal is quite difficult to work with. I don't think I will have any margins of error". Information relevant to the Supergym proposal is as follows: Possible Prices: Ted has estimated the following possible prices that the Stallions would be prepared to pay for each gym type Gym Type Price Probability Price Auto High 60% R270 000 Low 40% R230 000 Manual High 30% R220 000 Low 70% R200 000 Imported weights: Each gym requires specially designed weights, imported from Britain. The cost of these weights (which would be identical for whichever gym is chosen) is 6 000. Ted has spoken to the foreign exchange department at his local bank and they have indicated to him the possible fluctuations in the Rand/ exchange rate which might occur leading up to the time of acquisition of the weights: State of Rand against Probability Rate of Exchange Weakens 30% R11.00 = 1 Stable 50% R10.00 = 1 Strengthens 20% R 9.50 = 1 The current exchange rate is R10.00 = 1. . Current Resale Value R50/kg Raw material requirements: These are identical for each type of gym: Stock Item In stock Required Original Current Purchase Purchase Price Price Galvanised 1 000 kgs 1 000 kgs R75/kg R80/kg Metal A 200 kgs 1 000 kgs R9/kg R10/kg B 300 units 100 units R70/unit R75/unit 500 kgs 200 kgs R22/kg R20/kg D Om 200 m R30/m R30/m R8/kg R50/unit R18/kg n/a Two years ago, he purchased 1 000 kgs of galvanized metal for an order that was cancelled and for which, prior to the gym possibility, he had found no alternative use. As Ted explains to you, The best offer I've had so far, is a scrap metal dealer offering to acquire the entire 1 000 kgs from me at a guaranteed price of R50/kg. if I did that, I would sell it at a loss, as I originally paid R75/kg for the metal. So I'm keen to use it for the Stallions' order." A and Care in regular use. B is not in regular use, but could be used as a substitute for a stock item in another job that is unrelated to the Supergym, and which costs R40/unit. Labour and Supervisory requirements: These are the same for each type of gym. Ted's workforce is currently fully utilized during normal time, but the requisite workers and supervisor would be available to undertake the manufacture of the gym during overtime hours. The estimated labour hours required is 600 hours at R15 per hour. The supervisor would cost R3 000. Hire of equipment: A special bending machine would have to be hired at a cost of R30 000 for the duration of the manufacture of the gym. The same machine would be used irrespective of whether an 'auto' or 'manual gym is manufactured. Automatic pulleys: These would only be aquired for use with the 'Auto' gym. The cost of these is R40 000 General Fixed overheads: Ted normally charges his fixed overheads at a rate of 50% of the prime cost of the order. QUESTION TWO [20] Assume that Products A and B can be bought-in at a price that will yield a contribution of R1,50 for Product A and R1,00 for Product B. The existing limiting factors do not change. Demand equals 200 units for Product A and 150 units for Product B. Required: Determine the new product mix, given the above information, and the total contribution. [40] QUESTION ONE Ted makes sports equipment. He is currently considering bidding for a job to manufacture a 'Supergym' for one of the country's leading provincial rugby teams, the 'Stallions'. There are two proposals. Proposal 1 requires an 'auto' gym and Proposal 2 requires a 'manual' gym. The 'auto' and 'manual gym are identical, exept the 'auto' gym has an automatic pulley system. The Stallions have stipulated that each possible supplier may only place one bid; either for the 'auto' or the 'manual' gym. However, Ted is concerned about the Supergym order. He says to you, "my estimated prices are a lot lower than I would normally charge because I expect there to be a lot of competition to build the gym. I need you to evaluate the proposals and advise me accordingly. Would I make a profit? The prestige of getting this order would do my business a lot of good, but on the negative side, the galvanized metal is quite difficult to work with. I don't think I will have any margins of error". Information relevant to the Supergym proposal is as follows: Possible Prices: Ted has estimated the following possible prices that the Stallions would be prepared to pay for each gym type Gym Type Price Probability Price Auto High 60% R270 000 Low 40% R230 000 Manual High 30% R220 000 Low 70% R200 000 Imported weights: Each gym requires specially designed weights, imported from Britain. The cost of these weights (which would be identical for whichever gym is chosen) is 6 000. Ted has spoken to the foreign exchange department at his local bank and they have indicated to him the possible fluctuations in the Rand/ exchange rate which might occur leading up to the time of acquisition of the weights: State of Rand against Probability Rate of Exchange Weakens 30% R11.00 = 1 Stable 50% R10.00 = 1 Strengthens 20% R 9.50 = 1 The current exchange rate is R10.00 = 1. . Current Resale Value R50/kg Raw material requirements: These are identical for each type of gym: Stock Item In stock Required Original Current Purchase Purchase Price Price Galvanised 1 000 kgs 1 000 kgs R75/kg R80/kg Metal A 200 kgs 1 000 kgs R9/kg R10/kg B 300 units 100 units R70/unit R75/unit 500 kgs 200 kgs R22/kg R20/kg D Om 200 m R30/m R30/m R8/kg R50/unit R18/kg n/a Two years ago, he purchased 1 000 kgs of galvanized metal for an order that was cancelled and for which, prior to the gym possibility, he had found no alternative use. As Ted explains to you, The best offer I've had so far, is a scrap metal dealer offering to acquire the entire 1 000 kgs from me at a guaranteed price of R50/kg. if I did that, I would sell it at a loss, as I originally paid R75/kg for the metal. So I'm keen to use it for the Stallions' order." A and Care in regular use. B is not in regular use, but could be used as a substitute for a stock item in another job that is unrelated to the Supergym, and which costs R40/unit. Labour and Supervisory requirements: These are the same for each type of gym. Ted's workforce is currently fully utilized during normal time, but the requisite workers and supervisor would be available to undertake the manufacture of the gym during overtime hours. The estimated labour hours required is 600 hours at R15 per hour. The supervisor would cost R3 000. Hire of equipment: A special bending machine would have to be hired at a cost of R30 000 for the duration of the manufacture of the gym. The same machine would be used irrespective of whether an 'auto' or 'manual gym is manufactured. Automatic pulleys: These would only be aquired for use with the 'Auto' gym. The cost of these is R40 000 General Fixed overheads: Ted normally charges his fixed overheads at a rate of 50% of the prime cost of the order. QUESTION TWO [20] Assume that Products A and B can be bought-in at a price that will yield a contribution of R1,50 for Product A and R1,00 for Product B. The existing limiting factors do not change. Demand equals 200 units for Product A and 150 units for Product B. Required: Determine the new product mix, given the above information, and the total contribution