Answered step by step

Verified Expert Solution

Question

1 Approved Answer

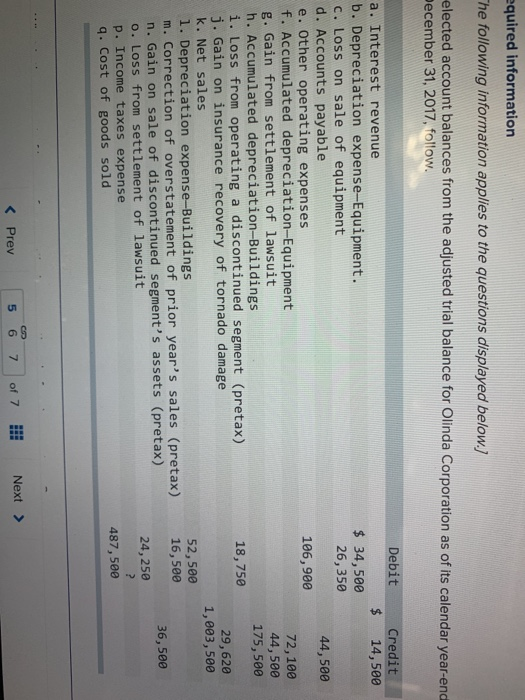

40% tax rate UT 90 equired information he following information applies to the questions displayed below. elected account balances from the adjusted trial balance for

40% tax rate

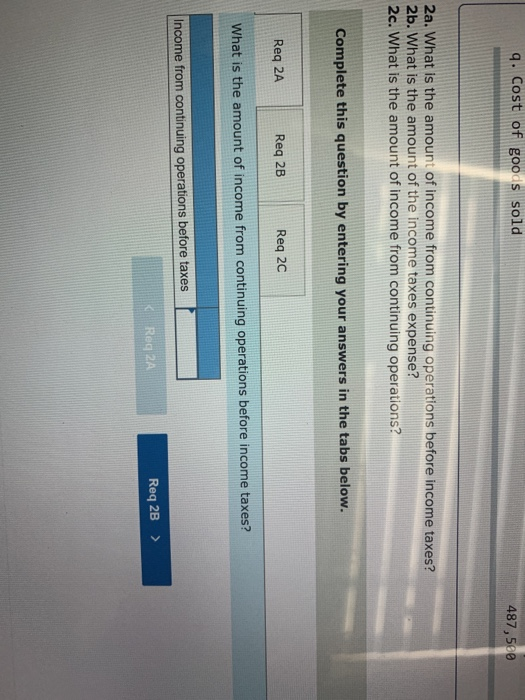

UT 90 equired information he following information applies to the questions displayed below. elected account balances from the adjusted trial balance for Olinda Corporation pecember 31, 2017, follow. as of its calendar year-end Debit Credit a. Interest revenue 14,500 b. Depreciation expense-Equipment. c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation-Equipment g. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings i. Loss from operating j. Gain on insurance recovery of tornado damage k. Net sales 34,500 26, 350 44,500 106,900 72,100 44,500 175,500 a discontinued segment (pretax) 18,750 29,620 1,003, 500 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Loss from settlement of lawsuit 52,500 16,500 36,500 24, 250 p. Income taxes expense q. Cost of goods sold 487,500 CD q. Cost of goods sold 487,500 2a. What is the amount of income from continuing operations before income taxes? 2b. What is the amount of the income taxes expense? 2c. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. Req 2A Req 2B Req 2C What is the amount of income from continuing operations before income taxes? Income from continuing operations before taxes Req 2A Req 2B Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started